12. Constellation Software Series I Debentures Offer Rights

Short take on an attractive rights offer spread opportunity with asymmetric payoff

On August 3rd, 2023 Constellation Software announced rights offering that entitled common shareholders on the applicable record date to purchase up to C$700 million aggregate principal amounts of unsecured subordinated floating rate debentures, Series 1 of the Company (the “Series 1 Debentures”) - ISIN CA21037XAA87. These are the addition to the inflation linked debentures that have been on Constellation balance sheet for a decade, now being extended with additional volume issue.

By now, each Constellation shareholder received one right per common share, and would need 3.03 rights to purchase CAD 100 notional amount of additional Series I issue, under the subscription price of CAD 133 with accrued interest of CAD 0.217 (thus total price to be paid 133.217), as of 4:30 pm Toronto time, September 29th, 2023. Debentures currently trade at CAD 137, with a CAD 3.79 spread between the market price and subscription price.

Using the ratio of 3.03, the current implied value of the right is 1.250825 (3.79/3.03). Rights trade at 0.21, thus implying the expected price of debentures of 133.85 (3.03×0.21+133+0.21). This opens an interesting spread of almost 6 times. Spread will most likely not fully disappear as not all holders of the rights we take any action (they will let them expire worthless), however, it does present an asymmetric win – lose outcome.

Series I Debentures

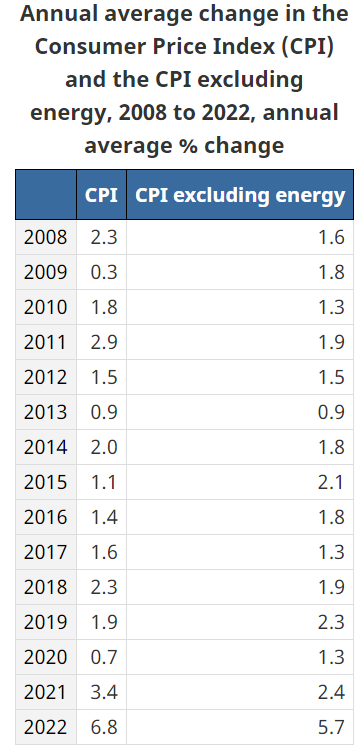

A crucial point in identifying whether there is at least any level of certainty in realizing this spread, is to understand how Series I Debentures define their coupon. As per prospectus, coupon is calculated on a nominal value of CAD 100, multiplied with 6.5% + annual change in Canadian CPI measured as of December each year. Once set, coupon is constant from June to March next year. Then reset is done again. These changes in consumer price index are available online and are shown below.

Adding last CPI change of 6.8% to fixed part of the coupon of 6.5%, yield 13.3% as mentioned in the prospectus for the right offer.

Furthermore, current change in CPI is 3.3%, implying a coupon of 10.1%. That is, if this relative change holds throughout December 2023, which is the date used to identify the CPI change used to reset the variable element of the coupon as of, and not including, 31 March 2024.

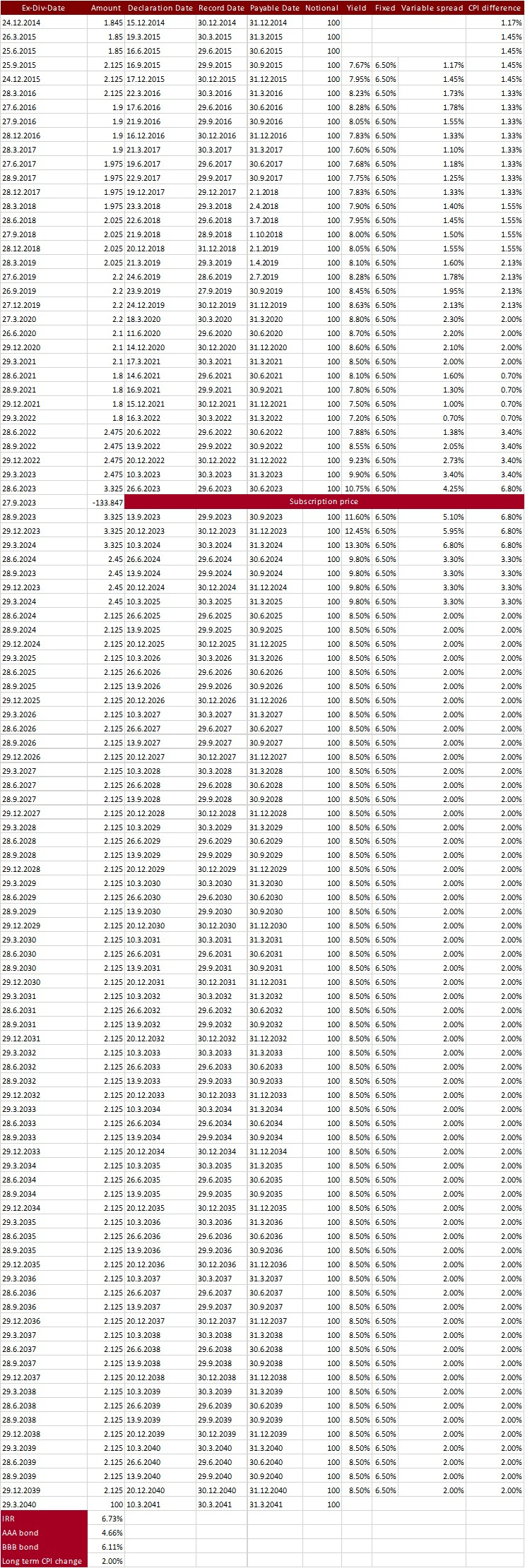

Assuming long term inflation of 2%, it is possible to derive and internal rate of return of the debenture. Below is the coupon and principal repayment plan.

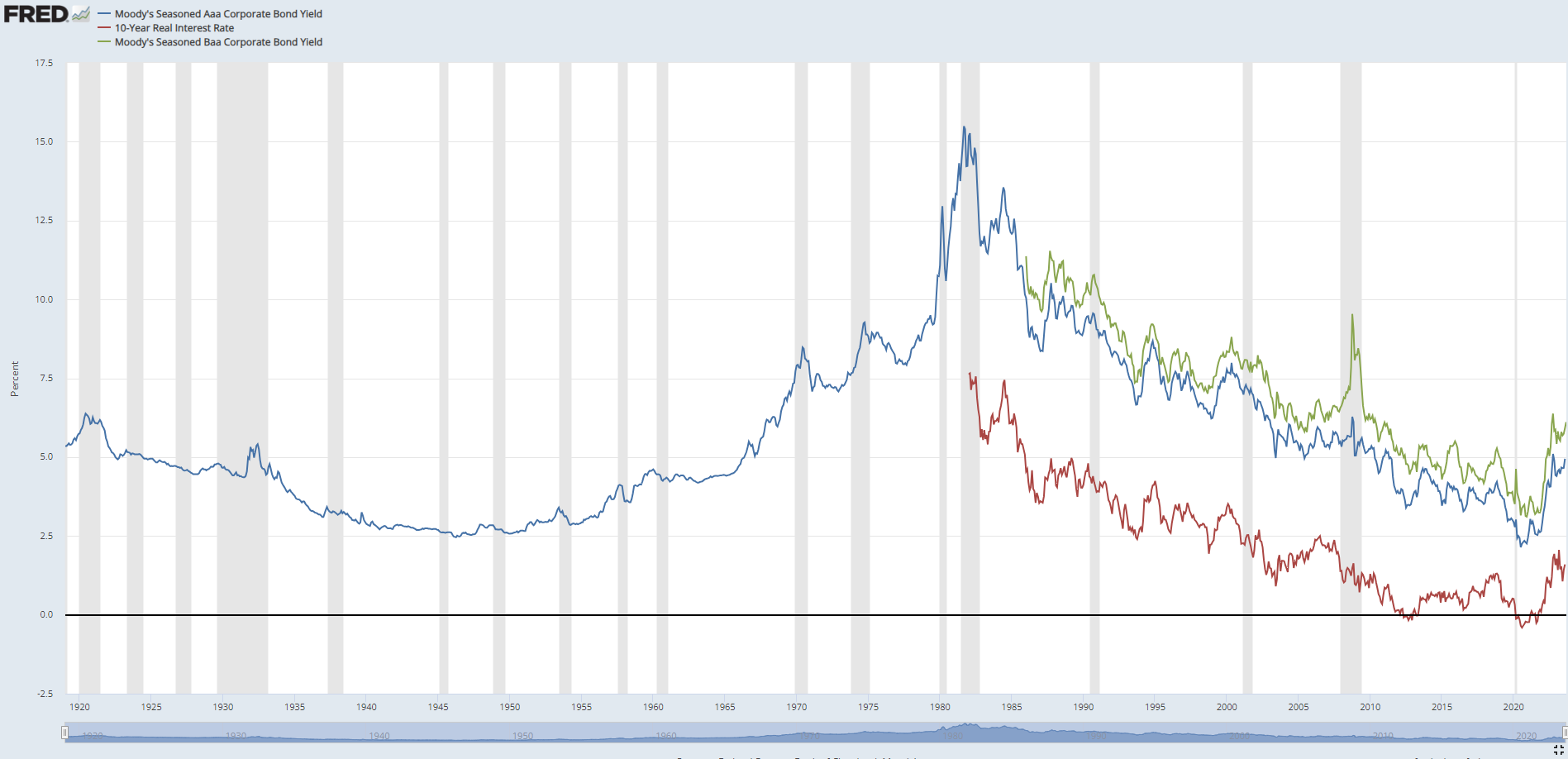

Series I debentures are rated as BBB+ by Fitch, implying a yield on 20-year maturing bonds of more than 5%, which is less than what current price and coupon expectations on debentures offer. However, it is easy to argue that Constellation could fall in the AAA category, as it is probably rated as a software company and not as a capital allocator. Figure below, shows that it is not that far fetched to assume that 5% yield on these debentures is a reasonable yield in recession awaiting times. Most likely, yield will decrease over time as the recession victims and survivors are known.

Simple calculation above shows that current implied return of debentures 4.83%, which is between current 20-year AAA and BBB corporate debt as rated by Moody’s. At least based on implied yield, debentures seem to be fairly priced, thus reducing the risk of extreme loss even if one is to execute on the rights and ten wait to sell the debentures once market calms down after initial days of volatility.

Downside

One of the risk on the realisation of the intrinsic value of these rights comes from the issue being not as subscribed as needed to create a enough demand for these rights to close the gap.

Constellation has a large institutional ownership, and it is safe to assume that some of these institutions are not interested in holding these rights, thus selling them at any price. Most likely, this is causing the current decrease in price.

Constellation performed similar rights issues on few occasions before. In all cases, it failed to have a full subscription. However, high subscription levels were achieved, meaning that at the end a high number of rights were executed and that the demand existed for them even when Constellation was far less mature business.

Risk is also there that Constellation might activate a redemption clause on the debentures and redeem them at par value. This on the other hand could be mitigated by purchasing the newly distributed warrants, which would allow their owners to substitute Series I debenture to equivalent non-redeemable Series II debentures. However, Constellations has mentioned in the prospectus that it does not have immediate plans to redeem the Series I debentures. there is no universal definition of the “immediate“, however, 30th of September seems to fit into that time range.

Summary

Debenture rights are not a safe investment, however they are a tempting speculation with asymmetric payoff at hand. Theoretically, they could increase in value from current 0.21 to 1.25, but most likely only 60% to 80% of the theoretical value could be achieved by the time they expire due to the fact that many will let them expire worthless. In worse case scenario, at this price, they are equivalent of purchasing Series I debentures at CAD 133.85, which would imply an internal rate of return of 6.7% over the period of next 17 year. Entering this deal, with that as a fallback, is not a bad prospect.

I own them. My average price was CAD 0.21.

—Update 09/09/2023

Another useful overview that helps with the comprehension of the risk of holding debentures, is the sensitivity of their implied intrinsic value to the prices of debentures and discount to that value, which will be achieved in real life. This can be presented in a simple table:

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full time job.

Best of luck to all of us! 🍀

Since the gap between the market value of rights and their implied value did not close, I subscribed to debentures.

To track debentures price, follow this link:

https://ceo.ca/CSU-DB

To get the price of the rights, follow this link:

https://finance.yahoo.com/quote/CSU-RT.TO?p=CSU-RT.TO