13. Topicus - Value shortcut

Overview of my current information on Topicus, including latest valuation

I have written about Topicus several times so far, and the intention of this note is just to provide the latest updated information on its current state of business and link it to how I measure the value of Topicus as a business.

The fundamental principles I use currently to value Topicus (until they change) are that I see it as:

Diversified conservative capital allocator, coincidentally operating in the vertical market software industry

The result of a precise financial engineering with consistent application of its business model

An European company

To keep this more than empty phrases, what this means is the following.

Topicus invests in companies with low or no growth but with positive cash flows to equity, which are then aggressively reinvested into similar businesses. These businesses return cash to the main holding or sub-holding companies, which is then reinvested into other companies whose uniqueness is added to the collective. As long as the prices paid for the acquired companies and leverage on the holding level are kept constant and there are no aggressive and dilutive equity raises to fund the acquisition model, I consider it a conservative allocator. Investing every available cent of retained earnings and adding additional debt is far from the normal definition of conservative operation, but this links me to the second point.

Topicus is an example of financial engineering that I look for in any company I find. My (unproven) belief is that running any business with a strong focus on optimising its financial performance, but not at the expense of the business itself, can lead to the creation of shareholder value. A competent CFO can give a competitive advantage to a business that does not have an inherent competitive advantage, simply because competent CFOs are rare. There is an anecdote in banking that can probably be applied to the general business environment, that there are more banks than competent bankers in the world.

The reason why I prefer this is because it’s easier, at least for me, to observe evidence of strong financial discipline versus operational competitive advantage, or moats. It is not the only thing I search for, but it is one of the fundamentals I need in order to make any sort of estimate of intrinsic value.

The last point is that I see Topicus as a European, Euro-linked company that is, for some obscure reasons, linked to a Canadian stock market and has its share price denominated in Canadian dollars. This has many implications and probably leads to some confusion for close followers of Constellation Software. Euro to Canadian dollar exchange parity must be taken into consideration when assessing whether investing in Topicus is a safe investment.

The EUR/CAD exchange rate is historically volatile, and it offers an interesting opportunity to EU investors. From time to time, it can change its price in EUR, which is the real price of Topicus as a business operating mostly in Europe, quite suddenly opening short windows of opportunity and ensuring the safety of investment. It can also create illusions of cheapness, like during the worst of the October 2022 stock market misery, when actually you would not be much better off buying it than today. Purchasing a share at CAD 71 in October 2022 at EUR/CAD of 1.35, or EUR 53, versus today's price of CAD 91 at EUR/CAD of 1.5, or EUR 61, looks much more rewarding in CAD than in EUR. Yet, Topicus makes most of its revenue, expenses and net income in EUR.

The Measure of a Business

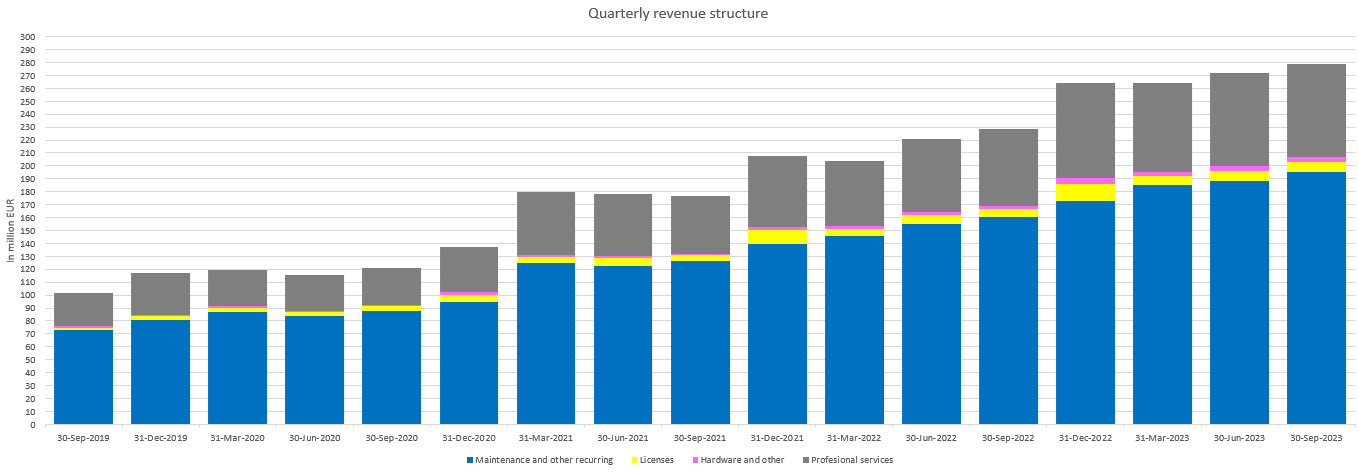

The following figures show the development of Topicus as a business-tough income statement (in EUR, last time mentioning this). So far, revenues have grown in line with a long term compounded average, and there are no significant indications of this slowing down or that the structure of revenue sources is changing. It is a Constellation model fully applied.

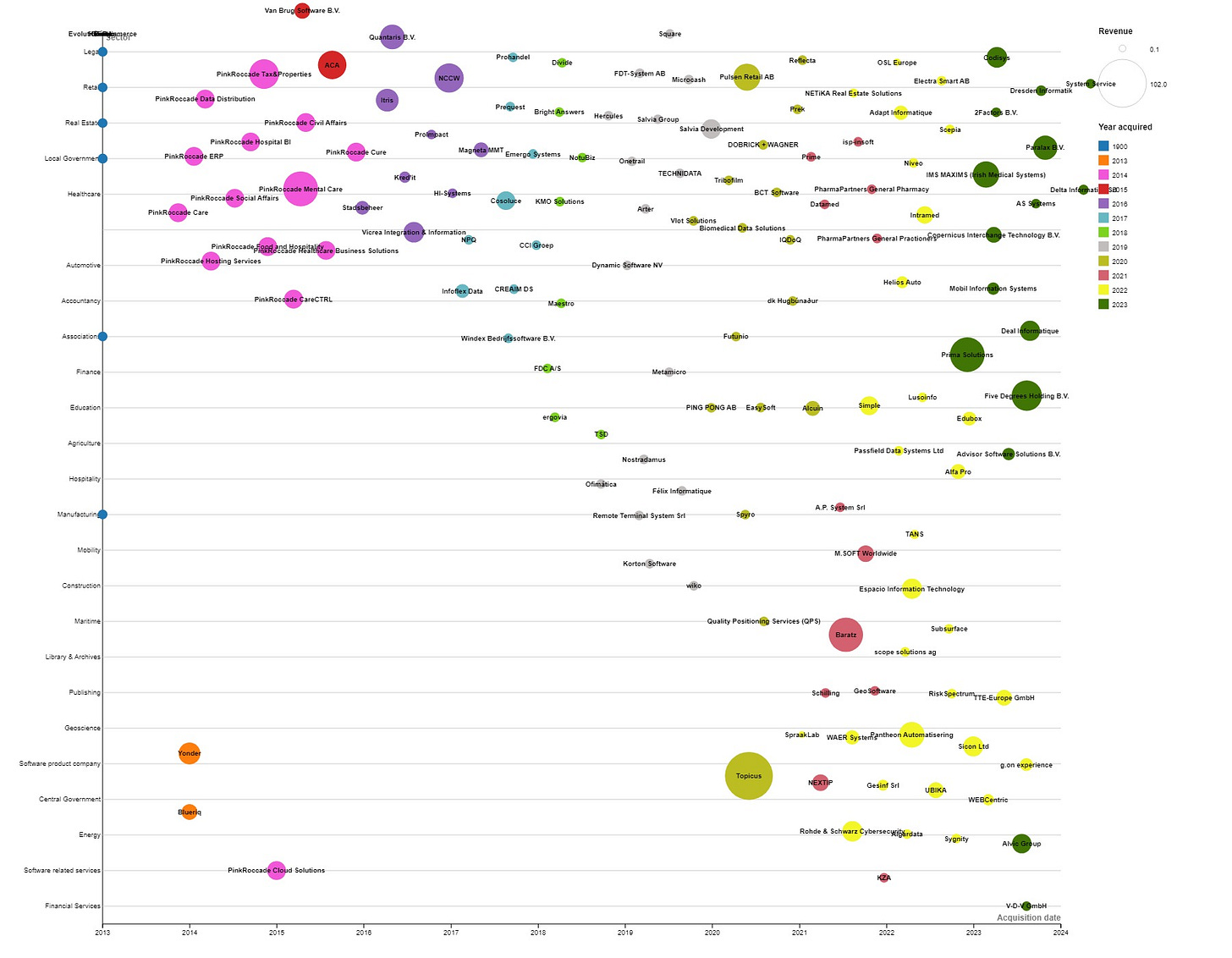

As for the business development through acquisitions, below is a nice overview of how Topicus grew before and after acquisition and spinof by TSS and Constellation. It can be overlooked, but scope of industiries in which comanies are being acquired is growing. Might not seem as much, but in case of serial acquirer addicted to cash flow, diversification does bring stability and predictibility. This in turn facilitates easer capital allocation planning.

As for the organic revenue (better visible in the separate graph), Topicus slowed down its growth in real terms during 2022, when across its operating markets it experienced inflation of 6-8%. Although not worrying, it would be good to see the real value of organic revenue growth remain above 0% in the long term, or 2% in nominal terms.

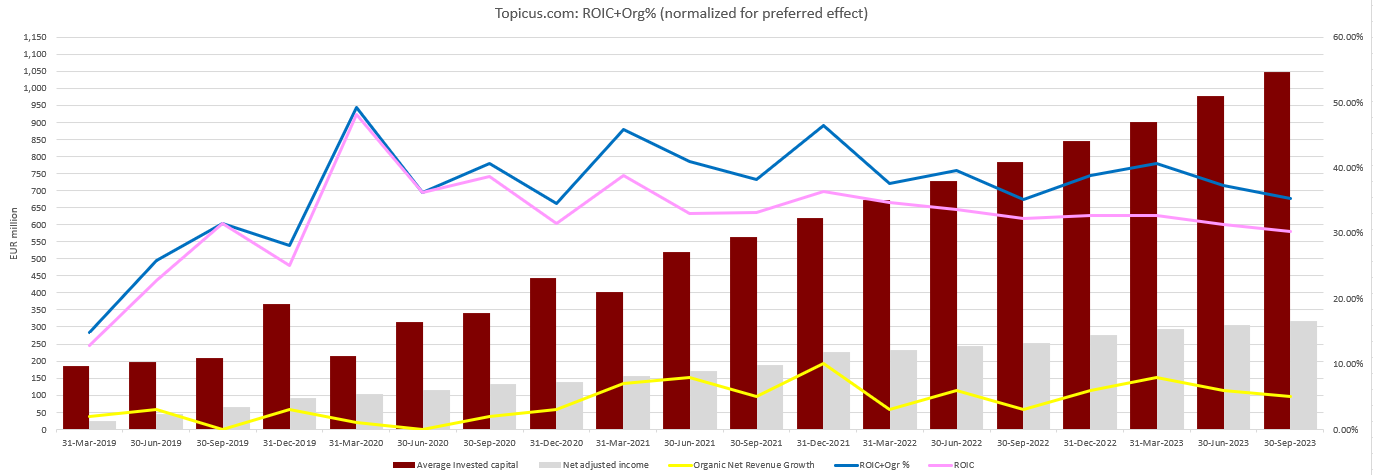

For those who are long-term investors in Constellation, ROIC+Org% is a well-known metric that was once embedded into the CSU internal performance assessment scheme. Although it has been dropped since a few years ago, it is still a good proxy for initial shareholder returns (note: those who provided initial equity). Maintaining this rate above 20% is something only a few companies can achieve without excessive leverage. In the case of Topicus, some midterm level of 25% can be expected.

Constellation Software used similar metrics to track the bottom-line profitability of their activities and growth and to monitor business development, and that makes perfect sense. Constellation measured invested capital as capital from retained earnings belonging to the shareholders (minus non-controlling interest) increased for cumulative results on intangible asset amortization (non-cash expense).

The only change I applied here is that instead of using average firm invested capital over a period of time, I would use the market value of invested capital, as it better reflects the price I have to pay to own part of the total capital return.

The Measure of the Value (Value Shortcut)

As a shareholder, I would, however, compare net income adjusted for non-cash items with the market's perception of invested capital (equity) value. As tempting as 30% ROIC looks, the reality is that that number is relevant only for the founders of the firm, while for most of us, that return is reduced by a factor significantly greater than one.

Resulting value provides probably the biggest shortcut I have to quickly decide whether Topicus is overvalued or undervalued. Simply by comparing its net income adjusted to reflect cash flow to equity holders and then putting it in relation to the market value of the common.

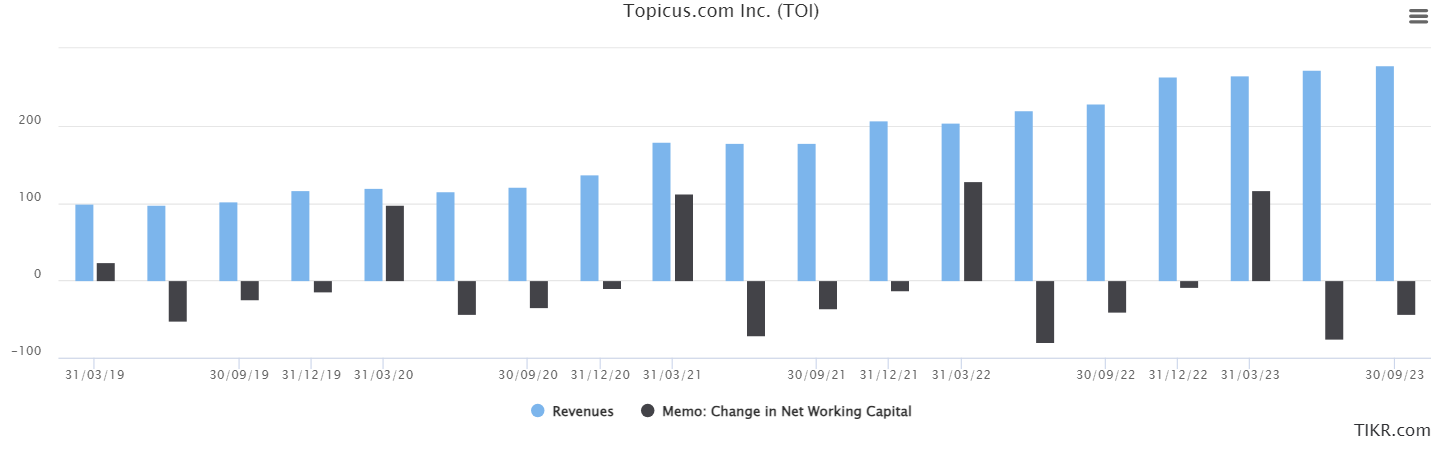

To estimate this measure, I would calculate an implied return as a ratio of adjusted net income, as shown in the figures above, and the market value of 129.8 million shares of Topicus. To this value, I would add some average value of organic growth, as long as this growth is truly organic and does not require additional expenses or investments in working capital to be made. Based on the data I have, Topicus has cumulatively increased its working capital by close to EUR 70 million in the past 3 years, which can be considered insignificant. For some normalized estimate of organic revenue growth, I would take a 3-year average (4-5%) to correct for 2022 as a high inflation year, when almost every healthy organization increased their revenues by the amount of inflation (8%). For changes in net working capital, I would just assume that over a longer period of time, organic revenue growth is really organic, in the sense that it’s achieved through growth of existing client relationships, price increases, and not additional investments. The figure below supports this statement regarding net working capital needs.

What we are left with is a simple evolution of the implied yield over time, which now stands close to 10%. As I will show later, by coincidence, luck, or maybe even augmented reason, this is quite close to the implied rate of return I would obtain in my standard DCF approach.

However, implied yield, as defined above, shows the following evolution of Topicus as an investment. In hindsight, paying a price of CAD 125 per share might have been excessive (note the black line below).

Two additional points I follow are Topicus intangible asset development and the evolution of the sales-to-capital ratio. Understanding the importance of intangible assets in the case of Topicus is a necessary, as they are a major source of cash flow that is not observable at a first glance. However, two points must be made about intangible assets. Although it is reasonable to add back their amortization to each period's result in order to obtain the true estimate of generated cash, thus increasing its NOPAT and total amount of intangibles, gross intangibles (current intangibles increased by accumulated amortization) are in fact actual shareholder money spent in acquisitions. Therefore, capital employed (total equity plus interest-bearing debt net of cash) must be increased by accumulated amortization, which is not shown in the balance sheet since the balance sheet shows only net carrying amounts. This shows the actual size of the capital employed by Topicus since its inception, which is now over one billion Euros, roughly two times more than just 3 years ago (in line with the ROIC shown above of close to 30%).

Where this comes in handy is in analysing how consistent Topicus M&A team is in the execution of the acquisition strategy.

Measured through the sales to capital with accumulated amortization, we can see that to run Topicus over time, you would need to invest 1 Euro per each 0.8 to 0.9 EUR of revenue. Marginal version of this ratio, might be volatile, but in the overall this ratio seems stable. Take as many companies that are acquiring others as you wish, and try calculation sales to capital with accumulated intengable asset amortization. Much more volatile numbers will appear in front of you. In case of Topicus, stability of sales to capital employed and ROIC+Org% is what makes it a great business.

It does not just end here. Using above mentioned capital definitions (invested capital - cumulative retained earning, capital - total equity and interest bearing debt, and capital including amortization of intangible assets), we can also look at the capital structure. Historical data does not forecast the future, but it is sometimes correct and can serve to evidence the built in stability of the system.

Although it might appear that Topicus fell into the trap of borrowing to grow, one repetitive disclosure in their MD&A, casts a different light.

Roughy 10% of the debt Topicus carried on its balance sheet for almost 2 years was interest free. Adjusting the debt figures for this amount in the period in question shows greater level of stability (red line in focus).

How do I use this last point? Well, Topicus is now generating over 1.1 billion in revenues per year. If you think that it will increase its revenues over the next, say, 5 years, three times to 3 billion, you are in effect implying that it will invest 2 billion x 0.85 = 2 billion over that period. Roughly 30% of that amount, or 600 million, will be through additional debt, increasing the total debt level to roughly 900 million. The other 70%, or 1.4 billion, would have to be generated by current and future Topicus business units through after-tax cash flow. At its current size, Topicus generates EUR 200 million in cash flow from operations, and it grows that number by roughly 20% each year, making this seemingly a plausible assumption (200+240+288+345+415=1.488). Plausible. Yes. At the same time, this is an impossible task for 99% of global corporations.

Valuation

I use the above thought experiment as a simple plausibility check around assumptions, but it would not hurt to also run a simple DCF with some simulations around the main narrative. The main assumption for Topicus is that it will follow the Constellation playbook. Apply its hurdle rates. Allocate its cash from operations and more (debt issuance) and roughly replicate what Constellation as a business did between 2013 and 2023 (business size increased almost 6 times). Note here that the focus is on business growth, not the market value of the business.

Translating this into numbers, for Topicus or any acquirer, I try to create a rough estimate of what their growth would look like if they maintained their financial and operational discipline over some midterm period. By financial discipline, I mean that they continue to invest the same relative level of capital (both capital from retained earnings and from debt raises) while paying prices for the companies they acquire that would be comparable to their previous history (IRR of 20%-30% percent depending on the country). By operational discipline, I mean that the companies they acquire continue to operate at least at similar levels of profitability. The strong assumption I am making is that no company ceases to exist. The last point would be visible as potential goodwill impairment, but also, from time to time, I check on some random sample of Topicus companies. So far, I have found no evidence of prior acquisitions disappearing unless consolidated into other existing entities.

The point of the model is to show what the achievable state is in the case that the above holds, and in the case of Topicus we get the following:

Summary

Topicus is as good a company as one would like to find, but it is still priced at a level that leaves little margin of safety in case any assumptions in the value estimation are wrong. This is a bittersweet conclusion since, on one side, it is priced still close to the level of an index's implied internal rate of return while heading into turbulent times. On the other side, any market shock unrelated to the operating model of the majority of the Topicus business units, fluctuations in the CAD/EUR exchange rate, or some other irrational behavior, might create an opportunity to add to one's holdings at attractive prices. That depends on your hurdle rates. In my case, I would require a price of close to EUR 60 to EUR 64 to consider purchasing additional shares. Lucky for me, the little proxy I have blinks when either the price decreases enough or the business further grows with the price level unchanged.

Disclaimer and kind request

I own Topicus and Constellation Software.

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to suport my writing which I do in my spare time, while working a full time job.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Best of luck to all of us! 🍀

Annex

It would not be a CSI universe note without the radial tree representation of current group structure of Topicus, showing chronological and industry distribution development. Enjoy!

Really love this write up on Topicus, great job. I own it, Constellation and Lumine in my portfolio

Hi, given that Topicus Inc, listed in the Canadian stock exchange only owns ~62.1% of Topicus Netherlands, shouldn't you apply a ~40% hair cut on the profits you are projecting?

Essentially what we own is the shell (Topocus Inc) who doesn't own 100% of all the profits Topicus Coop (Netherlands) makes.

However, when reporting, the consolidate all the earnings on the financial statements. That is why at the bottom of the income statement, there is this line item that says "Net income attributable to Equity Holder of Topicus"

This was in the latest Q4 FY23 filing:

"The Company’s non-controlling interest at December 31, 2023 is associated with Topicus Coop, an entity

domiciled in the Netherlands and certain subsidiaries of Topicus Coop. Topicus Coop’s common equity

consists of Topicus Coop Ordinary Units. As at December 31, 2023, there were 129,841,818 Topicus Coop

Ordinary Units outstanding, which are held by Topicus Coop’s unitholders, as follows:

Topicus: 81,889,763 Topicus Coop Ordinary Units, representing 63.07% equity ownership.

Joday Group: 39,331,284 Topicus Coop Ordinary Units, representing 30.29% equity ownership.

Ijssel Group: 8,620,771 Topicus Coop Ordinary Units, representing 6.64% equity ownership"