20. Trinity Exploration acquisition by Lease Operators Limited

Illiquid spread on an acquisition transaction

This is a short and quick post on what I see as a nice and quick opportunity to capture a speared on a soon-to-be-closed acquisition transaction.

Investing is driven by random idea generation in my case, and this one came to me unexpectedly. While waiting for my Trubridge notes, Trinity will have to suffice.🍀

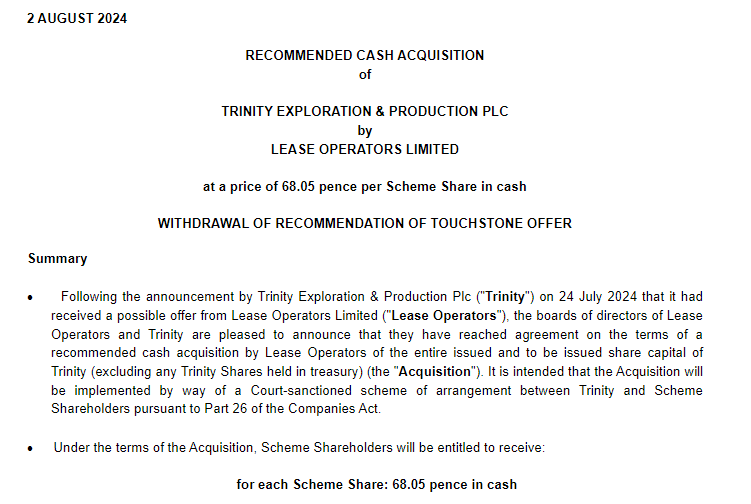

In short, Trinity Exploration is being acquired by Lease Operators Limited, on behalf of Well Services Group from Netherlands, which in turn is owned by Excellence Logging, for 68.05 pennies per share in an all cash transaction. These are four companies you never heard most likely, and this is not that relevant. What makes this an interesting opportunity, is the set of circumstances before this acquisition offer was announced.

For detailed offer document, and to do your own due diligence, you can go to this link. Where sources are not named, I have taken the document snippets from here.

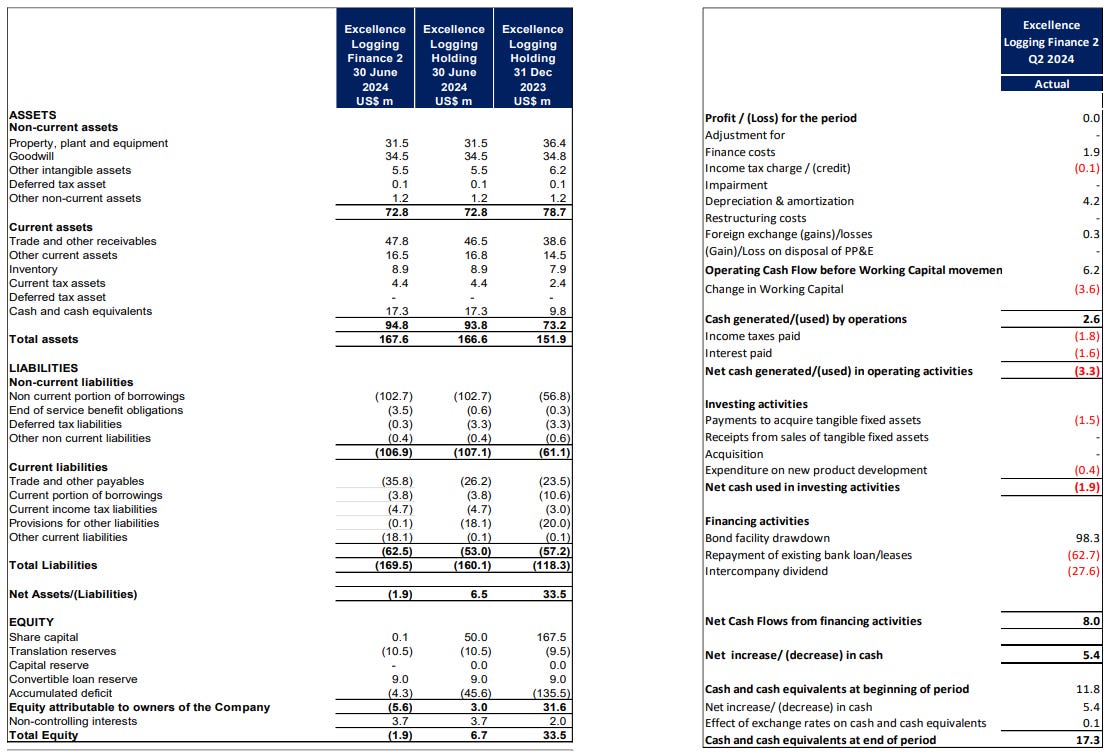

At least on consolidated level, Excellence Logging seems to be large enough to finance this acquisition

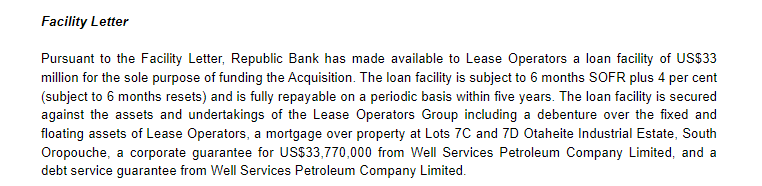

More importantly, Lease Operators have secured the financing and guarantees for the transaction.

On May 1st, 2024, Trinity received the offer from Touchstone Exploration for all shares of Trinity in exchange for 1.5 newly issued shares of Touchstone.

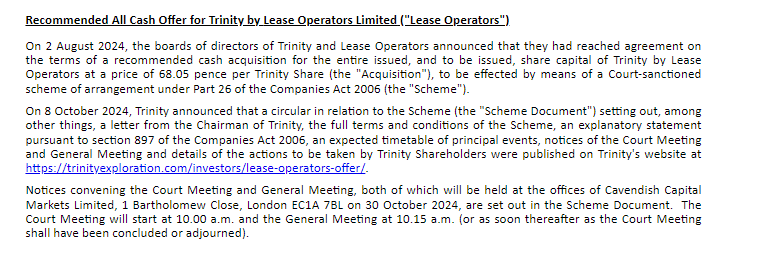

This offer was subsequently lapsed by Touchstone as Trinity received another offer, this time for an all cash transaction from Lease Operators for a 68.05 pennies per share. In transaction to become effective, 75% of the shareholders of Trinity have to vote in favour and regulatory approvals have to be obtained by the Trinidad & Tobago regulatory authority.

What is interesting, is that the shareholders already voted in favor of the Touchstone offer, which reduces a risk of failed shareholder vote when it comes to Lease Operators offer. Arguably, current offer is better for the shareholders simply by offering cash instead of shares alone.

following the Court approval and shareholder vote transaction should terminate within 14 days.

In addition, in their latest operational update, Trinity released the details of the meeting that is scheduled at October 30th, 2024.

After the 15 minute Court session, General Meeting will take place, where shareholders will vote on the offer.

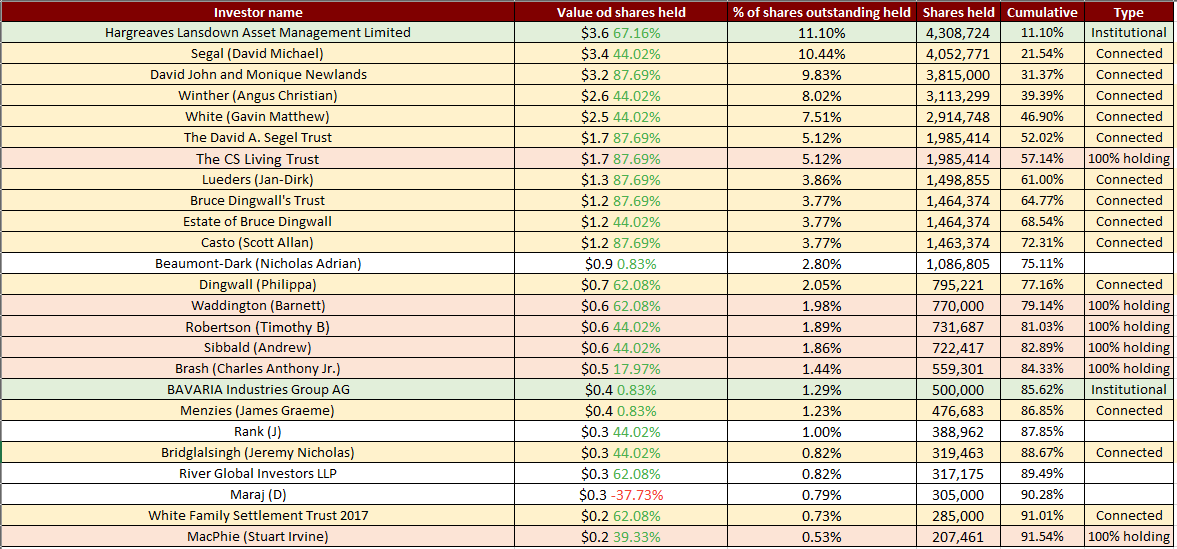

Looking at top 25 shareholders, and assuming that those who are connected with the company, are institutional investors, or have this as their only holding will vote in favour, shareholder support for the deal seems to be there.

I expect this to close by the end of November the latest.

I have a minor position in Trinity Exploration.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe, even for a month. Even years after you have read something from me, based on realized experience.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Deal is approved https://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20241030:nRSd2738Ka&default-theme=true

Thanks for the write up. Have you looked at Covestro ?