21. Trubrige Inc: Second time around

Attempt on valuation(s), based on my subjective interpretation of the management communication.

Following post will be held behind a paywall until I am certain of some of the assumptions I am making, and until US presidential election outcome euphoria does not subside. I do not wish to stoke the fire or feed into now dominant feeling of missing out. Initially, I planned to keep this open to all, but I could not have imagined how much greedy the overall market will become in the course of four weeks since my latest Pinetree update when I promised to share my notes.

Until then, efficient market will have to be patient. Those of you who communicated with me, but do not wish to pay the subscription, feel free to contact me for the access to the notes.

🚨I could be very wrong on this one. Take everything below with ultimate distrust.🚨

I am a numbers' person. My ideal investment is manifested as a company that has a procedural approach to every aspect of its operations. I rejoice when I discover companies with roles devoted to margin planning and management, that use scenario analysis and hurdle rates in their capital allocation decisions or constrain their growth with own generated cash flow.

Trubridge, formerly known as CPSI or Computer Programs & Systems, does not fit any of these categories, or at least it did not until Vinay Bassi was appointed as CFO as of January 1st, 2024. Below analysis is based on last three annual reports and conference calls Trubridge held since February 2021. I had no contact with Trubridge or any of their past or present larger shareholders from which I could shape any of my views. Analysis below, is my own subjective view with great potential of being wrong.

Premise

It all starts on the February 9th, 2021 when Trubridge decided to make a strategic shift into focusing on their revenue cycle management (RCM) solutions as opposed to splitting the focus between it and EHR.

During the past several months, we have partnered with a premium consulting firm to review our business and growth opportunities and to assist us in identifying the best path to increase value for our shareholders while also safeguarding the interest of other critical stakeholders such as our clients and employees.

The purpose of this assessment was to more clearly define a strategy that would drive long-term sustainability and stewardship, grow CPSI's footprint, and maximize our success in a post-COVID world.

Our assessment confirmed and identified several compelling opportunities to grow our core business while investing in new technologies and improving overall profitability. The outcome is an aggressive yet attainable plan that is intended to provide significant shareholder returns over the next 3 to 4 years, culminating in an end goal of $80 million in adjusted EBITDA in 2024.

There are 3 equally important components to this plan that we will pursue simultaneously: core growth, margin optimization and tangible upside growth through innovation. The core growth component of our plan is concentrated around our current markets and, along with margin optimization, will help drive our targeted 2024 adjusted EBITDA.

The initiatives for core growth utilize our 41 years of success in the healthcare market and our most valuable asset, the client base that we have acquired along the way. The core growth component includes 3 initiatives intended to drive higher demand, penetration, and share in our current fields of play.

First, we will continue expanding our established sales relationships by cross-selling TruBridge services (author note: RCM) into our substantial acute and post-acute EHR bases. While this initiative is not new to CPSI, we look to improve our execution on this opportunity, turning the page from good to great.

With a total market opportunity of $400 million in annual revenues, we have confidence in a target of $60 million in incremental annual TruBridge revenues through cross-sell efforts by the end of 2024.

J. Boyd Douglas, CEO, Q4 2020 Earnings call

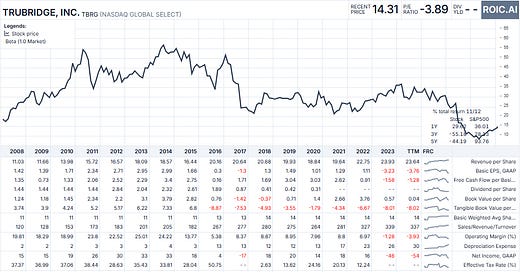

For perspective, these are the operating results of Trubridge at the time, and how they adjusted their EBITDA since.

Fast forward to today and we are here.

Let this serve as a warning in taking the rest of this analysis for granted.

Business overview

TruBridge, formerly CPSI, provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally. The company operates in three segments: Revenue Cycle Management (RCM), Electronic Health Record (EHR) and Patient Engagement. Of the three segments mentioned in the description, RCM is the key, EHR is the tool, and rest can be considered legacy business which will become less and less material over time.

In simplest words, RCM is a rounded accounts receivable software specific to the USA healthcare system. EHR is a patient health and progress tracking software. More details for those who want to save some time from reading 10-k reports are below.

RCM: This segment is in theory the company's primary growth engine, comprising 57% of consolidated revenue in 2023. TruBridge offers a comprehensive suite of RCM services, including:

Central Billing Office (CBO) services: Provide end-to-end revenue cycle management outsourcing.

Extended Business Office (EBO) services: Focus on collecting outstanding patient balances after insurance payments.

Coding services: Assist hospitals in accurately assigning medical codes for billing and reimbursement purposes.

RCM analytics and complementary outsourcing services: This capability was strengthened through the acquisition of Viewgol, which specializes in ambulatory RCM solutions.

Subscription-based RCM software: TruBridge offers a software product designed to streamline revenue cycle processes.

Within RCM, CBO and EBO are apparently the key into stabilizing and potentially growing Trubridge as a business. It’s worth noting that Trubridge RCM solutions are independent on who is the provider of EHR. It could be them, or some third party, in both cases integration is possible. Also, RCM is a more human intensive business and as such has lower margins. However, based on Trubridge own estimates EHR has much larger addressable market since the majority of hospitals uses in-house RCM solutions (80% to 85%), and Trubridge aims to outsource that role from them. Think of it this way, a small 400 bed hospital would have to hire probably 5 to 10 people working on accounts receivable management. Over time, expertise would get concentrated in one to three key people. Moment, they leave or retire, issues with denial claims, wrong coding and delayed collections would arise. For a larger hospital this inefficiency could be overcome by financing working capital with loans, but the smaller the hospital, the harder it gets to overcome the irregular revenue stream. Trubridge is there to provide business continuity (they keep your working capital staffed) and apply constant level of management practice. Once they are in as a service provider, there is very little reason for a hospital to change back to in-house team.

EHR: This segment provides a digital version of a patient’s medical chart that can be shared across different healthcare providers and organizations. EHR is offered under different licensing under perpetual licensing model (now minority) and software as a service. Trubridge makes no secret that growth in EHR is not a priority (in January 2024 they have divested from American HealthTech, which Healthland, acquired by Trubridge in 2016, acquired in 2013 from HealthTech Holdings, LLC). There is little clue left why this is so. My only assumption is that this market faces much lower labor intensity once EHR system is implemented (either in-house solution or third-party solution), so one variable that would affect the continuity of the process is gone and with it an argument for a change. However, within EHR, TruBridge offers nTrust, EHR/RCM bundle. In simplest words, if current EHR customers get converted to nTrust, they have also become RCM customers. nTrust is Trubridge shortcut to cross-selling.

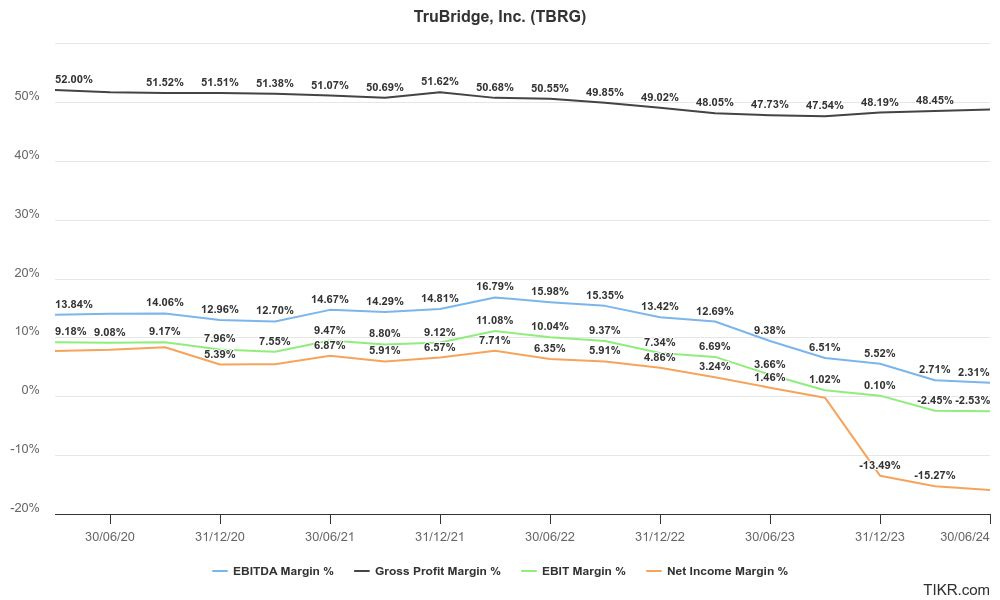

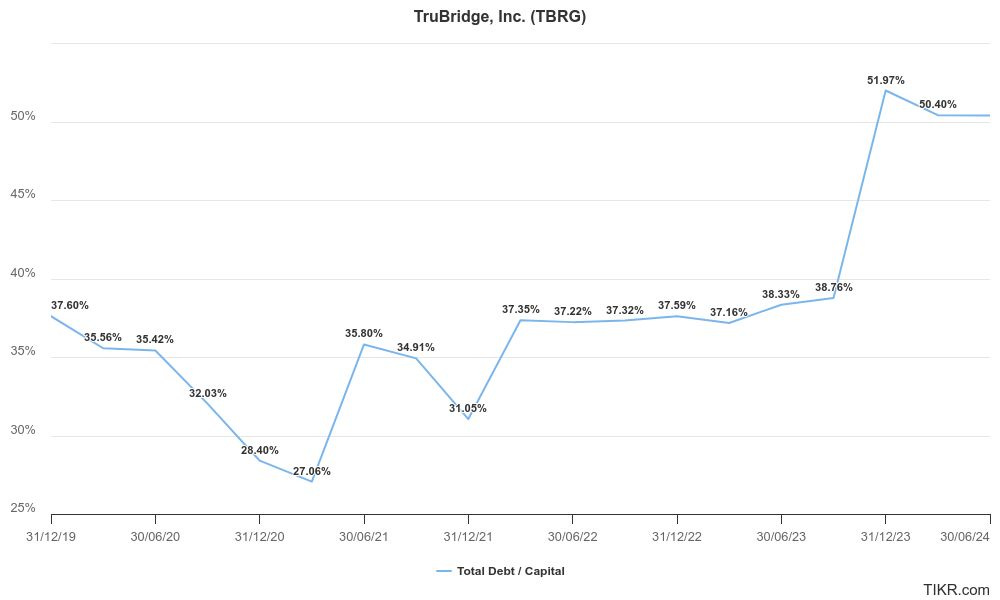

Today, Trubridge is moderately leveraged business with high cost of debt (8.5%), margins depressed compared to historical levels or levels of the industry in which they operate, and with small issues in working capital management (ironical for the company that sells accounts receivable management software). They have grown organically, but mostly through acquisitions which we mostly overpaid. For past 3 years they have been undergoing strategic business model optimization with a goal of moving away from EHR to RCM which caused significant severance costs which still reduce profitability. Owning it over the past few years was not fun, but this has created an interesting situation. We are now faced with a company that can improve its margins to some industry average level (plausible outcome), manage its working capital better and through that increase its cash flow generation, reduce its expensive debt and potentially refinance it once healthier operating results are achieved.

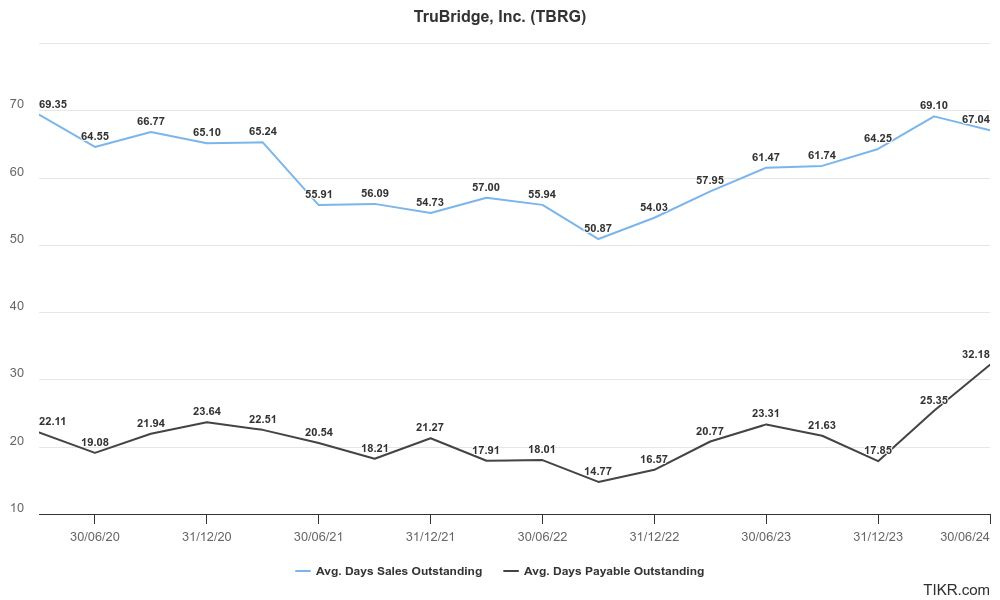

Below is an overview of some of for me relevant financial matrices for better understanding Trubridge. Data is taken from Tikr, but it is a fair representation of the financial statements (LTM values for each quarter since Q1 2021 are shown).

Working capital at the end of 2023 was affected by large amount assets held for sale prior to the divestiture from American HealthTech.

Trubridge no longer generates enough CFO (that has changing in last two quarters though) to cover its current liabilities, although current assets cover them. They do not have any large lump sum loan repayments and do not have concentrated sources of revenue. This reduces the risk of them not being able to service their current liabilities.

There are early indications, visible also above, that active collection efforts are being taken to reduce days sales outstanding, and it seems that both the trend in increase of days outstanding is going to revert, and the gape to days payables outstanding is going to narrow.

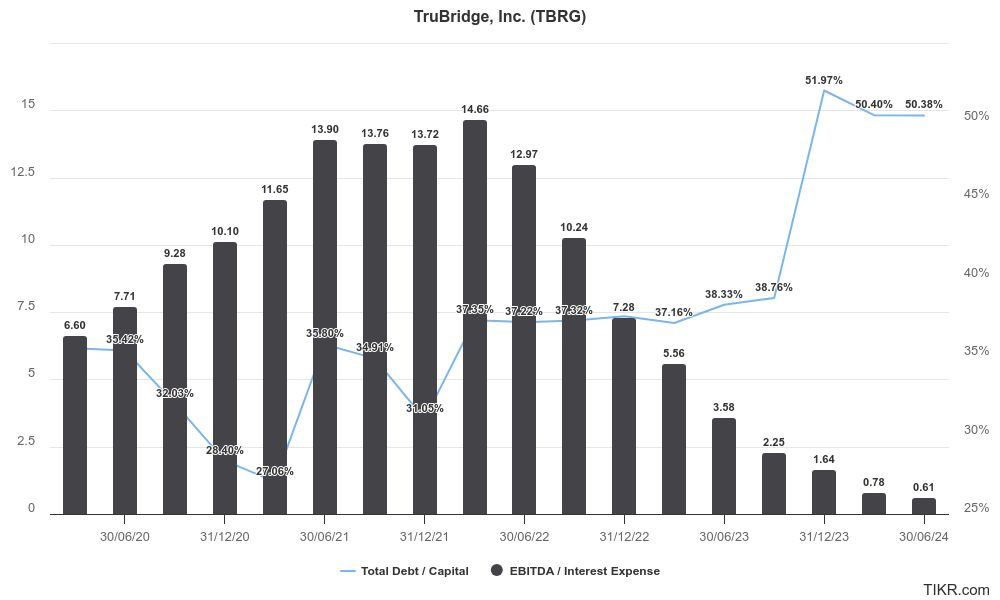

Looking at debt levels and interest coverage situation seems scary at first, but EBITDA (LTM) shown below was affected by large goodwill impairments related to the mentioned divestiture. Without them, interest coverage would be higher (more on debt is provided below).

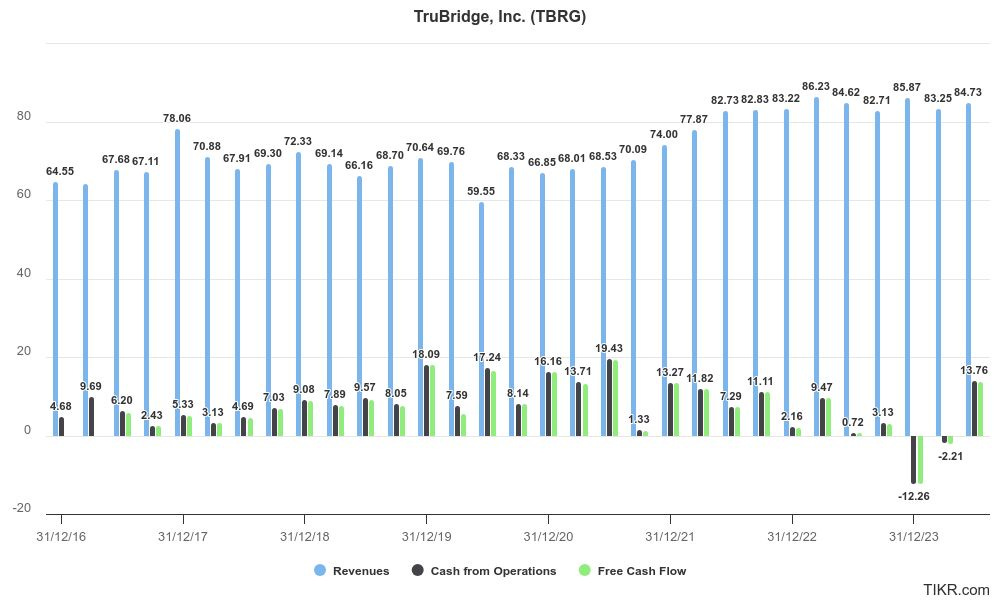

Trubridge is currently a 340 million dollars business measured through revenues, and it has grown to this level though a mixture of organic growth and probably value destructive acquisitions, with the latest one happening in October 2023 when it acquired Viewgol.

These acquisitions were targeting growth primarily in the revenue cycle management product offering, but at the great cost.

Since March 2016 and acquisition of Healthland, Trubridge has cumulatively invested over 310 million in acquisitions, and managed to grow its revenue by 60 million on annual basis, while reducing its cash flow from operations from an average 30 million per year to it now being just above 0. On a positive note, some level of organic growth was always being achieved.

Before continuing, I will just point that, prior financial history carries a lot of noise in case of Trubridge. Instead of adjusting historical statements for one-offs and legacy inflows and outflows in order to get a quantitative measurement of a stable system though time, in this analysis I will apply a top-down approach. I will take current state as it is. and by analyzing what Trubridge has communicated, I will attempt to estimate realistic capital structure in their future stable state, realistic operating and net profitability and cash flow generation. For that we need to go through the recent history of disclosed information and try to find out, what is it that Trubrige has been trying to achieve past three years.

Restructuring plan

Trubridge does not publicly provide a clear target they want to achieve in their effort to reshape their business, timeframe in which they want to achieve that state, nor means by which they want to achieve it. Everything from this point is my own interpretation of publicly available data from their financial statements, result and conference presentations and earnings call transcripts.

Based on the information provided in the transcripts, the following quantifiable activities that can work in favor of making Trubridge more profitable are mentioned.

Leverage and capital deployment

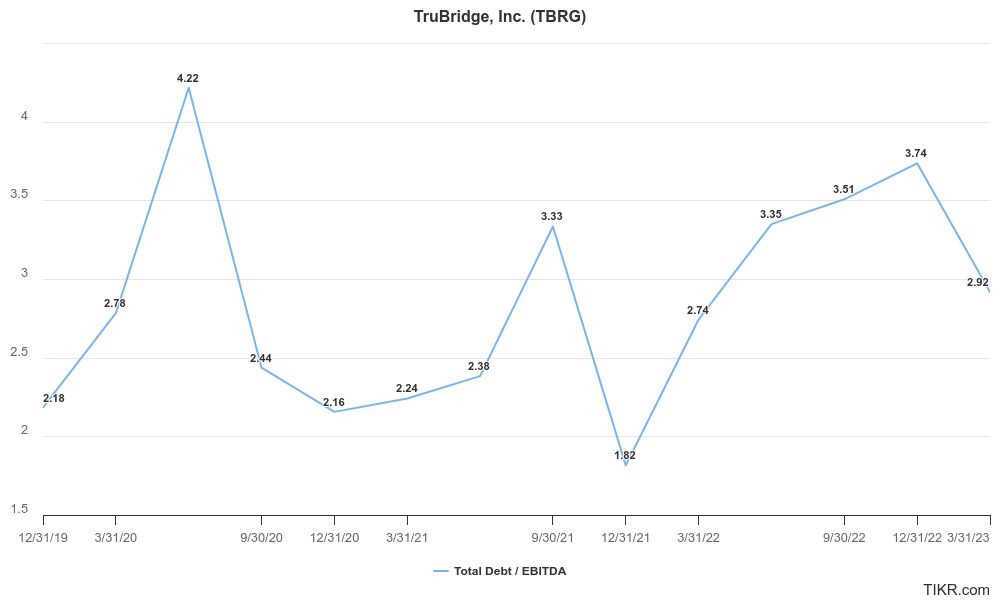

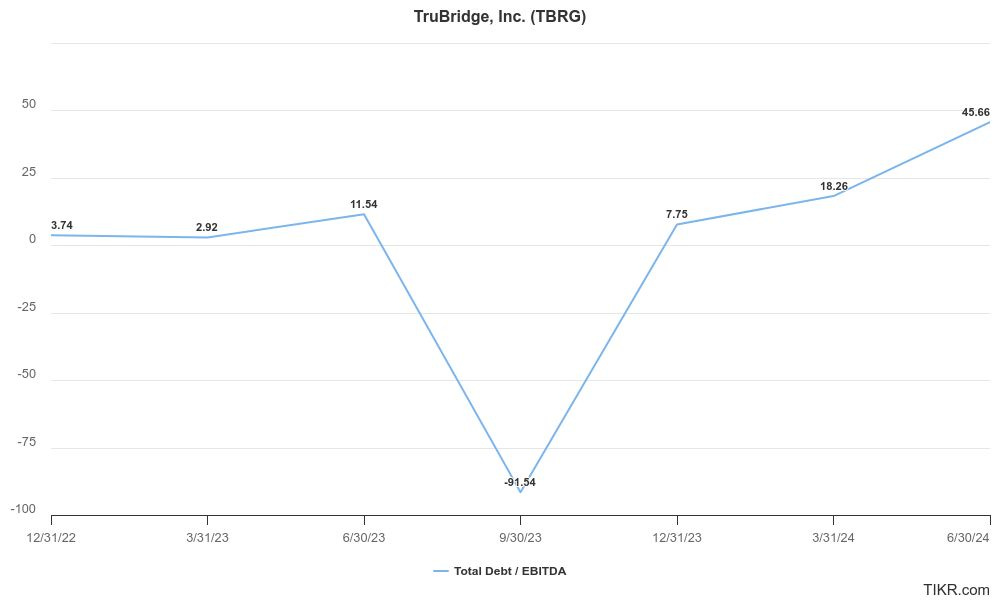

Although not stated as one of their most important targets, throughout the last few years leverage ratio of up to 2.5 Debt to EBITDA was mentioned. Initially, it seemed that this threshold is controlled for.

However, debt levels have increased significantly in the past 2 years, driven by acquisitions, Health Resource Group (HRG) and Viewgol. Looking to more recent periods (below), extreme negative value in debt coverage was due to 35 million goodwill impairment booked prior to sale of one of EHR businesses (American HealthTech, also known as AHT, to PointClickCare). During 2023, AHT contributed to 16 million in revenue and 2 million in Trubridge adjusted EBITDA (sold for 21.4 million).

Trubridge was not that active in prepaying their debt, and this is not surprising since it struggles to generate operating cash flow. Debt reductions that occurred lately were financed by proceeds from divestiture.

Since relative debt to profitability has gone to extreme levels, Trubridge had to renegotiate its debt several times over, and was on a verge (it is still) of defaulting on its debt and being treated as a workout client by their creditors. Currently, Trubridge is paying on average 8.5% interest on its debt, or about 4-4.5 million interest and 0.9 million in principle quarterly repayments. There is a tendency to disregard debt related cash flows when valuing companies, and just deduct the debt value from the final economic value estimated. However, in this case, always keep in mind the scale of debt related outflows Trubridge has. Trubridge generate roughly 40 million in gross income, not operating or net income, at close to 50% gross margin per quarter. 12-13% of that goes to servicing debt. The rest is not that much, and often, quarterly cash flow from operations does not suffice in covering this cash need.

At the same time, debt reduction could be one of the biggest, most certain and simplest value drivers in case of Trubridge.

More on this in one of the valuation approaches at the end.

Offshoring

Offshoring is the single biggest value driver for Trubridge. In case you are wondering what is meant by that, simply, it's hiring people in India in favor of the USA domiceled workers. If executed correctly, it can transform Trubridge into a stable cash generating business. If executed badly, it can decrease customer retention (which is close to 95% per year) thus undermining their SaaS model, and also result in additional ram up of costs through local hiring of the customer services.

First hints of staff reduction and replacement with employees outside of North America were given in early 2021. Initial cost reductions of 25 million on annual level were expected based on organizational changes, which included both offshoring and organizational changes.

Our operational initiatives over the next 3 years will seek to optimize margins, further supporting our 2024 adjusted EBITDA target of $80 million as we execute towards targeted cost savings of $25 million by 2024. The first facet in our margin optimization efforts is an organizational realignment intended to help create a more nimble and dynamic organization that will spur faster decision-making by flattening our organization to bring our leadership closer to our customers and frontline employees.

The 8-K that we filed today reflects our efforts to date with this optimization initiative, with 1% of our employee base impacted by today's position eliminations. While these were certainly difficult decisions, they were essential to fostering the transformation necessary for CPSI to reach our long-term goals.

All told, the actions announced in today's 8-K filing will result in annualized cost savings of $3.9 million, with a $3.3 million impact to 2021's financial results. By realigning our organization, we have the framework in place to begin improving how we work. We are establishing efficiencies by defining and standardizing processes and activities by function, aligning incentives to ensure productivity and desired outcomes, and reassessing vendor partnerships that may present expanded automation and offshoring opportunities in the future.

J. Boyd Douglas, CEO, Q4 2020 earnings call

At the beginning of 2023, 100 people were offshore, with a plan to bring that number to 400 people by the end of 2023. Interestingly enough, offshoring started in late 2021, and according to transcripts, it has been deliberately slowed down in order to limit the operational risk of employing less than adequate workforce.

And so it was an 18-month build to get to this 100 employees fully offshore, which if you think about it, a really long time, when you think about the size and scale of some of the offshore vendors that are out there providing this work, they have thousands and thousands of employees that we could have turned the switch and be at 600 employees in 6, 8 months.

And I'd say all that to say that we knew that there was risk. We wanted to make sure that more than anything that we did not put at jeopardy the service that we were providing and the relationships that we've created with our customers. And so again, being very intentional over that 18-month period to feel confident about, one, the workflows that we've now chosen to do offshore; and two, the partners that we've selected to perform that work so that now we feel confident in ramping this up.

~ Christopher Fowler, CEO, Q1 2023 earnings call

A big change in the offshoring strategy came with Viewgol acquisition. Prior to it, Trubridge used third party agencies to hire workforce abroad. But this, apparently, did not work as planned and has affected the speed of onboarding of new clients. Viewgol is a 20 million revenue RCM business, producing 4.5 million EBITDA and 1.5 net income. Under the terms of the agreement, the purchase price is $36 million in cash, with an additional earnout of up to approximately $31.5 million based on a combination of achieving certain profitability metrics for 2024. By any measure, Viewgol is a low ROIC investment, and I can only sympathize with those who were shareholders at the moment of announcement. But inheriting a bad investment is not as bad as inheriting a bad investment policy, at least for subsequent shareholders. Viewgol was most likely acquired as a “strategic” investment, where the goal was more to obtain the own platform for hiring workforce abroad, than earning directly from the acquired business.

First, availability of domestic and global resources have put pressure on timely deliveries and performance in our RCM business. This isn't really anything new to us as the scarcity of domestic resources was essential motivation behind our global workforce strategy. What's incremental, however, over the last 90 days has been the inconsistent resourcing from our global partners, which has led to some delayed go-lives for RCM services.

Global partners will continue to be an important contributor to our workforce strategy. However, they are now part of a broader solution for us. Our sole reliance on partners put us at a disadvantage as we were working to scale our global workforce. With the acquisition of Viewgol, I am confident that we are on a better path to eliminate this bottleneck.

For context, we expect to have 400 global resources by the end of this year and a total of 800 global resources by the end of 2024. And we anticipate 30% at a minimum of these global resources to be CPSI employees, thanks to this acquisition. This deal also provides some wow factor margin expansion potential by bringing these efforts in-house. Initially, our offshore partners helped us lower our labor expense by 41% for each FTE but the Viewgol transaction will enable us to bring offshore capabilities in-house, bringing the savings opportunity closer to 75% per FTE.

~ Christopher Fowler, CEO, Q3 2023 earnings call

With Viewgol, Trubrige got access to an entity which can hire direct workforce in India. Viewgol has a large part of their workforce operating from India (salary levels there, for the same level of work, tend to be 4 to 5 times lower. Take this moment to appreciate the benefits of organized and wealthy societies that many take for granted). With Viewgol, Trubridge got a chance to eliminate the middleman for finding workforce in less expensive geographies. To put it in perspective, an average FTE in Trubridge is responsible for between 90 and 110 thousand dollars gross according to my estimate. Shift these through a third party staffing agency and cost is now between 54 and 66 thousand. Move to Viewgol and cost is in the range of 23 and 28 thousand. This translates to savings of 2.1 to 3.8 million in staffing costs per year for each 100 FTEs that were previously employed through third parties compared to Viewgol (there are risks associated with growing Viewgol too fast, though). The above quote was provided before Viewegol Acquisition, and it’s safe to assume that by the end of 2023, 400 people were indeed offshore employees. Substituting them with own Viewgol employees would result in annual savings of 8.4 to 15.4 million. Compared to current levels of revenue of 340 million, this could increase the operating margin by 2.5% to 4.5%. More importantly, having additional 400 people offshore and through Viewgol would decrease operating costs by further 26.8 to 32.8 million compared to the USA based workforce, or 7.9% to 9.6% increase in the operating margin. Combined mean effect of both employee migration I mentioned would increase the operating margin by more than 12% (restructuring outcome #1).

Beginning of the 2024 saw a mention of a long-term plan of having 70% of the workforce offshore and 30% in the USA. No mention of the timeline was provided.

Longer term, our goal is to achieve a workforce comprised of 70% offshore and 30% U.S.-based employees. While we work through this transition, it remains a top priority to remain -- to maintain the same quality of service for all of our customers. As we look forward into 2024, our entire organization is committed to returning to growth and realizing the operational leverage that our global workforce can achieve.

~ Christopher Fowler, CEO, Q4 2023 earnings call

In 2024, it became clear that offshoring of CBO (Central Billing Office) and EBO (Extended Business Office) services. As of June 2024, 43% of the workforce was reported to be offshored, compared to 25% in March 2024. Initial plan was that 800 employees should be hired outside of the USA by the end of 2024. Based on the above reported progress in 2024, it is fair to assume that the process of workforce substitution will finalize in 2024. Severance costs and some parallel functions facilitating know-how transfer might still exist in 2025 though.

Offshoring comes with risks. Detach your customer service and development teams from the cultural, language and geographical areas in which your clients operate, and you are risking higher customer churn. This might have happened.

As we stated last year, we did see some hiccups with our offshore partner, which spurred us on to the acquisition of our own captive offshore operation with Viewgol, but some of last year's challenges with that offshore partner has translated into slightly lower retention this year. To counter this, we're doubling down on our client retention efforts and being more proactive by leveraging Viewgol's extensive experience and best-in-class approach to customer management, specifically getting the domestic client management teams and offshore production teams aligned quickly and as smoothly as possible. We look to end the year on stable footing and continue to be optimistic about the delivery of the offshore staff.

~ Christopher Fowler, CEO, Q2 2024 earnings call

It could be that integrating Viewgol could be challenging and that there are some issues in communication between US and non-US domiciled teams.

Target size of RCM business

Throughout transcripts, the figure of 400 million for the total cross-selling opportunity for RCM business is mentioned. This was a number circulating even before Viewgol acquisition. Initial plan was to achieve this figure through cross-selling to EHR customers alone and selling outside of the EHR base. A total of 180 million was expected to be added by cross-sell to RCM, and an additional 75 million though new contracts. Trubridge was a 260 million business at the end of 2020 when the plan was laid out. Expectations were made based on the assumptions of organic growth alone.

With a total market opportunity of $400 million in annual revenues, we have confidence in a target of $60 million in incremental annual TruBridge revenues through cross-sell efforts by the end of 2024.

Second, an estimated 85% of our hospitals are still managing their RCM operations in-house. With hospitals facing increasing financial pressure due to fluctuating patient volumes, increasing self-pay accounts and the impact of COVID-19, we expect to see a continued shift to outsourcing, and we remain confident in our ability to continue expanding TruBridge market share of those providers that use competitor EHRs, including upmarket into larger hospitals and health systems.

With a total addressable market outside of more than $1 billion in annual revenues, our target of $25 million in incremental annual TruBridge revenues from outside of our EHR base by the end of 2024 is attainable

J. Boyd Douglas, CEO, Q4 2020 earnings call

Slight change in this narrative occurred since, and both revenue and EBITDA resulting from acquisitions started being added while explaining distance from the set of 2024 targets.

An even bigger change in narrative occurred in 2022, when CEO succession was announced, with 400 million targets now being related only to the installed customer base (cross-selling to EHR customers). At that time, Mr Boyd retired after more than 30 years in Trubridge and was succeeded by Christopher Fowler, who had over 20 years of experience in Trubridge.

But over the next 2 or 3 years, our growth accounts for -- or actually the models that we have expects more growth from our installed customer base. So there is a very close dependency between the success and the retention of our EHR customer base and the conversion of success for TruBridge. So again, I think the number I shared in the prepared comments was $400 million, which is what's left from an opportunity standpoint for TruBridge inside the installed customer base, both acute and post-acute.

~ Christopher Fowler, Q1 2022 earnings call

By the middle of 2022, the message was being sent out that Trubridge is ahead of achieving its revenue target for 2024.

With next quarter, cross-selling market size was first time communicated as arrange of value from 300-400 million, although still emphasizing 400 as the goal.

As I mentioned earlier, we see tremendous opportunities for TruBridge within the CPSI client base, which we estimated between a $300 million and $400 million cross-sell opportunity. In fact, cross-sell bookings increased 30% sequentially. RCM-centric services represent close to 60% of total CPSI revenue today compared to roughly 40% of revenue 3 years ago. To illustrate our progress in this regard, trailing 12 months cross-sell bookings from TruBridge are 28% higher than pre-pandemic levels. And net new bookings are 31% higher.

~ Christopher Fowler, Q3 2022 earnings call

In the same call, more emphasis was given to M&A growth, deviating from the initial idea of organic growth only. This was prior to Viewgol acquisition and it’s safe to assume that initial contacts have been already made at this point.

To review, the 3 tenets of our long-term plan we are committed to are, one, growing the core. This means net new customer adds as well as increasing wallet share across our existing base. Leveraging our TruBridge brand of RCM services is integral to unlocking the $400 million potential that we discussed. We also will continue to support and grow the Evident brand, which is the trusted EHR solution of choice in our market of rural and critical access hospitals.

Number two, operational efficiency, namely unlocking value through automation and offshoring in the form of driving scale and margin enhancement enabling CPSI to deliver more value to our customers. And lastly, making key investments in adjacencies that enable CPSI to accelerate growth beyond our core. Get Real Health and our migration into the public cloud are 2 such examples.

Finally, we intend to continue following a measured and disciplined capital allocation strategy. We aim to balance R&D investments to meet the evolving needs of our customers with selective M&A in strategic areas like TruCode and HRG previously that added value to our solution set, enhancing our brand and creating scale.

~ Christopher Fowler, Q3 2022 earnings call

Throughout the period, HGR acquisition was used as an explanation for reducing EBITDA margins as it was described as services-intensive offering (human intensive).

At the beginning of 2023, significant change in narrative has occurred. By this point, Trubridge was a 326 million sized business by turnover, and it became obvious that achieving 400 million revenues by the end of 2024 (within 24 months) is not possible. The old goal was substituted with:

The company had previously provided an $80 million EBITDA target for 2024, but we now feel the more appropriate target is returned to double-digit organic revenue growth over the next 24 months, with strategic acquisitions being additive to that growth.

From a margin perspective, we believe we can achieve 20% adjusted EBITDA margins over the same time period.

~ Christopher Fowler, Q4 2022 earnings call

One of the reasons stated for lower-than-expected revenues were the changes made in the sales teams in the prior year. This change was disclosed in Q4 2022 when only a mention was made of client executive to customer ratio, then being one third of what it used to be. Fast-forward half a year and:

In hindsight, we were far too bullish on our sales force expectations following our reorganization last fall. We should have taken into account that sales is a relationship business and that it would take a few quarters for the reorg sales force to establish the new contacts needed to close new business. As a result, bookings are coming in just shy of expected levels, but we are up the learning curve now and back on track for the second half of the year.

~ Christopher Fowler, Q2 2023 earnings call

This is nothing short of blunder in planning of business expansion. Sales are a relationship business and always have been, but Trubridge learned this through lost growth.

Added to this, Trubridge started facing issues in converting bookings, or potential revenues based on signed contracts, to real revenues after service offering started. These are nothing by implementation issues, and one of the challenges that Trubridge discovered when approaching larger clients.

Again, as we have signed a greater proportion of larger deals in the past 2 quarters, we have realized that the timing to fully implement these contracts is also a bit longer than we have historically seen. As we looked into the detail of the deals this quarter and last, we have found that the timing of full implementation extended further out than we were expecting. And the lesson learned is that we are now learning not to be quite as aggressive with our bookings-to-conversion revenue assumptions that we've had in the past.

What this means is that our revenue guidance from 2024 is coming down slightly from a range I gave last time of $340 million to $350 million to a revised range of $330 million to $340 million.

~ Christopher Fowler, Q1 2024 earnings call

Similar goal was reiterated in 2023 by then new CEO (since July 2022) Christopher Fowler.

Next, while total bookings of $21 million were relatively flat year-over-year, as Chris shared, the real story is that RCM bookings grew 41% with cross-selling efforts making up 47% of total RCM bookings

~Matt Chambless, Q1 2023 earnings call

Digging a bit deeper on the RCM bookings, 47% was a result of cross-selling our RCM solution into our large and loyal EHR customer base. In the majority of these cases, the customer knows they need an RCM solution, and choosing to move forward with CPSI as their provider is an easy one given the existing relationship.

A particular note, we signed a nearly $2 million nTrust contract, which -- nTrust, which bundles together our full RCM services along with our EHR solutions. The $2 million contract was for 4 hospitals with one of our longest-standing and largest EHR partners. This continues to represent a meaningful opportunity for us with a dollar amount of cross-sell bookings in the quarter being just a small percentage of the $400 million annual revenue cross-sell opportunity.

~ Christopher Fowler, CEO, Q1 2023 earnings call

Trubridge is keen to point out that bookings (signed contracts measured in total value) carry different meaning between RCM and EHR. In case of RCM 1 million of bookings translate to 1 million of annual revenue. In case of EHR, this figure is spread over 5 years, resulting in 200 thousand of annual revenue. The timeline in which bookings are converted to service offering is unknow, though some mentions of three to six months are provided. Nevertheless, bookings as a measure tell little, since they can refer both to new and existing customers. They are calculated as the total contract price (for non-recurring, project-related amounts) and annualized contract value (for recurring amounts). Given high client retention ratios Trubrige discloses, and evolution of total revenue since 2021, it can be assumed that bookings are related to new customers only in part, however this is difficult to prove, and for the time being I will ignore the information on bookings.

What is more important is that the true size of the RCM business that is achievable through organic growth is not 400 million. With this pace, it will take Trubridge more than a decade to achieve this level of revenue from RCM in nominal terms. When valuing Trubrigde this assumption is best to be left as an aspiration than a real goal.

Cost savings

Apart from savings Trubridge wishes to achieve through offshoring, until recently there was very little information related to any other cost optimization. If anything, Trubridge was focused on being a growth company for past four years, and with a legacy of multiple acquisitions, cost inefficiencies could be expected. This is not necessarily bad, as I am looking at the Trubridge as at a potential turnaround. More dire by manageable its current situation, the better.

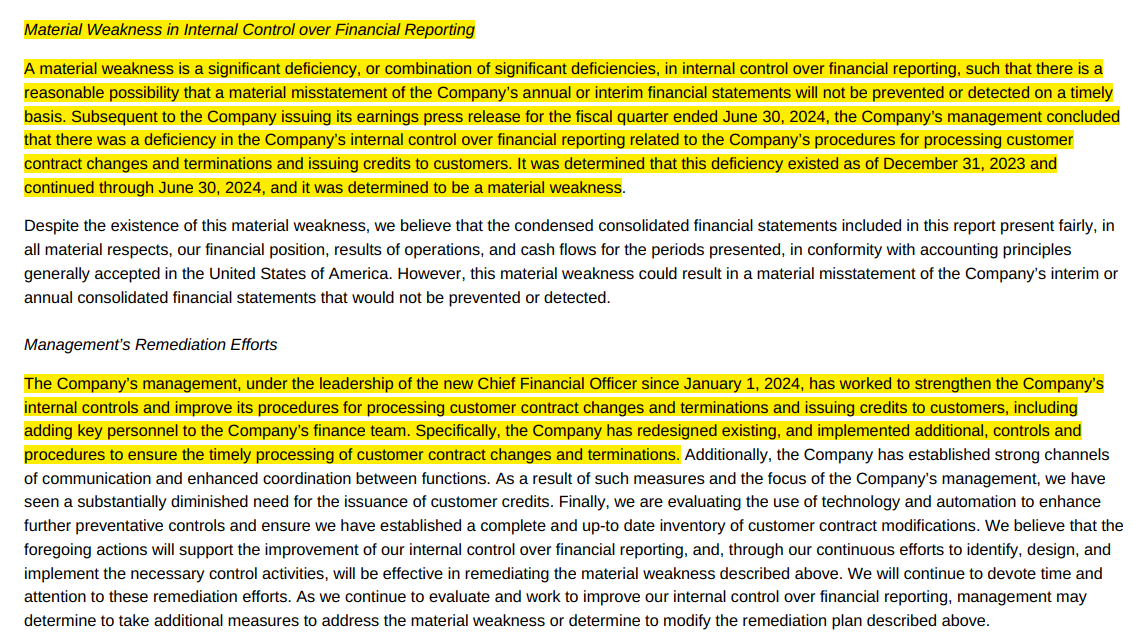

As of Q1 2024, new CFO (Vinay Bassi), appointed in January 2024, started making some interesting comments on how the overall business is being viewed now. Most notably, instead of focusing on simply revenue growth and EBITDA, he started talking in terms of return on investment (ROI). Within a few months after his appointment, several smaller projects were shut down and headcount and capex reductions resulting from this have allegedly reduced run operating rate cost by 8 million per year. Again. Using 340 million as run rate revenues, this would translate into the 2.3% increase in operating margin. Before buying the Trubridge stock just on the basis of this information, it’s worthwhile to stay grounded to reality and accept recognize the fact that module which development was put to a stop was replaced by a third party offering from Multiview. This means there will be recurring costs. Since this deal was announced as a partnership by Multiview, it’s fair to assume that it will be a fixed percentage of revenue generated through their product. How much will this be, I cannot tell, but I will assume 1% cost, resulting in the remaining 1.3% in true cost savings for Trubridge resulting from this partnership (restructuring outcome #2).

We have made meaningful progress on the financial initiatives I laid out last quarter. Specifically, we have taken a fresh look at our capital allocation and rightsizing of cost when we can't find a clear near-term ROI. On a run rate basis, our CapEx is lower, and there is still work to be done in the rightsizing process. We have already shut down a couple of projects and reduced headcount accordingly. As an example, late in the first quarter, we shut down the development of a financial management application. While we felt this type of solution would be helpful to our customers, it was outside of our core competency. So as Chris noted, we found a partner with a track record in health care that has experienced success in this area.

We also found $2 million in permanent cost saving opportunities per quarter. We implemented these cost savings in the second quarter and expect to realize $1 million in second quarter. Going forward, we anticipate $5 million in cost savings in 2024 and an annualized run rate of $8 million. These savings are from headcount, further optimization of cloud and reduction in noncritical vendors. The headcount savings are primarily from shutting down projects with low ROI as well as rightsizing the organization.

~Vinay Bassi, CFO, Q1 2024 earnings call

Furthermore, Bassi started mentioning working capital management. This may seem irrelevant, but currently non-cash and non-debt working capital needs of Trubridge are roughly 10% of revenues.

To finance this, Trubridge pays 8.5% per year, so this already has a high cash cost just though interest alone. It is not likely that Trubridge can reduce its financing cost for the next year or two, however they could try and reduce working capital requirements. Historically, working capital requirements (excluding divestiture affected quarters) ranged from 6% to 12% (using on quarterly level using last twelve months revenue data. It’s fair to assume that at least some lower percentage than current of close to 11% can be deliberately achieved.

The second part is harder, but very doable is working capital management. Working capital management is -- my path goes through collections, putting a maniacal focus on that, and that's what I've said in my prepared remarks, reviewing daily collections. I've boosted by 100% my collectors team and putting more focus on how it needs to be done from a focus perspective. And the second part relating to that is payables. It's just making sure we do a good working capital management on that because otherwise, I'm using my debt to pay my AR. So part to that free cash flow goes through my improved EBITDA from gross margin. We're very tight, getting a lot of operating leverage from OpEx and then improved working capital.

~Vinay Bassi, CFO, Q1 2024 earnings call

If my reading of the transcript is correct, expenses have been made to boost collection teams. Time will tell if they really do collect. Be it how it may, assuming Trubrige is able to reduce its working capital needs by 200 basis points, would in effect increase its FCFF by slightly less than that (restructuring outcome #3).

There are limitations in cost savings, and it seems that Trubridge is about to exhaust this source of operational performance improvement.

I would say 3 months in I would say where -- how we are -- how I'm designing the cost saving optimization, I call it more the optimization is figuring out areas that we need to get more efficiency. So there are 2 or 3 buckets which are mainly -- one is the ROI focus approach on projects. So we have just started on that. So there might be a little more room there, again.

And then I think where we are, the second bucket is more about noncritical vendors. I think that we have cleaned up a good amount by now. Inefficiencies or the rightsizing of the organization in OpEx, I think we have covered 80% plus. But I would say I don't expect another significant like this amount, but there could be a smaller amount as we go through the balanced quarters.

…

On the EBITDA side, why we kept that is these cost savings, what I have given is not that it has not started. We have already executed -- started executing some of these savings and a good proportion will be done -- has already been done and will be done in the coming weeks. How you should look about -- look at the EBITDA ramp in the second half is think about it in my first half again using the midpoint from a first half to second half, the improvements will come from $4 million, $5 million from my cost saving by offshore the conference cost won't be there for that.

And then the $5 million of in my example, will give me leverage our gross margin again of approximately 50%, 2.5 million. So based on that, I feel you should get confident at from a ramp, getting the $4 million, $5 million is coming from a cost savings I have the NCC costs, the conference cost is no longer there, and I do have the offshore and then the gross margin pickup.

~ Vinay Bassi, CFO, Q1 2024 earnings call

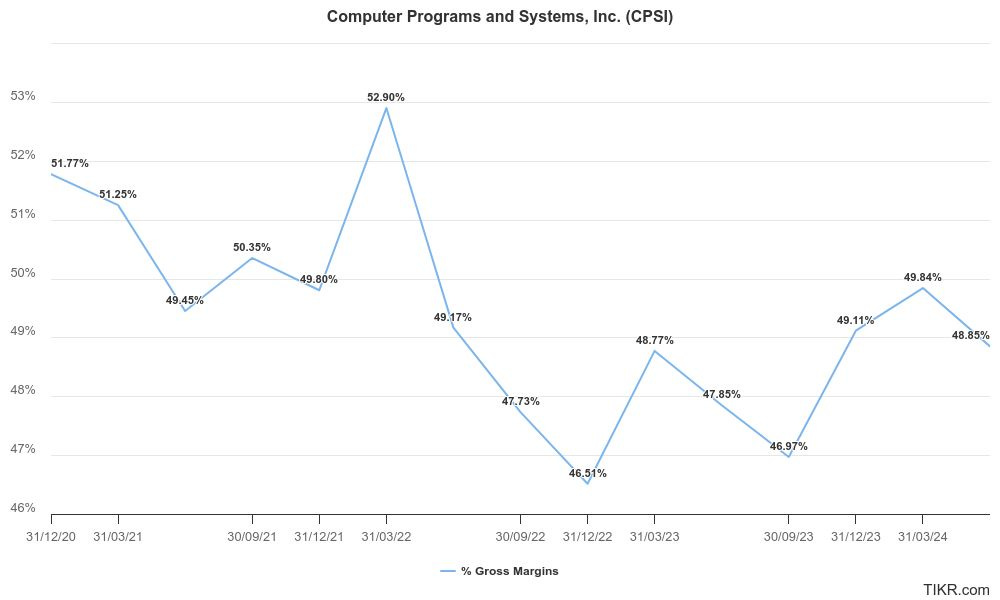

My only reading into this quote is that very definitive cost savings can be expected to be visible even with Q3 2024. In addition, some 2 million of conference costs mentioned, are a real recurring cost, but they happen once a year in the first half of the year and should not be ignored. According to Bassi, gross margin of close to 50% can be expected. This is in line with historical levels, so the question why are savings not visible already? Answer provide by Trubridge is usually referring to one off expenses, severance costs and parallel staffing in the transition period to independent offshore workforce. This is a plausible answer, but one that should be use only for a few quarters more. Otherwise, this thesis breaks.

Peer analysis

When I am faced with understanding a new business like this, my starting point is gaining the understanding of how the average industry in which it operates performs. In absence of Bloomberg terminal, here I borrow from professor Damodaran data, knowing fully that it might contain errors.

Trubridge operates in the Health Care Technology Sector (Healthcare Information and Technology in the data I used for benchmarking).

Looking at US companies in the same industry we can set the benchmark.

Historically, Trubridge had gross margins on par with the industry. However, it had drastically lower EBITDA margin especially as of late.

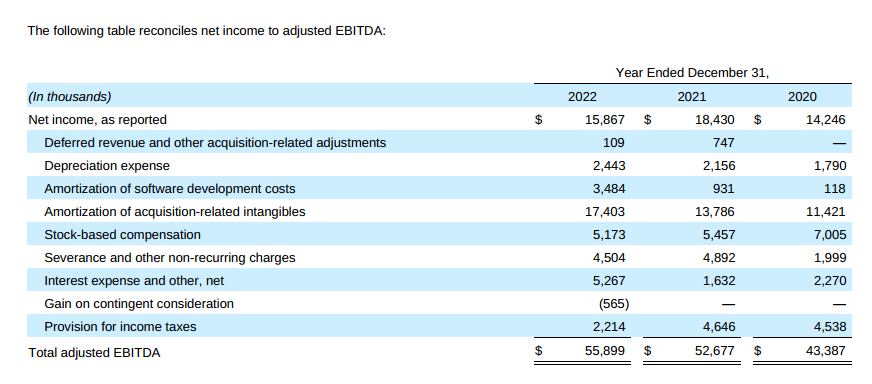

Although a hated measure by many, their own adjusted EBITDA holds important clues, however. Not going into justifications for other adjustments, Severance and other non-recurring charges should decrease drastically once the restructuring is complete. Stock based compensation is a real cost, just paid with a different form of currency. With this in mind, Trubridge generates roughly USD 11 thousand quarterly or, EUR 44-50 million EBITDA (by annualizing quarterly or data for last six months). In effect, this brings it close to the level of the average company in their industry (13% to 14.5% EBITDA margin).

Now, coming back to what I identified above as their potential savings, it seems that just ending the restructuring without affecting the current product, and it's maintenance development, would produce results. Add to that the savings on workforce they hope to achieve (mean savings of 12% of revenue) and Trubridge would be 25% to 26.5%, or an 85 to 90 million EBITDA generating business. Sounds great. But there is a catch

One important part missing in this adjustment relates to amortization expense. While TruBridge takes out their intangible asset amortization expenses from EBITDA, it omits to add back a regular expense, which they choose to capitalize. Trubridge capitalizes part of their R&D expenses. In FY 2023, they capitalized more than 20 million, roughly equaling the amount of their intangible asset amortization for the year.

So these R&D investments can be considered as maintenance capex, and are a real cash outflow, although not treated as expense. This means that if one is to adjust EBITDA to better reflect operational efficiency of the business, it should take into account also this. Returning to our range of 85-90 million EBITDA, we are now at theoretical 65-70 million adjusted EBITDA.

Can they, do it? They should be able to in theory, as this would result in them being 19.5% EBITDA margin business. Nothing but averagely profitable company in their sector.

Do they have the will to do it? Pinetree, L6 Holdings, and Strikwerda think so in part (since only part of their portfolio is invested here). And additionally, L6 Holdings is asking them to.

Summary of expectations

Before proceeding to valuation, I will just provide a shorer summary of what I consider to be reasonably expected changes and future plans for Trubridge:

They will acquire no businesses in some short to midterm (next 2 to 3 years) and will instead operate what they have.

Overall business volume measured through revenue will grow at some 5% per year. I would expect them to reinvest 1 dollar for each dollar of organic growth additional to their amortization and depreciation costs (excluding intangibles amortization).

Research and development costs and capital expenditure will go down. I have no estimate for this, and I will not include it in my valuation, but it is in line with low business growth, and positive for the cash flow generation. Once there is more clarity on this, I will update my expectations.

RCM and EHR mix in revenue will not change dramatically and legendary 400 million cross-selling opportunity will not be won.

a Significant portion of the RCM workforce will operate from India, and effects of this transition will be visible from 2025. Median savings as a percentage of revenue will be 12% (with a range of 10.4% to 14.1% - decimals here can be ignored since they probably offer false precision)

Non-cash (and non-current debt) working capital needs should be reduced from the current level of 9% to 11% by at least 200 basis points, or to the level of 7% to 9%, freeing additional free cash flow to the firm.

Additional savings like in the form of outsourcing non-core financial products' software to external providers (Multiview) should provide reduction in costs at the level of 1% of revenues.

Once offshoring is complete, severance costs should reduce to some stable level of 4 to 5 million per year, from current 15 million. As a percentage of revenue, this is close to 1% of cost reduction.

There will be no extreme debt reduction. Current indication is that Trubrige wants to keep overall debt to EBITDA of 2.5 to 3 times, which implies debt reduction of around 20 million. If I had a choice, I would use all of FCFF to repay expensive debt, as it is the simplest way to increase the per share FCFF (in effect double it in three years).

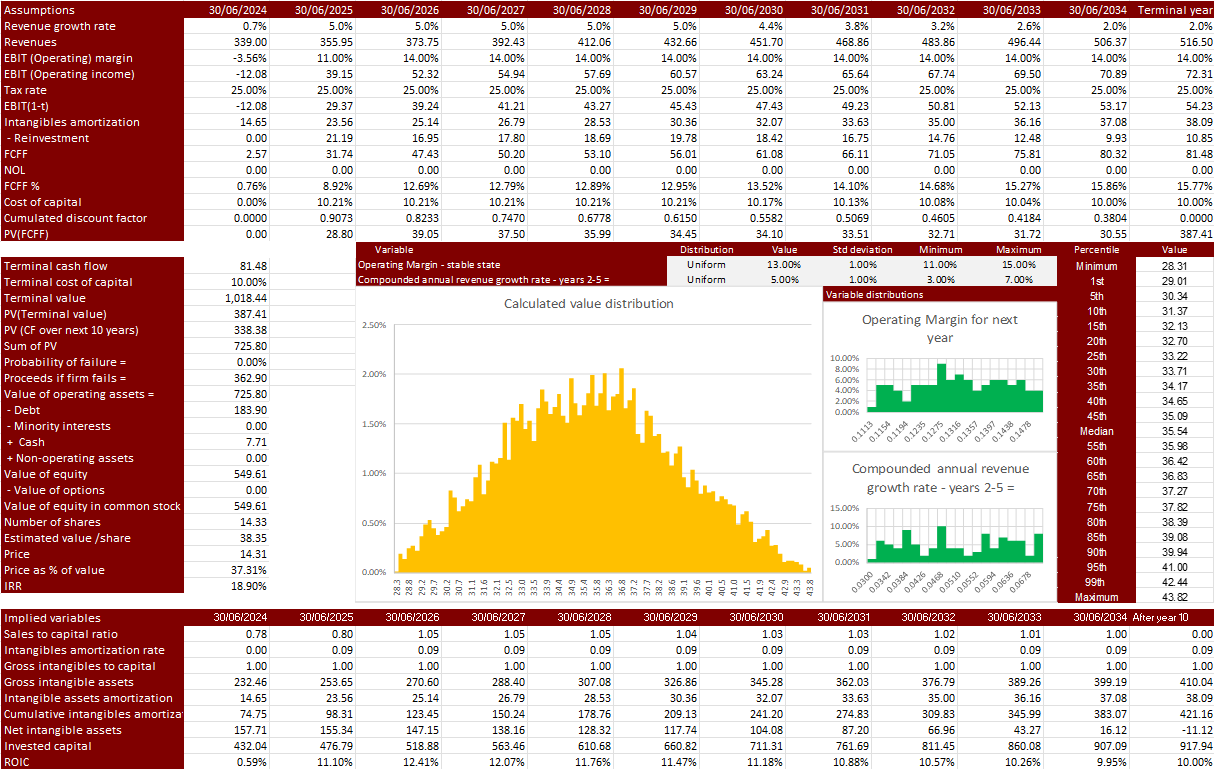

To summarize, in a stable state, I would expect 5% organic revenue growth, cost reductions equal to 14% of revenues pre-tax, or 10.5% post-tax. Intangibles amortization should amount to 7% of revenues (until intangible assets are expensed) and reinvestment needs above depreciation and amortization costs (other than intangible assets) of close to 4% of revenues. This would leave Trubridge as 13% FCFF to revenue generating business with invested capital turnover slightly above 1 (in simple terms, ROIC between 10% and 11%). This is quite close to the median company you can find out there. Nothing spectacular. In turn, it makes this outcome plausible.

Valuation

Valuing Trubridge, or any other potential turnaround, is an ungrateful task, especially in the case that the end goal is not defined by the company and can be only speculated about. Here I will provide my standard DCF of what I think is a reasonable pathway for Trubridge (I have many more in my archive), in line with the above summary of my own expectations (intentional emphasis on this). But keep in mind that even a slight deviation from my assumptions can have significant impacts on the value of Trubridge in future (and present value today).

After defining my base scenario, I then ran 10,000 simulations around it, allowing for the variation in the organic growth rate before leveling it off with the long term inflation rate, and by varying the overall level of operating profitability across the full forecasting horizon (and terminal year). I have no way of defining the distribution of these variables, so I assumed that any outcome within this range can occur with equal probability. My medium simulated estimate is USD 35.5 per share, which is a discount of more than 60% to the current price (USD 14.31 as of November 12th, 2024). My 25th percentile of distribution results in value of USD 33 and 75th in USD 37. This does not mean that these values are likely to realize, but just that DCF model does not break apart with high variations applied.

Alternately, one can just value Trubridge based on owner earnings, which would result in the following:

if you are interested in this approach, you can find it the book Value Investing: From Graham to Buffett and Beyond explained through examples.

For the last, there is one, though, experiment I could not escape. It's probably the simples way of generating per share value Trubrige has. Currently, Trubrige carries 180 million in debt. I roughly estimate that it can generate 50 million free cash flow to the firm (post tax cashflow before debt repayment and dividends). Trubrige can repay its debt in 3 year and continue producing its 50 million FCFF, which would then be almost fully free cash flow to equity holders. Assuming no growth from there and discount factor of 10%, we would end up with 500 million EV, which would also be its market capitalization (no debt outstanding). Take these 500 million, discount them to today, and you would have 375 million in present value (discounting is cruel). Divide with 14.33 million shares, and we would end up with slightly more than USD 26 per share.

All of the three approaches above are by definition wrong in assessing the value of Trubridge, however they point to one common property. If there is a will, and some level of skill within Trubridge management to significantly increase the value of their business, there is also a way.

I own a small position in Trubrige, and I will keep it small as it is a speculation more than an investment.

I will leave you with this, and ask for your comments on what the end story for Trubrige could be.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe, even for a month. Even years after you have read something from me, based on realized experience.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

One part I forgot to put in the note, but could be relevant (was for me), is this little insight in Bassi's thinking

https://x.com/pymnts/status/1773387201587360221

It could be self promotional from him, but if its not he is showing signs of mental frameworks you would expect from a capital allocator.

Did anyone else notice the surge in litigation TruBridge is currently facing? While suing customers is already a red flag, allegations of data theft, copyright infringement, and even antitrust violations should raise serious concerns for shareholders.

1. TruBridge v. Putnam County Memorial Hospital (Ala. Sup. Ct., 2019)

TruBridge sued for breach of contract after the hospital allegedly diverted data to avoid paying fees. The default judgment was overturned on appeal, allowing the case to proceed.

2. TruBridge v. Ozarks Medical Center (W.D. Mo., 2021)

TruBridge alleged the hospital breached a billing services contract by switching systems and locking them out. The court denied summary judgment; case is still ongoing.

3. TruBridge v. Crook County Medical Services District (S.D. Ala., 2024)

TruBridge sued a Wyoming hospital for ending their contract early; the hospital counterclaimed citing poor service. The case remains pending in federal court.

4. TruBridge v. Houston County & Braden Health (M.D. Tenn., 2024)

TruBridge filed for breach of contract related to services at a reopened rural Tennessee hospital. The case is in early stages, with no rulings yet.

5. TruBridge v. TimeTrex Software (S.D. Ala., 2025)

TruBridge alleges wrongful contract termination and interference; TimeTrex counters with claims including copyright infringement and antitrust. The court denied TruBridge’s TRO; litigation is ongoing.

6. TruBridge Healthcare Pvt. Ltd. v. Ashish Yellapantula (Bombay HC, 2024–2025)

TruBridge sued a former employee for stealing and deleting confidential data. The court imposed a monetary penalty for contempt and warned of possible jail time.

Might be worth digging deeper into the legal risk exposure.