Continuing with a merger-and-acquisition-spread chasing hobby of mine, I purchased shares in Penneo AS after the announcement was made by Visma that it is launching a cash offer to acquire it at 16.50 per share expected to close at the beginning of February this year. Below are some of my notes created over the past few days. They are far from a deep dive into Penneo business or Visma operation.

Timeline of the offer was published by Penneo of December 19, 2024 on their website with the following timeline of the transaction:

I managed to acquire a relatively small number of shares at 15.70 for a spread of 5% before tax. I intend to keep this a relatively small position due to the risks of the deal failing. At a moment of an offer, close to 53% of shareholders have committed to accepting the offer, with approval of 90% of shareholders being needed to accept the offer.

The Board has made a recommendation to accept the offer. Institutional ownership is small (close to 5% based on what I managed to find), and I would always assume that institutions would be in favor of the deal that offers a price above the prior market price by a margin of 100%.

Not crucial to the point, but it also helps that one of the founders decided to move on and search for other opportunities.

In case that this 90% acceptance is not achieved, there is a small probability that price or threshold could be renegotiated over time, or Visma might accept to take certain share (at least currently pledged 53%) of the company, start a delisting process and force remaining shareholders to private company ownership in an attempt to drive out minority shareholders unwilling to sell at this price. In theory, Danish law would allow this.

Danish law distinguishes between two takeover situations:

i) where an investor has already obtained a certain control over the target company, or

ii) where an investor wants to obtain control over a company but has not yet achieved such control.

In the first scenario, the investor is required to present an offer to the remaining shareholders of the target company to acquire their shares. In general, control is deemed to exist when a shareholder, directly or indirectly, holds at least one third of the voting rights (unless the shareholder can prove that such holding does not constitute control) or otherwise has control over the target company.

The second scenario arises when an acquirer wants to obtain control over a company and as a result presents an offer to the shareholders to acquire their shares.

Some of the key distinctions between a mandatory and a voluntary offer are that in a mandatory scenario the offeror must offer a fixed price, which under normal circumstances must be equal to the highest price paid by the investor for shares in the target company in the last 6 months. Additionally, the consideration can only consist of cash or shares, and the investor is not allowed to attach any conditions to the offer.

A voluntary offeror, on the other hand, can set the offer price freely and pay in whatever way the offeror chooses (except that all shareholders must be treated equally) and decide to make the offer subject to certain conditions (typically minimum acceptance threshold, anti-trust approval and MAC).

Source: https://kromannreumert.com/en/news/public-takeovers-key-considera-tions

Visma seems committed to complete this acquisition, and they generally do not back off from publicly disclosed offers. Obtaining the majority shareholder rights at the given price and postponing the acquisition of the rest of the company is a realistic outcome, but probably not the most likely.

There is also a risk that the Danish Competition Authority will not provide the acquisition approval. Visma had a similar transaction attempt in 2016 when it tried to acquire Fortnox AS in Sweden for SEK 1.4 billion. Close to the end of the offer acceptance period, SCA (Swedish Competition Authority) did not approve the transaction and Visma backed down. In hindsight, it would have been a good acquisition for them. Fortnox AB shareholders did approve in required majority before though (68% of shareholders voted in favor, while 50% acceptance was required).

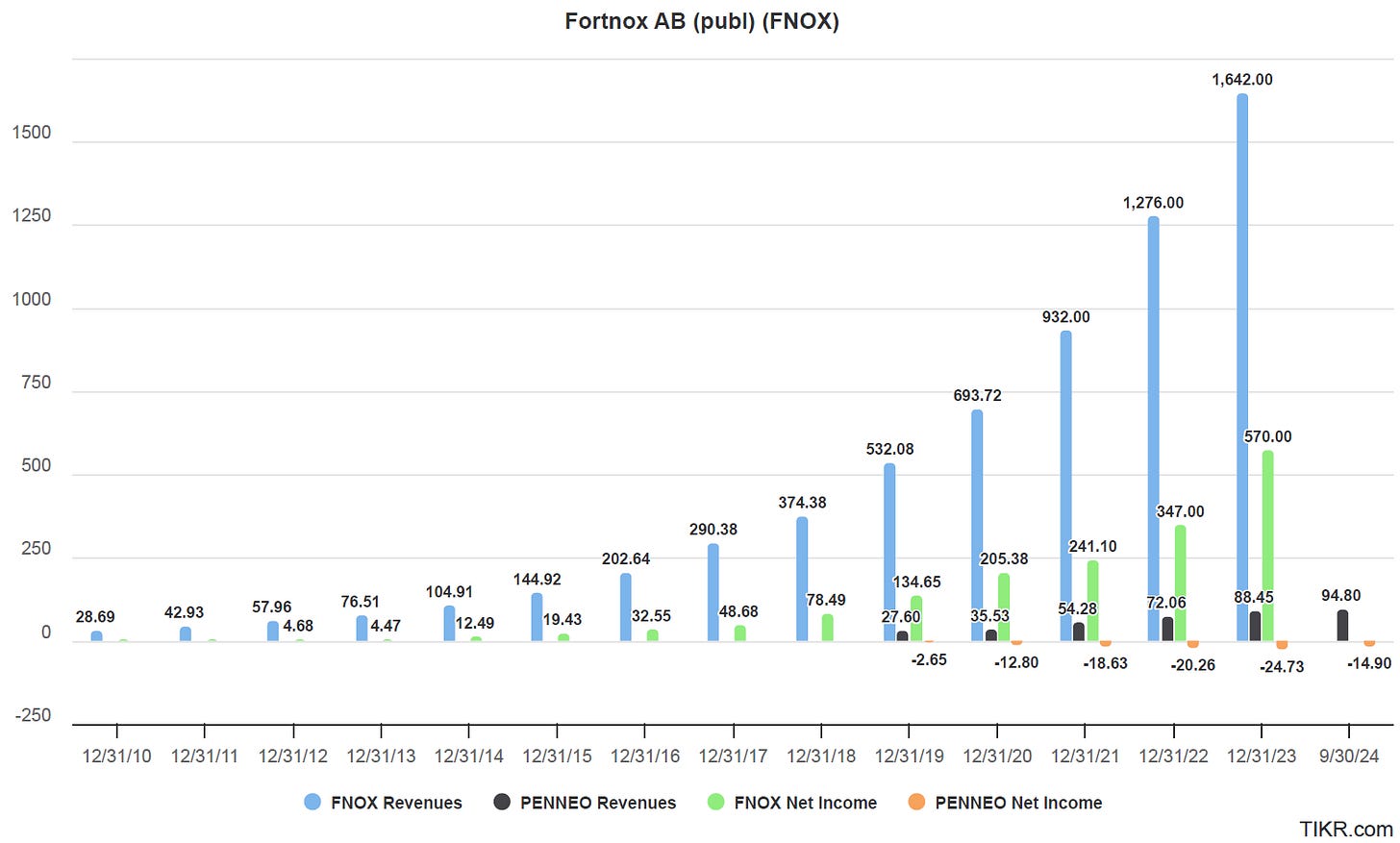

Just by seeing the above, maybe Fortnox AB is worth taking a look.

Contrary to Fortnox, Penneo offer is not subject to any regulatory approval. However, the Danish Competition and Consumer Authority has the power to call in mergers if the combined turnover of the involved parties in Denmark exceeds DKK 50 million, and there is a suspicion that the merger will significantly impede effective competition, particularly if it is likely to create a dominant position. In case of this deal, these criteria are satisfied, but such action has not been initiated by the authority.

Also, its worth mentioning that Fortnox and Penneo are different companies at the times the offers are being made, and Penneo has probably much weaker prospects than those of Fortnox in 2016 were (simplest way of looking, Fortnox was profitable since 2010 when it was equal in size of Penneo in 2019).

By seeing the above, maybe Fortnox AB is really worth taking a look, at least to keep on a list of potential investments.

As for Penneo, without going deeper, they seem to struggle in producing cash from operations at this point, but they compensate for the operational cash burn and capitalized R&D (reported in cash flow from investments) with stock issuance at not-the-most-opportune-moments.

In their defense, capitalized R&D is amortized and expensed, but far more R&D spend is capitalized than expensed through amortization.

Capital allocation by Penneo is not the best and not in the main focus. Company is still young, and it’s focused more on the revenue and revenue per customer growth, instead of profitability. Even in their own disclosure, describing how cash is used, comparison is given between the sum of Cash flow from operations and Cash flow from investing and recurring revenue growth. Now, how comparing total cash flow generation with incremental revenue generated is useful information, is beyond me. But even looking at the figures they have provided, and by comparing their investment cash flow with incremental revenue, it appears that Pennneo invests a growing amount of 20 million per year to generate incremental 17 million in revenue. They would need to convert revenue to free cash flow margin on revenue of at least at 12% to generate incremental ROIC at some average cost of capital of 10%.

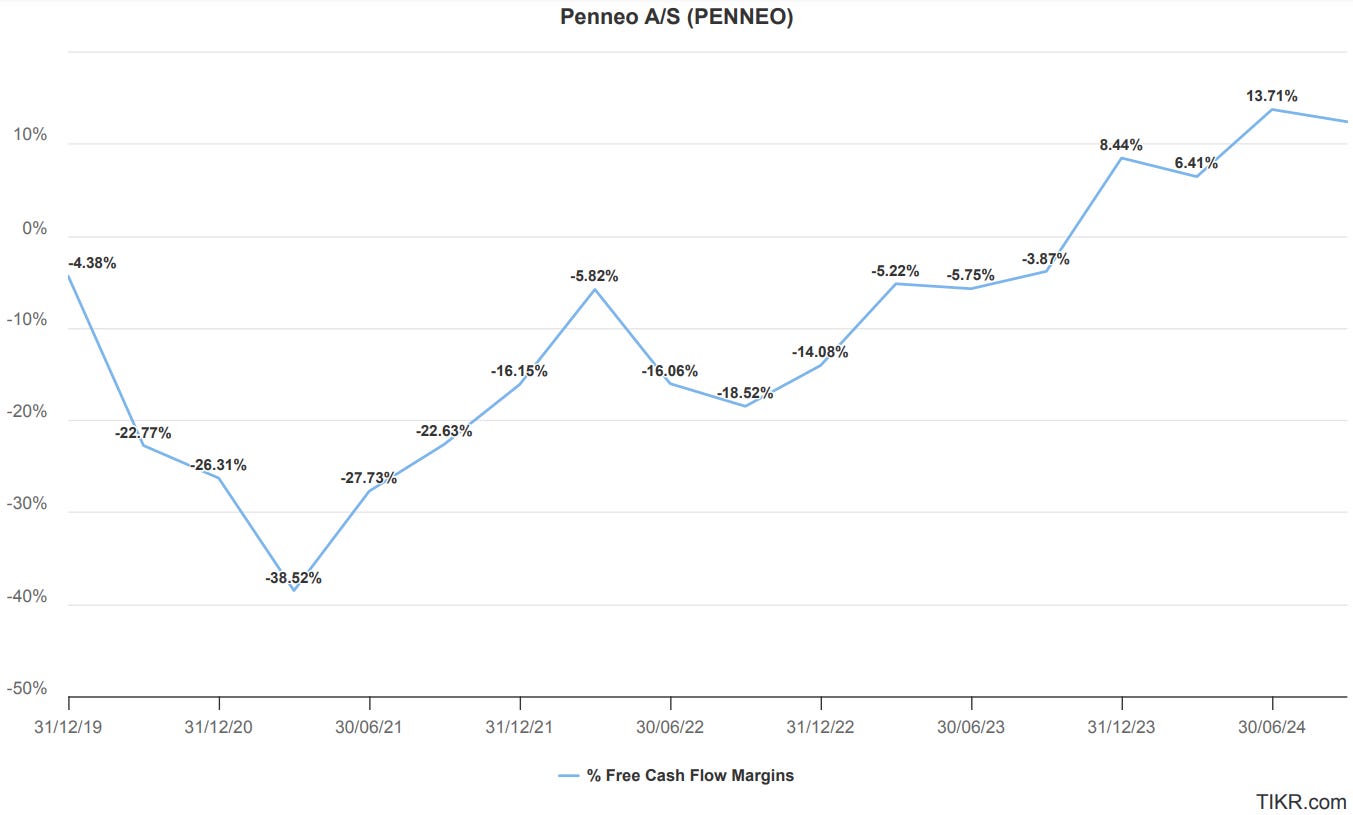

What is their FCF yield? At least using tikr as a source (which is a good proxy in this case), have been close to that at least as of recent.

Why I mention this is because, although Penneo is a growing business, how it turns its revenue to cash flow and how it turns their assets into revenue, results in median ROIC at best. It is a growing business, but not a value growing business.

For now, Penneo is managing to achieve both cost reductions and continued revenue growth, but there is a risk that their R&D spend might go down and thus limit their growth (they did reduce their headcount by 20%). There is a risk that Penneo might even stall in midterm (after announced expansion in Germany) due to aggressive cost-cutting. Thus, viewing it as a growth story without risks is not rational.

Maybe just to clarify, Visma probably hopes to turn it around and expand Penneo in Germany, where they already started selling their software and other EU economies, and generate value from there. Once acquired, some back office functions would most likely be transferred within Visma which would be a cost optimization that Penneo alone cannot do.

But as a current shareholder of Penneo, one should take stock of the current offer and contemplate what Visma expects to get when they pay DKK 550 million, or DKK 500 million with cash netted out, for an intellectual property and operating asset generating negative FCF of DKK 20 million per year. In order to make it a reasonable investment in a stable business, you would need to convert it to a stable 50 million FCF generating business. Looking at Penneo LTM figures for each quarter below, how achievable is it to generate that level of FCF in some midterm (keep in mind you are stating from 94 million in revenue)? Not so much.

Alternatively, assuming Penneo can be converted to 20 million FCF generating,or 20% FCF margin on existing revenue, or 4% yield on takeover offer, business with short term cost optimization, and that you can grow its FCF at 20% for next 7 to 8 years while reinvesting DKK 5 for each DKK 1 of incremental FCF (assuming 20% reinvestment return), rough math would imply a take private IRR of 8% at this level and Visma offer is made at a fair price, or at least close to it.

This 20% reinvestment return seems to be getting within a reach using unit economics data Penneo provides and comparing average ARR in the first year for the new customers times a hypothetical 20% FCF margin and dividing this number with customer acquisition costs (this approach unfortunately ignores R&D expense related to product development needed with its expanding use cases). As a shortcut when reading the table, if the ratio between average ARR in the first year for the new customers and customer acquisition costs is close to 1 and one assumes 20% FCF, this equates to an incremental ROIC of 20%. Since Penneo started its cost optimization in Q4 2023, it seems they are getting close to that.

To put previously said differently, expecting that historical growth continues over next 8 years and thus turning Penneo DKK 300 million business, while assuming FCF to revenue margin that was never achieved prior, and incremental ROIC reinvestment rates above historical, price one gets from Visma seems to be fair.

Again, a disclaimer, this is just a rough calculation, and I might be omitting important value drivers that those who have more insight in Penneo understand better. My sole aim is to derive expectations that would justify the price offered by Visma.

Should shareholders of Penneo, accept this offer? Or better yet, should they accept the offer at a price that factors in 20% business growth over the long term in a way that IRR on their investment equals that of the S&P 500 over the next 10 years, with far more company risk tied to an individual holding versus the index? Yes.

Should you accept the offer if you purchased Penneo shares at the beginning of 2021? All I can say is that I am sorry for your loss, but it seems Visma is offering a dignified way out.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe, even for a month. Even years after you have read something from me, based on realized experience.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

"Based on Visma’s preliminary and non-binding summation of acceptances, the offer has received preliminary acceptances representing 32,730,282 shares, including Penneo warrantholders’ irrevocable undertakings to exercise their Penneo warrants and sell the underlying shares to Visma, corresponding to approximately 91.52 per cent of the share capital and voting rights of Penneo (calculated on a fully diluted basis)."

https://www.visma.com/news/vismas-offer-for-penneo-accepted-by-more-than-90-percent-of-shareholders

I sold my Penneo shares before the tender results were announced. Hope some of you found value in this 🍀