25. Pinetree: FY 2024

Pinetree valuations. Article is paywalled until I make some decisions. If you had investment exchanges with me, and subscription is too much for you, please contact me.

My portfolio has now generated larger absolute return by owning individual investments from Pinetree portfolio, than Pinetree alone.

Below you will find my usual tacking and valuation of Pinetree and some alternative way of appraising it. Also, I tried to identify changes in Pinetree portfolio in hope that in the long term I manage to pinpoint the hurdle rate they used. I am still to define their investment style, but it is as interesting to follow as ever.

Here are some notable portfolio development details, apart from new positions.

Pinetree seem to have added 20 thousand shares of Topicus at CAD 118 (their historical cost was CAD 67) to their Q3 holding of 30 thousand shares. This was nicely timed before the announcement of TSS purchase of shares in Asseco.

Position in Trubridge was effectively doubled in value during February 2025 at an average cost of USD 27.97 (prior average cost was approximately USD 8.71). I cannot explain why this was done. It is correlated with appointment of Dris Uptis of Ocho Capital, and Jerry Canada (former Group President of Harris Computer) to the Board. Jointly, L6, Pinetree, Rorema Beheer B.V. (Strikwerda) and Ocho now own 1,828,393, 768,250, 760,450 and 1,114,178 shares respectively, comprising the grand total of 4.47 million shares of 14.32 million Trubridge float.

Since my estimate of Trubridge value is close to the last tranche average cost, I cannot really explain this. One alternative is that Pinetree wishes to establish a controlling influence on Trubrige operations to either change the growth policy, or start some sort of strategic review now that the poison pill from Trubrige is gone. The second alternative is that simply I am wrong about Trubrige in the first place. I believe my understanding the businesses Pintree owns is far more simplistic than that of Damien Leonard and Shezad Okhai. Whatever it is, Trubrige and Bravura are not positions that Pinetree cannot exit that easily without affecting their price, meaning that they will either remain long term holdings or will be liquidated though some off market transaction.

Sapiens International Corporation appeared in the portfolio again (it exited the portfolio in Q3 after some 70% gain was realized over a period of less than 2 years, only to be back in Q4). This time at an average cost of USD 37.9 per share. Unlike Topicus, this transaction seems to be poorly timed at the moment. Pinetree is not a perfect market timer, if that is what you are looking for.

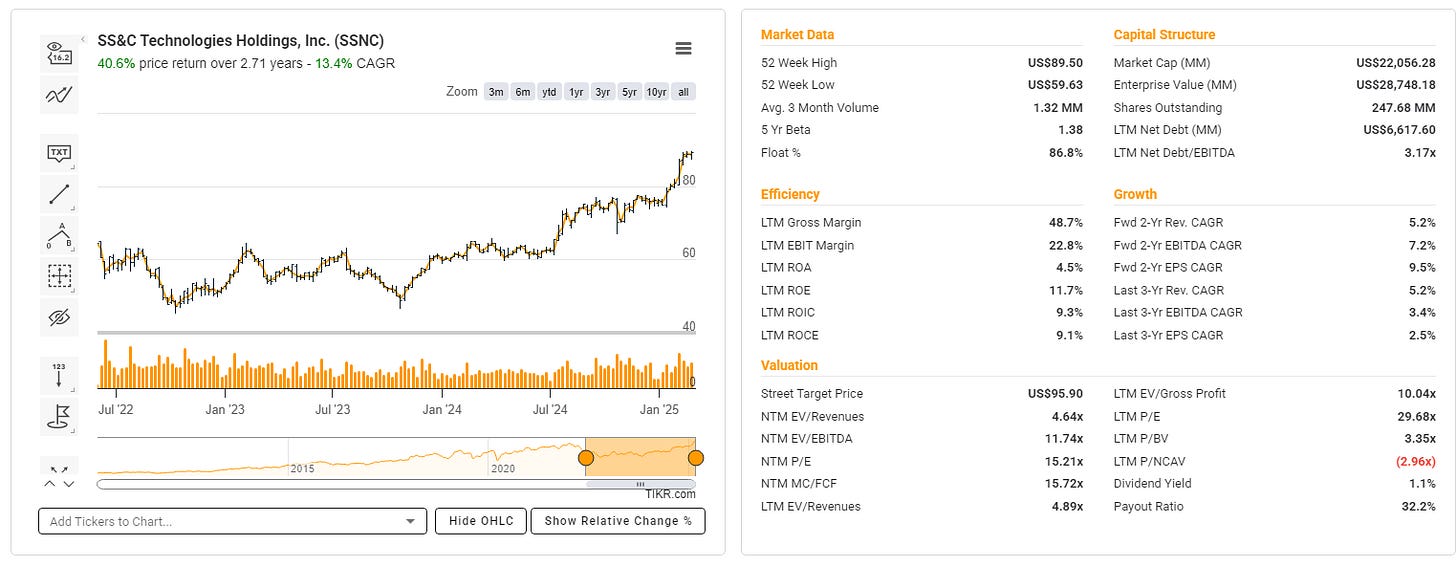

SS&C Technologies was sold in full, after, according to the Pinetree MD&A, it reached their fair value estimate. As investment, over the period of two and a half year, SS&C worked out just fine returning 54% in total price change, or 18% CAGR (SS&C pays divided of 1% not included in these numbers). Timing here also was unlucky, which is fine since Pinetree is not trying to time or trade. More interestingly, by studying SS&C it is possible to identify how they quantify fair value. Something I plan to do.

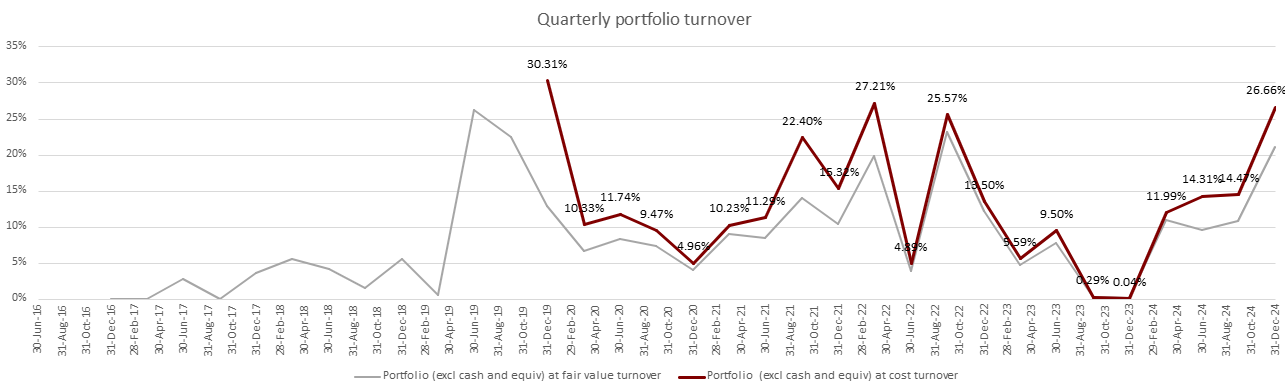

What is an interesting development, is how Pinetree’s portfolio turnover develops. Pinetree needs to turn its holdings. faster they do it, greater the present value of their tax shield. Currently, they are showing no sign of slowing down.

Valuation

There are several ways to value Pinetree, all of which making strong implicit assumptions, all of which imprecise.

Keep reading with a 7-day free trial

Subscribe to Nicoper’s Notes to keep reading this post and get 7 days of free access to the full post archives.