The previous period started relatively quiet for me, only to become exciting in the middle of the March. Read below for mentions of Topicus, Terravest, Tasmea, Enghouse, Penneo and some odd lot situations.

Diversification has a bad reputation, but it gives such an optionality in times like these. There are always nice opportunities to rotate your portfolio distribution in times like these. Recent turnarounds usually don't follow market drawdowns, but provide above average returns if successful. Certain sectors, like insurance, still benefit from rate hikes and the hard insurance market. This is a nice time to rotate them into higher beta quality companies one owns. Similar goes for telecom companies and utilities now, which are getting priced to perfection. It never feels right, makes your guts turn, irrespective of your age. With every sale, you think you are making a mistake. With every buy, you think you are exaggerating it, but in the long run, it's rational.

I tend to diversify my portfolio, not by the number of companies or sectors in which they operate, but by the financial constructs they are. Some are turnarounds and value situations (Trubridge, Quorum or Philips), some are growth companies still in their early years (Mader and Tasmea), some are capital allocators (CSI universe), and some are simply leveraged economy trackers (insurance businesses in my case). They all tend to reach their fair values, or get overvalued, at different times in the market cycle, forcing you to time the market by reducing your positions or selling them out completely. One of the best examples I had in my portfolio was my holding in Lam Research, which I sold out gradually during the AI craze, when my estimate of the IRR was far below the risk-free rate on 10-year US government bonds. This does not mean I can estimate the exact IRR (I am more likely to understate it since it always implies a slowdown of a business), but it does give me this warning light that maybe my money could be employed somewhere else with a greater probability of higher return.

Where I did allocate a lot of capital, before the March drawdown, was in Penneo (I made a mention of it in my last portfolio update). Since it reached a risk-free stage of its take private journey, I tried to acquire as many shares that were not initially tendered (remaining 10% of the float) and tender them again until 28th February. On some days, I was the only one picking up the volume. This I financed fully with leverage in Interactive Brokers, ensuring a net annualized return of 5% (but since it is fully on leverage and only equity invested is interest cost, real return was above 300% - if only this was scalable). On a portfolio level, proceeds from this transaction would add some 0.4% pretax to my current net asset value. It is marginal, but it is real money and relatively effort-free by the time I executed it. Initial investment in Penneo, while it was not risk-free, required much more work. Prior to conducting this transaction, I had an exchange with ABG Sundal Collier who worked as a financial advisor of Visma on Penneo acquisition, where any concerns I had were answered. I still find it remarkable that a small individual investor can obtain information like this simply by asking the parties involved in a transaction.

I added to my positions in Topicus and Terravest. I was a little late to add to Topicus after initial disclosure of their stake in Asseco, but I revisited my valuation after I learned that Pinetree also invested in them in Q4 2024 at around CAD 118 per share. When valuing Topicus, using my standard approach, I was reaching the value per share of CAD 160. And this was before the Asseco transaction and Q1 acquisitions. But after they have allocated more to acquisitions/investments in Q1 of 2025 than in FY 2024 and FY 2023 combined, it is fair to assume that they also propelled themselves a few years into the future, at a cost of debt that is far below the ROIC they will get on these investments. They will probably take on significantly more debt than they had, but Topicus had historically low leverage compared to the Constellation, especially before last year's dividend distribution.

Terravest also presented a nice opportunity to add to my holding in the wake of the tariff narrative and conflict between Canada and the US. According to my understanding, tariffs would have only a limited impact on Terravest through steel prices, except if they result in overall North American recessions. I am not a good political analyst, but I believe that incentives are low for any political leader or party to push an economy that managed to avoid a recession, into one. History of the US presidents who caused a recession without a need to combat a real problem is short (in my recollection, Regan and Hoover are most well known cases, but in both situations, there was a significant issue before they took their actions - high inflation and 1929 market crash). I was lucky with my timing here, since I managed to increase my position by 20% in share count a few weeks before EnTrans acquisition.

Both previous additions I financed with the sale of my Philips shares (which is becoming more and more complicated for me to value) and realized return from Penneo.

There is no certain way to value Terravest, and investing in it will always include paying up for some future expected growth (except in the rare, extreme situations). Probably the simplest way to value it is to form your own view on how long will Terravest continue acquiring cash flows and at which pace will it compound what will ultimately become its stable state cash flow (their measure of cash available for distribution works well to approximate this). To simplify even further, you can then discount those cashflows with something around 10%, and you should be close to the fair value estimate. Terravest was until recently 100 - 120 million cash generating economic asset. After the latest acquisition of EnTrans, this has probably increased to a range of 150-180 million.

From here, one should decide on two more variables. Compounding factor for the cash available for distribution, and the period over which the compounding might happen. The compounding factor is linked to current management and their acquisition identification and appraisal abilities. Depending on what you consider a breaking point in Terravest history, the long term CAGR of CFAD varies between 17% (from December 2012), 18% (from December 2014), or 30% (December 2017 - year in which Dustin Haw became CEO).

Taking this further, and just as an example, assuming these rates of growth continue over the 5 and 10 year periods, you get the following distribution of present values for the terminal cash flows (excluding the present value of the dividends that will be distributed).

This is far from proper valuation, but it is one way to do it. Note that these are EV and not market capitalization equivalent values, but it is a nice shortcut to gauge market expectations or any premiums you might be paying at this moment in time. To quantify it, if you took current share count and CAFD base values above and discount them at 10% as perpetual cash flow, you would get EV estimates of 1,500 million and 1,800 million, or CAD 77 to CAD 92 per share, implying a high premium for growth included in the current price per share, especially when you take into account that after the EnTrans acquisition, Terravest probably carries close to 850 million in debt, or roughly CAD 44 per share. It is far from an undiscovered acquirer at this point.

Investing in any growth company is undeniably linked to the trust you have in the management at hand, and trust that they will continue the growth approach in which you have invested. Reality is that they can change their approach to running their businesses tomorrow, irrespective of how you will it. There is no law or higher moral code that forces them to maintain their capital allocation policy. They are responsible to shareholders, but this responsibility can always be used and misused. It is impossible to price this risk effectively, which is probably why most of the best serial acquirers are trading below their fair values today, estimated in hindsight 10 years from now. Successful ones, at least.

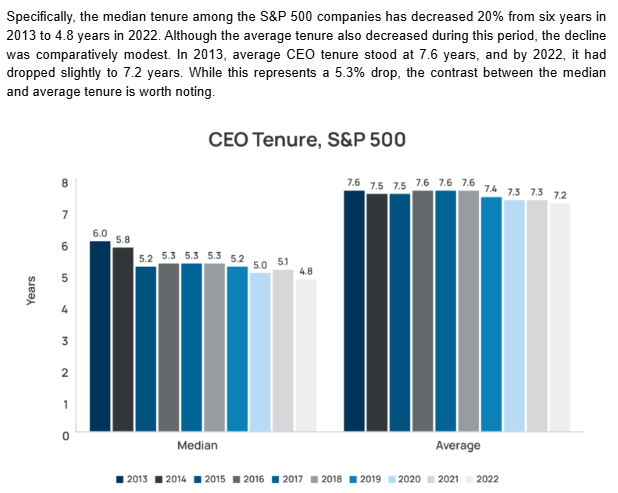

I like to believe that markets price serial acquiring strategies in alignment with average CEO tenures, which are surprisingly low. If a median CEO is at the helm of a company on average for five years, there is a reasonable doubt to have about the strategy of the company after this period. In effect, whenever you make a forecast related to a business further away than 5 years, you are betting on the unknown actions of an almost random individual. In the case of Terravest, Dustin Haw is there as CEO much longer.

Virtual friend and a fellow Substack writer,

💚📡(with much better content than you find here - if one odd lot from below earns you money, subscribe to his publication), gave me an idea to draft my more detailed valuation approach for Terravest. Time permitting, I will try to publish it soon.I spent a considerable time studying Enghouse. Most of the information on them can be picked up from their earnings calls. If anything, they give you a great deal of details on how profitability and client dynamics differ in SaaS vs. license models and on-premise vs. cloud (private or multi-tenant) options for software distribution. Management running it, and especially CEO Stephen Sadler do seem to work in the direction of creating shareholder value. They acquire VMS enterprise software companies, lately distressed ones, cut out unprofitable revenue and keep the remaining profitable core, and sometimes whole teams of developers if they are talented ones, irrespective of their product assignment. The obvious risk in their case is the impact AI might have on their call center solutions, but this seems to be overinflated, since Enghouse has been integrating AI solutions in their products even before the ChatGPT broke through. The bigger issue, not really an issue, but a suboptimal situation, I identified is their reluctance to allocate all of their excess capital. They seem to pride themselves on their cash pile and the fact that they don't use debt in acquisitions. Any debt they had in mid-term history came only from debt that was acquired. They seem to target IRRs of 16-20%. Use of leverage on the level of Topicus or CSI when it was smaller would increase their return on shareholder equity to similar levels of CSI. Reading the transcripts from 2019 onwards, I don't think they will change their approach, either to leverage or hoarding cash and keeping it as a security.

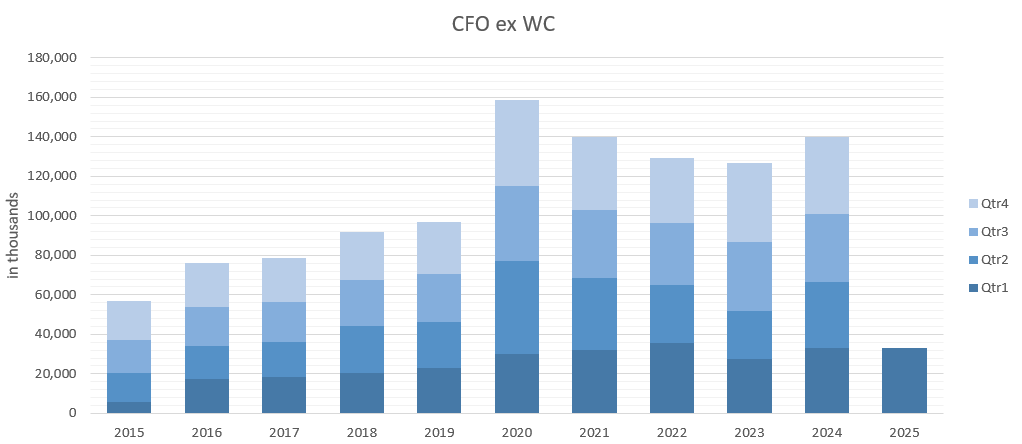

With this, it is fair to assume they will grow their free cash flow at some 10% in some mid-term future at least (2020 and 2021 years were affected by abnormal values in their video communication solutions, so the trend line ignoring these two years is indicative of their real growth). Most likely, their margins could also recover by a few percentages as the pricing pressure from unprofitable SaaS communication companies goes down in the next few years (on a few occasions they did mention this pressure in 2021–2022). On the other hand, they might remain on these levels as they are open about the SaaS model being less profitable than the perpetual license model of software distribution.

I still don't have a clear idea what Pinetree might see in Enghouse, but I am happy at least to own them at this price, though Pinetree. They definitely won’t treat it as Bravura or Trubridge where they do have some level of control through shareholder voting power now. I definitely do see some attraction to it as a value investment, with my IRR estimate now being greater than that of Trubridge. I will continue researching it.

During this period I identified two odd lot opportunities, none of which I managed to use. One was from WEX Inc, where a tender was issued to repurchase shares in a modified Dutch auction with a range of USD 148 to USD 170 per share. I was hoping that the price would go down to 146 on an odd day, and there were a few of these in the overall market in this period, but it failed to happen. Other odd lot opportunity that is still available out there is from Lithium Royalty Corp. It expires on April 30th, 2025 and the offer also provides an opportunity to tender the shares in the modified Dutch auction in the range of CAD 4.50 to CAD 5.20 per common share. This might seem trivial to most, but I like these incremental gains when I can have them at low effort (significantly reduced effort with the help of some AI tools). Usually, the proceeds are used to finance some newsletter subscriptions I would find useful.

My own portfolio is still doing well. It is close to its historical maximum absolute value (excluding the latest contribution of funds) ever, with still some investments within being undervalued according to my estimates, and probably some close to or above their fair value (insurance companies). Since COVID lows of March 2020, it's after tax liquidation value has compounded at 22.5% (or just above 30% before tax by simple division with 72.5% to account for taxation). I don't think this is sustainable. It is amazing to think that close to five years have passed since. All of us had many different visions of the world today back then, and reality is that the world has not changed that much since. My portfolio grew from levels that are not that significant to a nice safety cushion to provide a life of privilege to my family. Passage of time joined with compounding is an amazing thing, especially if you witness it firsthand, but the price for time gone by always seems too high. Hopefully, in a decade or so, it turns into generational wealth.

March is also my fund contribution month (I add funds two times a year, according to my contract with myself), resulting in some cash being available out there for additional investments.

Finally, the end of March is also an annual cut-off date for my portfolio tracking, and following the practice of many keeping their thoughts public, I prepared an annual letter to myself. Where I differ is probably in the fact that I have automated it a bit in an effort to save time. Values below show overperformance or underperformance to the hypothetical cumulative after tax value of my portfolio if it compounded at my 15% after tax return target (I cannot avoid 27.5% tax irrespective of the holding period). So here it goes:

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter/X account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe as a paid subscriber, even for a month. Even years after you have read something from me, hopefully based on realized experience.

In any case, it does not hurt to subscribe for free, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Great update! Very clear thinking, it’ll keep serving you well 💚 🥃

Wonderful piece and analysis. Thank you for sharing.