I found an interesting cash and share acquisition, in which I have not taken any position. When confronted with situations like this, and in order for me to underwrite any risk, I would either need to be able to estimate with a high degree of certainty if the Urban Logistics shareholders are getting a fair offer, or I should be certain that the shareholder approval is just a formality or close to being one. I am not able to value REITs, so the former is out of my reach. For the latter, I provide some details below.

I will leave a financial construct used at the end of the note. Consider it an idea exchange for any additional inputs you who read this could provide (you are still a small group).

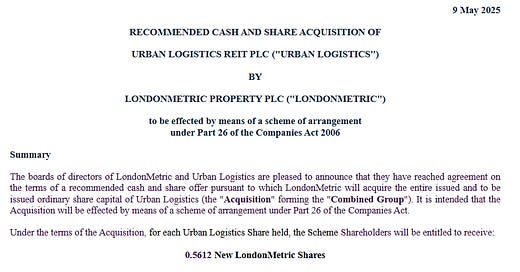

On the May 9th, 2025, Urban Logistics REIT plc received a takeover offer in cash and shares from LondonMetric Property plc.

According to the offer document, each shareholder of Urban Logistics would receive 0.5612 of newly issued LondonMetric shares and 0 .428 pounds, subject to court and Urban Logistics shareholder approval of a 75% majority.

The level of those who are committed to voting in favor of this deal is low, especially having in mind that 75% of Urban Logistics shareholders have to vote in favor of this deal in order for it to be approved. Voting will occur between May 23rd and June 30th (the exact date should be known on May 23rd).

One additional shareholder which might vote in favour of the acquisition is Achilles Investment Company Limited, run by Chris Mills and Robert Naylor, which owns 8.8% of Urban Logistics. Achilles made a polite request to fire the current management of Urban Logistics.

This was also followed with an explanatory note providing more details on potential issues with Urban Logistics. Among other things, the idea of sale of Urban Logistics was mentioned.

Where Achilles showed major distrust in the Urban Logistics management was related to the involvement and connections of M1 Agency LLP (a property consultancy firm specializing in the logistics sector) with Urban Logistics and Logistics Asset Management. When in March 2025 it was announced that Urban Logistics would acquire Logistics Asset Management and put Richard Moffitt to be a new CEO of Urban Logistics.

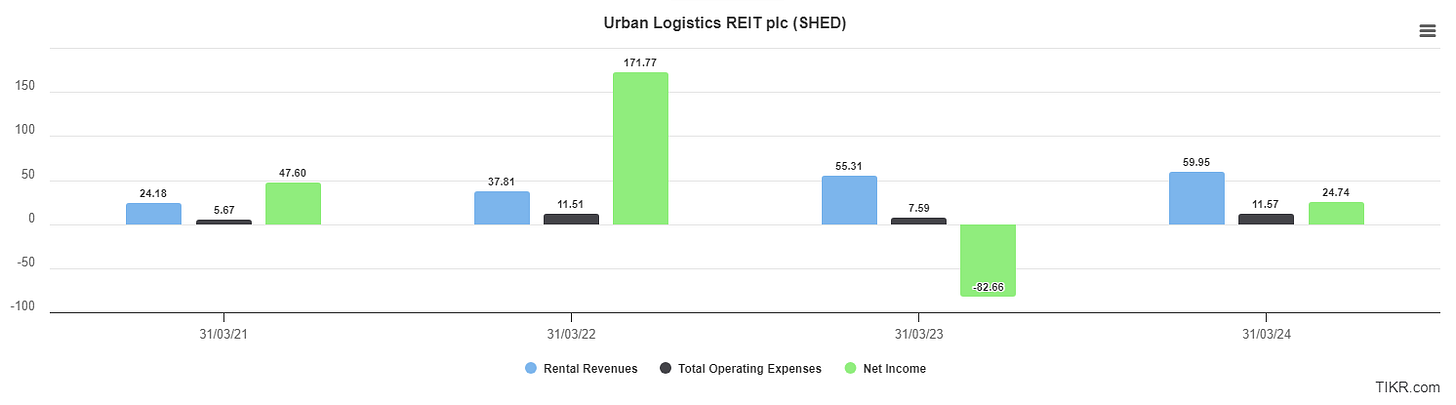

The connection between M1 Agency and Urban Logistics centered around Richard Moffitt, who held key positions related to both entities. Moffitt was the CEO of Logistics Asset Management LLP. Logistics Asset Management LLP was the external investment adviser to Urban Logistics. This means they were the company contracted to manage Urban Logistics REIT's property portfolio and investment strategy. Simultaneously, Richard Moffitt was a partner in M1 Agency LLP. Urban Logistics employed M1 Agency for services such as specialist advice, sourcing off-market property acquisitions, and brokerage services. Over a four-year period ending March 31, 2024, Urban Logistics paid over £6.3 million in fees to M1 Agency LLP. This was in addition to the fees (approximately £22.7 million over the same period) paid to Logistics Asset Management LLP (the external investment adviser where Moffitt was CEO). This total consideration paid was a significant portion of the total cumulative operating expanses in this period.

Achilles publicly highlighted these concerns, questioning the appropriateness of these payments and the governance structure. There might be merit to their concerns about the governance of the existing management team. Apart from canceling their request for an extraordinary general meeting at Urban Logistics in April 2025, after the initial offer from LondonMetric was mentioned, Achilles made no new announcements. My assumptions are that they have maintained their stake in ownership and that they would vote in the favor of the proposed deal, bringing the total vote in favor to 15.17% (8.8%+6.37%).

Who are the remaining owners of Urban Logistics? This is a difficult bit of information to obtain. To my best effort, I managed to identify that the following entities were involved in purchasing Urban shares (and in some cases shorting LondonMetric as a hedge) since the initial possible offer of LondonMetric was announced on April 11th (based on Form 8.3 provided at the following link).

Assuming all those who were dealing with Urban Logistics shares after the offer became public, intent to vote in favor of the deal, we are now at 46.68% of the votes in favor (note that two entities highlighted above are holding companies owned by Achilles). Some of these names are just brokerage accounts, but this assumption is probably not that far from the true intention of those still holding the shares.

Finding the remaining shareholders from here is difficult. The simplest source of information I found is actually from TIKR. From it, I assumed that institutional investors, some pension funds, and some hedge funds, as well as insiders, would vote in favor, resulting in a total vote count of 85.37%. Note that TIKR data has no information on Sand Grove Capital Management LLP, L&G - Asset Management Limited, Samson Rock Capital LLP, Glazer Capital, LLC, Kryger Capital Limited, Aberdeen Group plc, and Franklin Resources, Inc., from the table above, which jointly own 13.78% according to my count (my count can be wrong). Vote seems to be in favor, or at least close to being plausible that it is achieved. I would assume that the organizations like ISS (Institutional Shareholder Services) or Glass Lewis, or similar companies, will issue their formal voting recommendation for the proposed acquisition once the final scheme document is disclosed on May 23rd.

As for LondonMetric, historical acquisitions from LondonMetric indicate that this is not their largest deal historically:

Target Company: Urban Logistics REIT plc (SHED.L)

Status: Recommended Offer

Announced Date / Effective Date: Announced: May 8/9, 2025; Expected Completion: By June 30, 2025

Consideration per Target Share: 0.5612 new LMP.L shares + 42.8p cash + 4.35p interim dividend (retained by SHED.L shareholders)

Implied Value of Acquisition (Approx.): £698.9 million

Target Company: Highcroft Investments PLC

Status: Recommended Offer, Scheme Effective

Announced Date / Effective Date: Announced: March 27, 2025; Scheme Effective: May 21, 2025 (Expected)

Consideration per Target Share: All-share offer (Valued each Highcroft Share at 842.1p based on LMP.L price on Mar 26, 2025) + 35p interim dividend (retained)

Implied Value of Acquisition (Approx.): £43.8 million

Target Company: LXi REIT plc

Status: Completed

Announced Date / Effective Date: Effective Date: March 5, 2024

Consideration per Target Share: All-share merger (0.55 new LMP.L shares per LXi share)

Implied Value of Acquisition (Approx.): £1.9 billion

Target Company: CT Property Trust Limited (CTPT)

Status: Completed

Announced Date / Effective Date: Announced: May 24, 2023; Effective Date: August 7, 2023

Consideration per Target Share: All-share offer (0.455 new LMP.L shares per CTPT share)

Implied Value of Acquisition (Approx.): Not specified in summary, but shares issued

Target Company: A&J Mucklow Group plc

Status: Completed

Announced Date / Effective Date: Year: 2019

Consideration per Target Share: Not fully specified

Implied Value of Acquisition (Approx.): £0.4 billion

Target Company: Metric Property Investments plc

Status: Completed (Merger to form LondonMetric)

Announced Date / Effective Date: Year: 2013 (Effective Jan 2013)

Consideration per Target Share: Merger with London & Stamford Property plc (0.94 new LMP.L shares per Metric share)

Implied Value of Acquisition (Approx.): £830 million (deal value)

Interestingly enough, I found no evidence of cases where LondonMetric publicly disclosed an offer, which was then retracted or rejected by the targeted company.

Transaction

In order to execute a partially hedged transaction, one would need to do the following:

There is an interesting element here to consider if you look at the above. Having a profitable outcome in this construct assumes that the proposed dividend of 4.35 pennies is paid. If Urban Logistics were to, for whichever reason, decide to withhold dividend payment before the transaction, one would stand to lose close to 2% on its long leg. This, however, I believe is highly unlikely, because it was mentioned as a part of the deal announcement and board proposal, and changing the proposal like this cannot rationally motivate shareholders to accept this deal.

There is another hurdle to overcome, and that is one of the transaction costs. Depending on your broker, this might vary, but at least on Interactive Brokers you will end up paying significant fees on purchasing shares of Urban Logistics (close to 0.55%). Add to this borrow rate for the short leg currently at 0.13% (annualized 0.9%) and 0.05% fee on selling London Metric, and some 0.73% of any remaining spread is gone. This might eat up your return and boost the returns of Interactive Brokers. If you decide to use leverage for the long leg, you would be facing an annualized borrow rate of 0.81% over the holding period, or 5.7% annualized. The total cost of a fully leveraged position, which would save one from the FX risk, would come up at around 0.69% (including fees), removing almost all the spread available.

Alternatively, using no leverage and assuming a long position would expose one to all the currency risk with added fees. And potential compensation of existing spread minus the costs, which as of the moment of publishing sits at 0.93% of the long position. Is this adequate compensation for currency risk? Hardly.

For those interested, some data is in the Excel attached.

I have still not taken a position in Urban Logistics, nor LondonMetric, however I will reconsider it again once more information becomes available as of May 23rd. Hopefully the spread increases with no new real news in the meantime.

Ultimately, this was a worthy effort, if for anything, than because of how the idea was generated. I simply asked one of the LLM AI tools to “find M&A transactions in which publicly traded companies are acquired, which will close within two months, and where the difference between offer price and current market price is more than 1% (market price should be lower than offer price)". The work above is my own, and AI-free, but asking any research tool to do the same for you would probably result in something similar. The world of investing is changing rapidly.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter/X account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe as a paid subscriber, even for a month. Even years after you have read something from me, hopefully based on realized experience.

In any case, it does not hurt to subscribe for free, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Found some errors in my original calculations. Notes and the file have been updated since.