6. The whole Constellation

Two simple overviews of Constellation Software that tell a much more complicated story

When Covid-19 started creating havoc in financial markets in the early 2020, I made my usually market downturn investment decision. Take on any task that is loosely connected to the investment world and follow it through before you make any big investments. In that time, this meant listening the lectures of professor Aswath Damodaran one more time, and reading a hard copy of his book Investment Valuation : Tools and Techniques for Determining the Value of any Asset.

This then grew into having a far more sophisticated and psychologically far more bearable investing process I felt comfortable with.

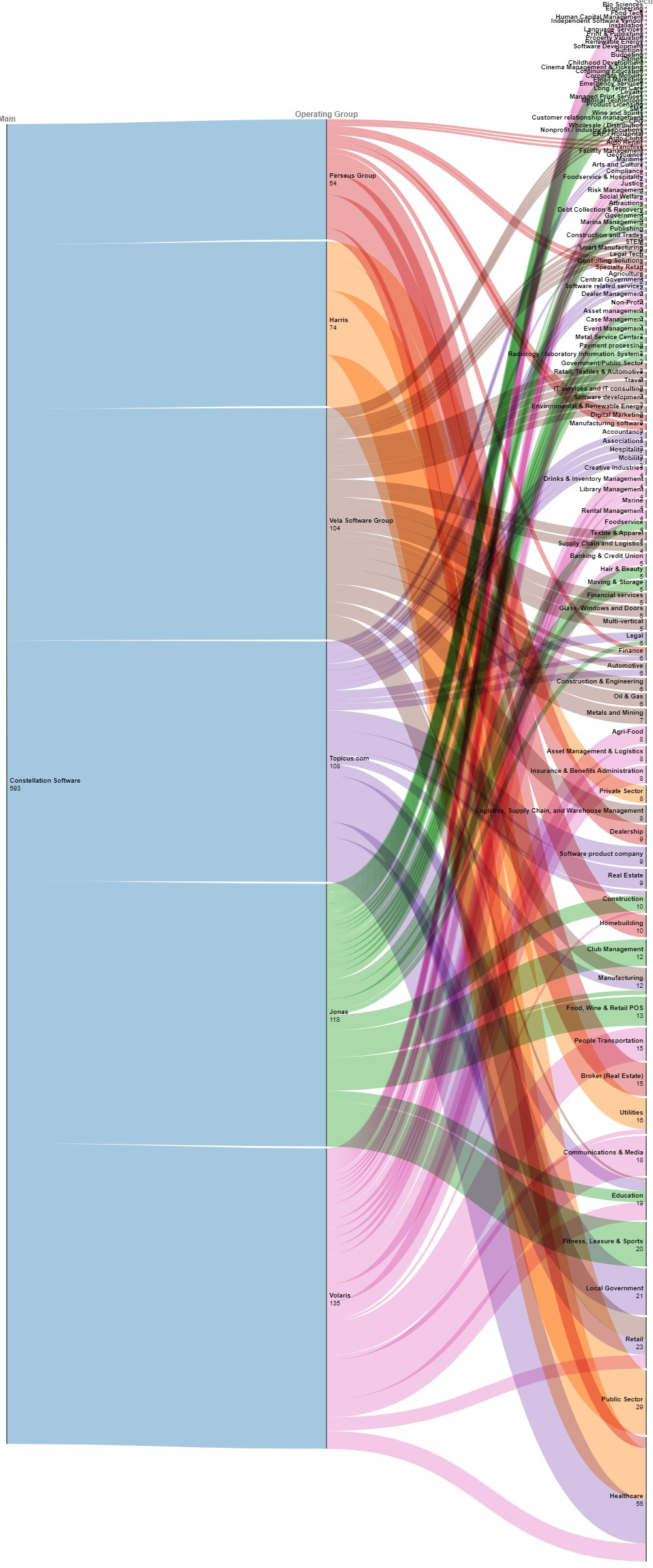

This time around, one of the posts from Liberty gave me an idea that I could create a simple organization dendrogram of Constellation Software. Behold below, the Constellation.

I wrote about how I see Constellation in my Seeking Alpha article (free to read). It was a simple analysis based on scarce data provided in the annual reports of Constellation. But what I missed was some tangible feeling of their business.

It was only when I accidentally learned that one of their businesses is providing a software for the bank I work for, that I got the urge to read about the rest of their businesses. In my particular case, software that is provided is billed annually at the rate that is just above the gross cost of one full time employee. If my bank was to have an in house development and maintenance of the same software, most likely, two people would be needed. Over time, they would develop a specific knowledge and create a key person risk, since the moment they would have left, no one would be able to take over from them in short time. Having this software externally maintained, updated, verified by usage of my bank’s peers, creates a lot more value and stability.

Constellation has hundreds of companies like this (roughly 600), some of which have been founded in the 1970s, with Schilling being the oldest I found (born in 1971, half a century ago). These companies are not just software companies. The way I look at them now is more like IT departments of real, and in most cases, quite boring businesses (note that boring is a desired quality in the businesses I invest). Maybe one of the best stories I read was from Remote Terminal System Srl , Italian company servicing corrugated board producers (cardboard boxes - business high one boredom scale). I urge you all to read it and realize how actually robust the business model of Constellation acquired companies actually is. They evolve with the rest of the world and businesses, despite being specialized.

But, to come back to the point of this post. Constellation is not just an average software company. It is a decentralized and externalized global IT department operating in a cross-section of the world economy. This has significant implications on how I view it. In the most blunt way, its beta goes to 1 and cost of equity is much lower than I previously considered. In human words, it’s not more risky business than the overall economy.

I will update my valuation with this, but for now, let us marvel at the industry diversification achieved by constellation (size of industry is based on a simple count of companies, industry names are according to the Constellation definitions)

Here is a fun trivia, I identified four Constellation companies that have interacted with my life so far.

Best of luck to all of us!