11. Mader Group: First Note

Alternative scenarios for Mader Group development and valuations

Below is the collection of notes I have collected so far on Mader Group. Due to some time constraints on my side, it might not be as coherent as usual, but some relevant information might still be inside. At the end, I provide my view on the possible value of Mader Group under different scenarios. Skip to valuations at the end if you dont have time to read.

Business overview

Mader Group is a provider of specialist technical maintenance services across multiple industries. Their historical focus was on the maintenance of heavy mobile mining equipment and fixed surface mining infrastructure. Recently, they have expanded into other industries, such as energy (oil and gas infrastructure maintenance) and even trucking. Overall, Mader divides its business activities between core mechanical services and growth strategy activities. Core mechanical services include:Mobile Plant Maintenance

Rapid Response Teams

Excavator Support Teams

Equipment Shutdown Teams

Maintenance Projects

Training and Mentoring

Rostered Support

Their growth strategy activities include:

Infrastructure Maintenance

Fabrication and Line Borin

Electrical Maintenance

Climate Control Maintenance

Professional Support

Marine and Power Generation

Rail Maintenance

Mader Clean Team

One of the notable elements in Mader’s service offering of late are also maintenance centres. These are classic brick and mortar mechanical service facilities, where contrary to previously listed activities, the client comes to Mader. The following short video provides an interesting glimpse in day to day operations of one maintenance centre.

Alternatively, and this is my preferred way of looking at Mader, is similar to companies that acquire small businesses. Mader takes this one step further by acquiring and further developing a highly specialized workforce, equipping it with adequate tools, and employing it in a more efficient way than OEMs or mining operators would. They provide maintenance services for the majority of the equipment of an average mining operation, both on surface and, as of recent, underground, covering servicing of both machinery and mining and energy infrastructure. They help repair and maintain equipment that the permanent workforce of the client cannot, either due to a lack of skills among their employees or a lack of a skilled workforce at all. In short:

Mader hires and further develops a highly specialized workforce, equips it with adequate tools, and employs it in a more efficient and geographically dispersed way than OEMs or mining operators would. Business finds them as they compete for a scarce workforce.

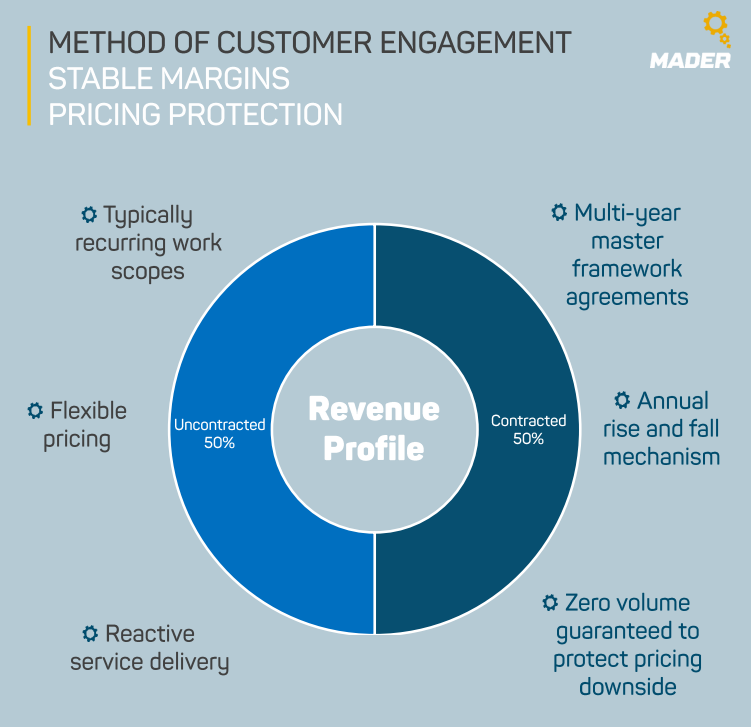

Mechanics, which are kept on permanent payroll in Mader, are then deployed based on received orders from the clients, and their work is billed either according to the time and efforts needed for the specific service provided, or in half of the cases, billing goes through mid-period service level agreements, which also guarantee some minimal amount of revenue, even in cases of limited engagement.

Irrespective of the underlying contractual agreement, Mader has only limited visibility into how their revenues will develop. According to the later earnings call, this visibility is between three and six months. Decreased visibility does, however, allow for greater flexibility and the shifting of resources to higher-margin geographies. This is probably one of the factors that shapes their short-term guidance, but more about that later. Be it as it is, historically, Mader has shown the ability to maintain clients and previous levels of employment. Put differently, its revenue is stable for the number of people it employs.

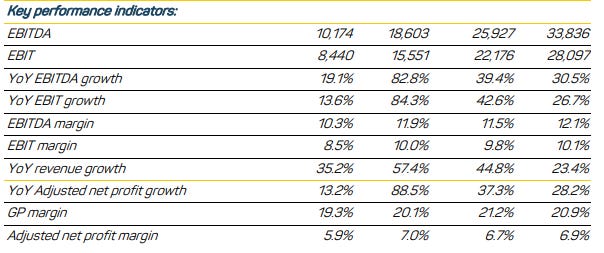

(Source: Multiple investor presentations and official financial statements)

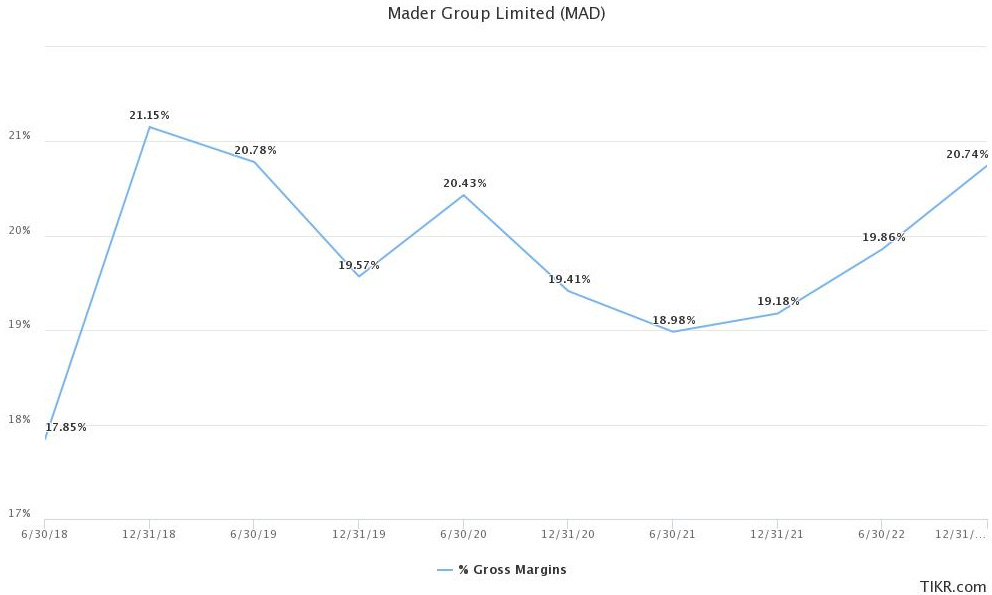

At the same time, gross margin generated is close to 20%, and it is relatively stable. This percentage hides one interesting detail about Mader. The cost of mechanics employed, as well as other direct costs related to repairs performed and revenue generation, is recorded here. Assuming that Mader's clients are faced with the choice of either hiring a permanent employee for an annualized amount of what they would be billed by Mader or outsourcing the same services to Mader, gross margin implies that Mader is able to employ an average technician close to 15-20% more efficiently. Think of it this way, if you owned a mining operation and had the choice of hiring an employee that would have 25 vacation days and 25 idle days during a year, you should be indifferent between your own employee, which you would have to train and replace if he leaves, and a technician provided by Mader when the need arises.

If you owned a mining operation and had a choice of hiring an employe that would have 25 vacation days, and 25 idle days during a year, you should be indifferent between own employee, which you would have to train and replace if he leaves, and a technician provided by Mader when the need arises.

One notable impact on its operating model came with Covid travel restrictions that limited its ability to reallocate its workforce within Australia and globally.

The last point mentioned is one of the rare potential sources of Maders competitive advantage that I have identified. Now employing over 2500 people, of whom probably 2300 are actual mechanics or engineers, it has achieved a great level of workforce skill diversification and concentration in each specific area of expertise.

In the event of lucrative opportunities appearing in regions of Australia, or anywhere in the English-speaking world for that matter, where currently no adequate workforce is available, chances are high that some of Mader employees will be willing to go on several weeks- or months-long rotations. In their April 2023 presentation, they even left a quite relevant hint about this practice, whereby they mentioned that out of the 120 people employed in Canada, 40 are on rotation from Australia. A lucrative client relationship was found, and the workforce has migrated accordingly. For OEMs without an adequately staffed regional office or a small regional maintenance service provider, this would be a lost order. Mader would profit on its own terms without needing to sacrifice its margin.

(Source: https://clients3.weblink.com.au/pdf/MAD/02153132.pdf)

In order to expand its business, Mader makes two types of explicit investments, and one additional alternative investment.

As for explicit investment, the first type is their fleet of vehicles, of which it owns over 1000. On average, Mader owns one utility vehicle, or ‘ute‘ as they call them, for every 2.5 employees. If we account for employees in the corporate center, this number decreases to 2.2. Additionally, some of the employees are employed in maintenance centers or work as fixed plant mechanics, so it's safe to assume that in reality, each ute is shared between two people. The cost of such vehicles is between AUD 120 and 170 thousand (estimate), and they are depreciated over a period of 5 years, although in reality, having a roster of 2300 mechanics has extended the fleet life far beyond that. Going through Mader’s social media pages, I was able to identify vehicles that were over 10 years old. This supports a recurring statement in Mader investor calls that all capex is growth capex. Reality is probably somewhere in between, and some parts of the fleet can be expected to be replaced or significantly restored within 10-15 year intervals. Given that Mader operates with a NOPAT margin of 6+%, this effectively translates into an ROC per employee of 20+% (employee NOPAT divided by half a ute). Of course, this piece of information is just anecdotal evidence of Mader ability to reinvest at a high rate of return despite being a low-margin business.

A second explicit investment is in the form of maintenance centers, which serve as centralized locations for repairs, in which clients equipment is brought instead of being serviced by field teams. The expansion of maintenance centers is a recent occurrence in Mader's development. The logic I see in it is manyfold. First, they enable more complex refurbishments to be executed, which would otherwise be difficult for field teams. Secondly, they are an alternative career path for those employees who seek to reduce their away-from-home time. Thirdly, they are a good instrument for knowledge sharing and training new personnel. The future will tell how maintenance centers will affect the turnover and margins of Mader, but so far the only visible impact comes in the form of higher working capital needs.

An alternative investment I mentioned is their investment in a staff training program offered to Mader and non-Mader employees (Trade Upgrade Program). Effectively, Mader is training the employees for their competitors. The rationale I see in this, apart from the monetary incentive they get, is that it should reduce workforce scarcity in the long run, which should alleviate the pressure on the margins Mader is facing in Australia. According to their words, real pressure does not come from the existence of competition but from a lack of a trained workforce. If one were to further speculate, it is quite reasonable to assume that mechanics trained by Mader will go and get permanent employment either in mines operating in remote locations or in OEMs, which might pay them less. They will gain experience there, and some of them could be hired by Mader a few years later.

Services offered by Mader are briefly explained on their website as:

Added in June 2023

(Source: https://www.madergroup.com.au/services)

This all is made available globally in over 40 locations, each employing between 50–60 people (not counting for corporate roles of approximately 100 – according to earning transcripts), with the number of service centres growing each year. Consider each of these as a resource of both material and know-how supplies, needed to perform some or all of the above services to the adjacent potential client in rapid response time.

The majority of Maders workforce comprises heavy-duty diesel mechanics. This is a highly qualified, scarce, and experienced workforce, able to earn up to AUD 200 thousand or USD 170 per year gross. This job is by no means easy. It requires frequent, longer period absences from home, life in remote areas, and a high risk of injury or even death. But at the same time, the job offered by Mader is designed to attract people in their mid-twenties who have not yet started their family lives and are more flexible and willing to explore the world.

(Source: 1H FY 2023 results presentation)

Company history and management

Mader Group was founded by Luke Mader in 2005. Luke himself had a long experience working for WesTrac, before he decided to found his own business, which would seek to provide better and faster maintenance services within the mining industry. WesTrac proved to be a great source for future Mader employees. Apart from Luke Mader, current Chief Operating Officer of the North American operation, John Greville, one of the founding members, also originated there. In addition, James Walker, former CEO of WesTrac, served until recently as a Independent Non-Executive Chairman of the Board of Directors. Rick Dillon, current general manager at Pilbara Ancillary and Rail Operation, also joined from WesTrac in 2010. Go through the CVs of the current general manager and board of directors, and in majority of the cases you will find people with long tenure at Mader and previous working experience as technicians and mechanics. Personally, I am biased towards managerial structures built from the bottom up and organizations that allow their employees to advance their careers beyond their initial technical skills. There is value added in having educated managers in the CFO area, and here Mader has executed as such with former CFO and CEO and now Executive Director for Emerging Business, Patrick Conway (based on my assumptions, the person standing behind the North America expansion), and current CFO Paul Hegarty.

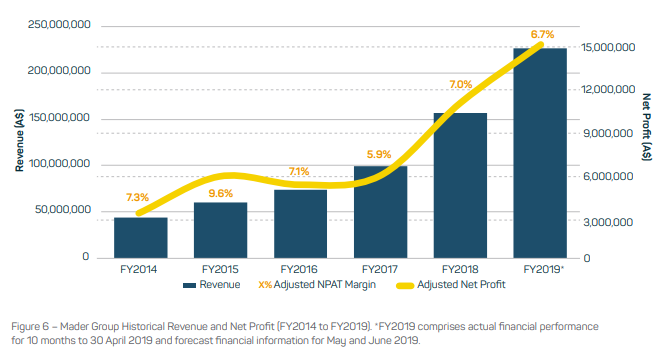

Initially operating as a brick-and-mortar repair service in the Kimberly region of Western Australia, Mader Group grew slowly and steadily until 2009, when the first field service was launched in Western Australia (a mobile service unit). By 2011, Mader started expanding outside of Australia to regions of Africa and Asia, following the trail of good client relationships made within Australia. By 2012, Mader had more than 100 employees, and the first significant capital expansion was made by securing an additional 25% of capital from Craig Burton, who has since served as one of the directors at Mader. Craig still owns approximately 19.5% of the outstanding common shares of Mader Group.

By 2015, Mader was growing rapidly. Then, with more than 250 employees, Mader started expanding into other service areas. An Ancillary Division offering the services of auto electricians, high voltage electricians, boil makers, light vehicle mechanics, and heavy road transport mechanics was funded, bringing it one step closer to what I assume is the ultimate goal of Mader, becoming one point of contact for all maintenance services related to running a mining operation. Between 2015 and 2012, annual revenue increased from AUD 25.2 million to AUD 60.1 million.

Within the next two years, the number of employees increased to more than 500. Mobile Plant Shutdown business unit was established, and overall group operations have further expanded across Australia, covering South Australia and New South Wales. Fiscal 2017 ended with close to AUD 100 million in revenue.

Already in 2018, the number of employees increased to more than 1000. The First Rapid Response Team was launched this year. This was a relevant evolution of the existing business, as it gave Mader a clear competitive advantage over OEMs service teams, which are notorious for longer waiting times to get the services needed. The same year, Mader started its US expansion by opening an office in Colorado with the goal of covering mining operations in Wyoming, Colorado, and Nevada. Revenue stood at AUD 156.4 by fiscal year-end.

As of 2019, Mader went public in an IPO, the rest is public history.

Financial Performance

Mader does not disclose much about their hurdle rates, capex budgets, or targeted debt-to-equity ratio. Even more related to capex, they are adamant that all of their capex is growth-related. On the other hand, measured through an observable history since it went public, the data behind Mader's business model shows a great deal of consistency and stability over time. Since detailed data is available only for the last five fiscal years, all figures below will show the last trailing twelve month (LTM) figures using semi-annual frequency (Mader provides comprehensive disclosures semi-annually, with limited quarterly updates), unless otherwise stated.

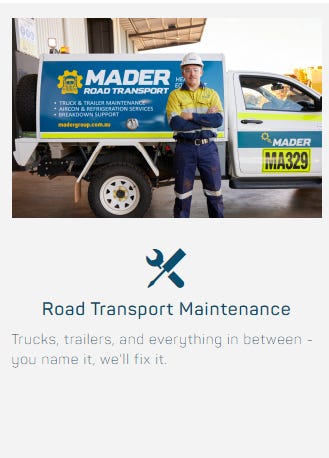

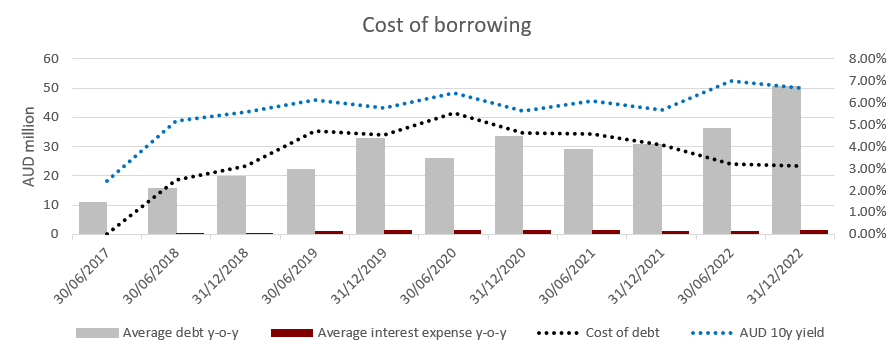

Starting with balance sheet development, Mader significantly decreased its debt burden since its IPO and runs a stable debt-to-equity ratio. Although one might be alarmed by the most recent increase in relative debt, one peculiarity of it is that it is cheap, even when interest rates are high.

Not shown in the chart above, but the latest results update further disclosed that the overall net debt level was reduced by 8.2 million as of June 2023.

Viewed through the eye of a banker, Mader is now far less risky, far more diversified, and a much larger business than it was only five years ago. This would to some extent justify why its cost of debt (measured through average interest expense over the same period average debt level) would behave so differently compared to the 10-year Australian government bond yields.

The fact that Mader borrows at levels below the Australian government over the long term is no surprise, as most of its liabilities are short-term and used to finance the time mismatch between their salary expense (biweekly) and receivable collection from the clients (up to two months and decreasing over time).

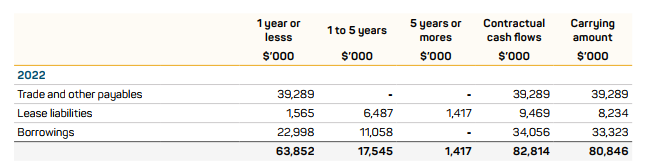

Bellow extract from 2022 annual report shows that over half of the debt including leases is short term, while rest is maturing in mid term. Looking at pure debt, two thirds are short term debt, and as it seems, it has a specific purpose, and that is that is namely financing net working capital.

Another curiosity related to Mader is that although its vehicle fleet is being depreciated over a period of approximately 5 years, its real life is much longer. As disclosed in the call below, and from contacts with their investor relations, many of the vehicles have significantly longer useful lives than assumed by accounting. In practice, vehicles are assigned to Mader employees, who are mechanics, and are maintained by them.

…Thanks for that question, Jason. Yes, look, absolutely. I mean we've got -- there's actually very few of our vehicles that have ever been moved out of the fleet. So some of the original vehicles are still out there, getting money for us essentially. So yes, the depreciable life is a lot shorter than the whole useful life of that vehicle. So there would be a significant portion of our fleet that is fully depreciated, but still in operation. And we continue to see that we're not -- I think as I said before in the presentation, all this capital being spent on new vehicles is all growth capital. We're not giving any out, this is a sustaining capital.

(Source: 2021 annual results call)

On first reading, I was tempted to add back the part of depreciation expense, roughly 1% of the revenue, to my estimate of the free cash flow to the firm, however, I decided against it due to a lack of transparency in this area. In the event that the abovementioned is true and Mader employees are responsible for maintaining the vehicles, true maintenance capex should probably be measured through missed billable hours spent on maintaining their own fleet. This information is not available, though. For safety purposes, I will treat the full amount of depreciation as a cash expense.

When it comes to profitability, Mader is as consistent as one could hope, which is even more impressive when considering the aggressive growth rates they achieve. New business is not won by dumping prices, and the business is generating growing net income over time. Actually, the net income target is used as one of the main midterm performance incentive targets for the management, reducing the risk of high goodwill acquisitions that could either dilute ownership or destroy value (so far, the only acquisition made was sold for profit).

As mentioned, the Mader model is built on being able to generate the gross margin using the same people for whom OEMs or mine operators would not be able to achieve the same level of employment. The ability to quickly deploy technicians to locations where they are needed, even on different continents, reduce their idle time, and keep them employed over a longer period of time is the key to their continuous success. Ultimately, people hired by Mader are most likely former employees of OEMs and mining operators. The need for the work they had been doing before they moved to Mader has not disappeared because they were changing jobs, only their employer has.

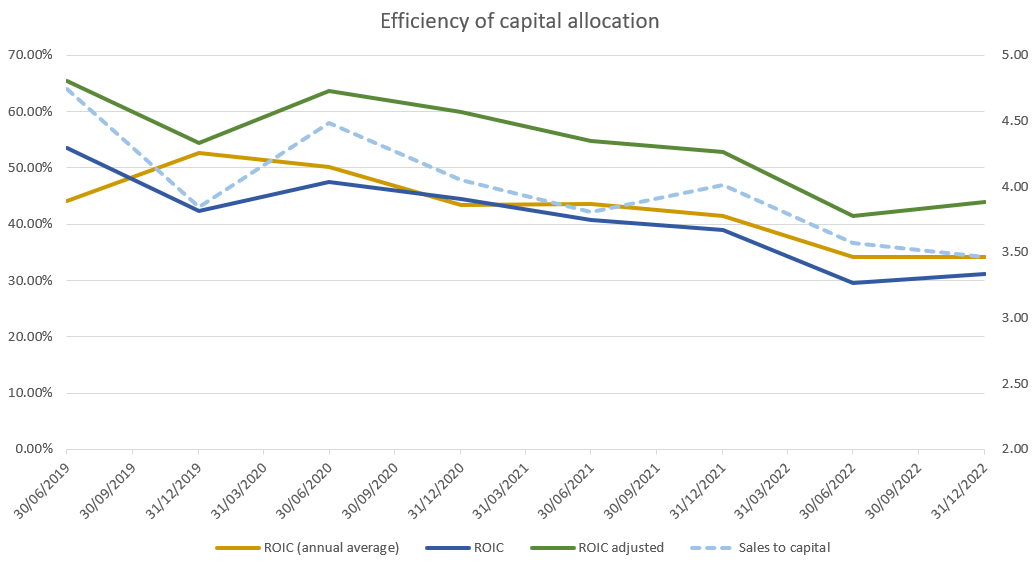

One of the metrics I use when trying to forecast future capital needs is the gross revenue to capital ratio (revenue divided with a sum of common equity and all interest bearing debt and liabilities, net of cash). Namely, it tells me how much capital needs to be raised on debt or equity markets, or retained from prior period earnings, to support current level of business measured through revenue. Here Mader shows high level of predictability over time and longer periods. Combine this with overal profitability and interesting discovery is made.

What Mader does with the money they collect is simple. They finance their interest payments on the short-term debt they carry, they pay a regular dividend, half of which goes to Luke Mader and the rest of the management team. The retained part is reinvested in their fleet of utes and maintenance centers. This, they execute with low margins, high capital turnover, and hence a high return on invested capital. The figure below shows the most recent evolution of the different ROIC measures I follow, where:

ROIC = NOPAT/(interest bearing debt + equity - cash)

ROIC average= Year on year average NOPAT/ Year on year average interest bearing debt + equity - cash

ROIC adjusted = ROIC with added back two thirds of depreciation

The key to these high rates lies in the capital-light model Mader advocates, where larger capital investments are vehicles that roughly cost as much as one annual employee's income but last 10 to 15 years. Probably the biggest risk for Maders future is that it becomes much more capital-intensive while still having margins in the range of 9%-11%. This is something to which one should pay close attention over the next few years. Based on information provided in investor calls, the average vehicle price in North America is higher than in Australia, but the difference seems to be compensated by the higher margins achieved there.

Total addressable market

One of the paramount factors in estimating the value of a growth company is identifying its total addressable market. Based on the first half of FY 2023 results, Mader is still a predominantly Australian-oriented company.

(Source: 1H FY 2023 results presentation)

In parallel to the above, Mader usually shows their potential addressable markets, measured through mining industry output.

(Source: 1H FY 2023 results presentation)

With this implying that, in mining alone, there is a potential to grow the size of the business in North America to roughly AUD 900 million from the current AUD 57 million, equaling the size they have today in Australia in South America, and potentially growing the business in the rest of the world to AUD 50 million (600 ROM / 2200 ROM times current Australia revenue). In total, this would result in Mader becoming more than AUD 1.3 billion revenue generating business using today's price levels and industry specifics. During the latest investor conference they attended, for the first time, a goal of AUD 1 billion in revenue was mentioned, although without precise time reference. In later communication with the investor relations team, this ambition was confirmed as a midterm goal for fiscal year 2026 (June 2026).

One interesting aspect is that there are no other impediments to growth than business development (company recognition) in the USA.

Thanks, Marcus. No, look, the U.S. I guess the limits to growth are probably in business development at the moment. Yes, that said, we're starting to see those growth rates really start to ramp up as we're doing more work in more states with more customers. But look, certainly -- where Australia is certainly more of a recruitment constrained environment, we see the U.S. is -- again, is development of business [ name ] is getting our product out there and grow that [ name ] in the U.S. So it's definitely a BD effort over there.

~ 2021 Annual results conference

But, though 1.3 billion sounds like a nice number, it is effectively meaningless if not tied to some monetary industry measures. I have limited knowledge of the mining industry, and this should be a significant disclaimer to anyone reading this. Mader is attractive to me more as an example of a company that reinvests its own retained earnings with high returns. But I would assume that research from S&P Global on the mining industry can provide some clues.

Based on this research, mining alone is in what one could identify as a secular decline. This is in line with overall expectations of a global population growth slowdown, economic uncertainties, and a gradual shift towards higher degrees of sustainability and recycling.

Total capital expenditure in the mining industry across 13 different commodities will fall by $11 billion in 2023, primarily driven by declines in development capex for iron ore and gold projects. Year-over-year reductions due to projects moving from the construction phase to production will outweigh increases coming through from earlier stages of the project pipeline, due to a lack of approved and financed new projects. Capital spending will fall further over the longer term, with current forecasts showing a nearly one-third decrease in capital spending from 2022 to 2026.

(Source: S&P Global Market Intelligence)

Note that Mader, currently generates large part of its revenue from Iron ore (Pilbara, East Coast) and gold (Perth and Goldfields)

(Source: 1H FY 2023 results presentation)

But more importantly, rather than focusing on the individual ores mined, I would assume that the focus should be on the part of the capital expenditure from mining operations that Mader is targeting. The same S&P analysis provides the same breakdown of capex between sustaining (maintenance) and development (exploration and expansion).

Our data, derived from the mine economics product and supplemented with reasonable estimates, shows that capital spending peaked in 2012 at $164.1 billion, due to extremely high spending on iron ore and gold assets, which together accounted for 58% of the year's total spend. Capital spending fell to a recent low of $65.8 billion in 2016, with the total reduction for iron ore and gold accounting for almost two-thirds of the annual decrease. Spending gradually recovered to the $98.3 billion forecast for 2022 — an eight-year high but 40% below the 2012 peak.

In this case, sustaining capex can be viewed as the minimum TAM of Mader, while development would define the potential for its growth. Using only sustaining capex, it would appear that TAM is close to USD 50 billion or AUD 75 billion. This in turn means that if Mader expands as a global mining equipment maintenance service provider to the level of AUD 1.3 billion, it would cover less than 2% of sustaining global capital expenditure needs. It should be mentioned that Mader currently focuses on surface mining equipment and infrastructure maintenance, but they have hinted on their social media outlets that they have started going underground, thus opening themselves up to the full scope of sustaining mining capital expenditure.

But, Mader looks beyond mining and has recently started expanding into the energy sector. Again, for this, S&P can provide some guidance.

(Source: S&P Global Commodity Insights)

Among these, it is safe to assume that Mader will not get involved in upstream operations (exploration), but other areas dwarf their current addressable market, depending on how you choose them. I could speculate on the part of the total market Mader could target, but a simpler approach is just to acknowledge that currently, its TAM is much larger than what their financing capabilities (without share issuance or excessive leverage) would allow them to grow. Even simpler, they are scratching the surface of their addressable market. Their bigger concerns are capital allocation blunders or a rise in competition from OEMs or others trying to emulate their approach.

One issue Mader might face is exposure to industry cyclicality. Just as any business, mining companies affected by the cyclical downturns would reduce their employee base to the level needed to meet the in-house maintenance needs while guaranteeing close to full resource employment in regular operations. Since breakdowns and other unforeseen events would require additional staff, this staff will still be provided by Mader. In practice, Mader operates as labor shortfall insurance, and shortfalls always happen. Add to this the fact that more and more of this specialized global workforce is being employed by Mader. In a way, they are cornering their market. This does not mean, however, that Mader is not affected by the cycles. It means that the cyclical nature of the mining industry does not cut off Mader’s source of revenue completely.

Competition

Mader does not have a direct competitor using the same business model, at least not among publicly listed companies. Apart from OEMs, only a few companies operate in similar areas. Notable examples are L&H Industrial, which, based on limited information, seems to operate similarly (a family business with a strong focus on corporate culture), and Metso Outotec. Metso has other areas of operations not currently existing in Mader offering spare parts together with repair services, however, they offer at least some comparable views on operational efficiency for similar businesses. More research is needed in this area.

Changes in narrative

In order to test the accountability of management, I went through the available annual general meeting presentations and tracked promises vs. delivered results.

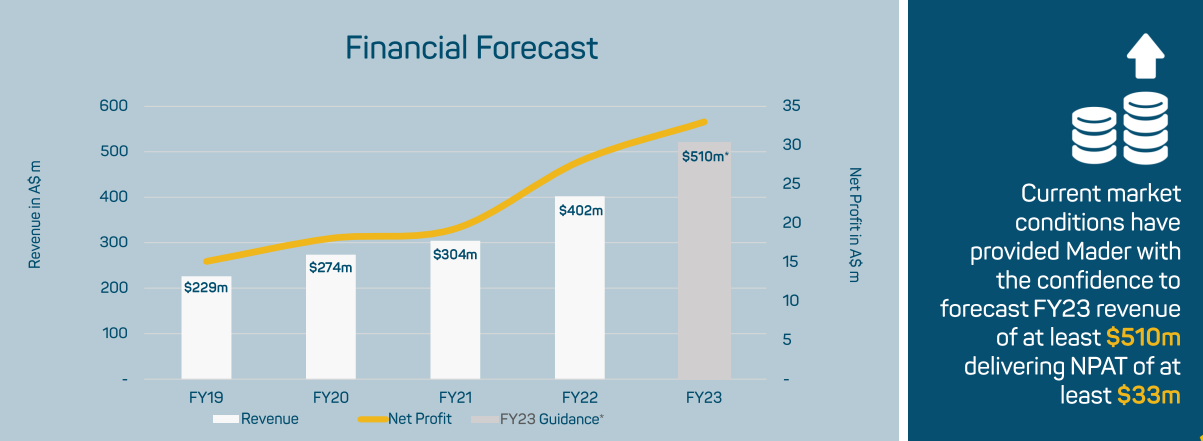

Starting from the prospectus information, Mader met its midterm targets for 2019 and 2020.

(Source: https://clients3.weblink.com.au/pdf/MAD/02153044.pdf)

Promises of 2019 could be summarized as:

Low capital intensity, or stable or increasing asset turnover

No equity raises to fund the growth

Fast forward to 2020, and Mader has delivered on the prospectus promisses

(Source: https://clients3.weblink.com.au/pdf/MAD/02314209.pdf)

During the presentation of 2021 results, following was set as a goal:

(Source: https://clients3.weblink.com.au/pdf/MAD/02410766.pdf)

While the comparable results were the following:

Fiscal year 2022 saw following forecasts:

Which was then updated in 1H 2023 (October 2022)

(Source: https://clients3.weblink.com.au/pdf/MAD/02587249.pdf)

At the same time, it appears revenue of above AUD 600 milion will be achieved, with net profit after tax of AUD 37 million.

The following quote provides some insight into why Mader gives conservative estimates of future business development (other than legal liability).

Paul Hegarty

Thank you. Question now from [ Ari ] from Barrenjoey. Thanks for joining us this morning, Ari. I'll let you answer this question because I'm allowed to. "Guidance implied at least 40% year-on-year growth in the second half. But in the first half we did 45%. Given the momentum, is there anything that would stop us factoring in at least the same level of growth?"

Justin Nuich

Yes. Good question, Ari. Look, obviously, there's lots of things that can happen. But we would rather sort of under-promise and over-deliver, and not that we think that's a major under-promise. We did start this year at a 510 revenue target, which a lot of people before that was pretty optimistic and to be here today, say, on 580, we're pretty happy we can deliver on that and deliver on it well. I don't want to get sort of too overconfident and let people down.

Paul Hegarty

Fair enough. Thanks for not throwing me under the bus on that one. Another question from Ari, "How many months of revenue visibility do we have at the moment and looking forward?"

Justin Nuich

I mean that can change day-on-day, Ari. But when I look at our rosters across the board, we would have a couple of months that are really solidly booked out, but that is sort of the nature of our business, that tap-on tap-off type maintenance that we provide. Yes, it's in many cases supposed to be quite reactive, but we're even seeing a lot of our reactive stores booked out for months in advance, which is as positive as it gets.

Mader Group Limited, H1 2023 Earnings Call, Feb 21, 2023

Put simply, their visibility of future revenues is quite limited. But, at least if judged by history, revenue is there as long as people who are skilled at doing repairs are allowed to do them. As time progresses, Mader is hiring more and more of this limited population.

Ownership

Largest single shareholder of Mader Group is its founder, Luke Mader owning 113,697,095 shares.

(Source: Fiscal year 2022 financial statements)

Mr. Nuich has recently (March 15th, 2023) acquired an additional 5,000 shares at an average price of AUD 3.96, according to the Change of Director’s Interest Notice published on the Mader’s website. This brings his total ownership to 191,081, or less than 0.1% of the total company. On top of this, the CEO has been awarded an additional 3,250,000 shares in kind in the form of performance rights and share appreciation rights, which will most likely increase his ownership to more than 1% at the expense of shareholders.

(Source: Change of Director’s Interest Notice)

Under the current incentive plan, the CEO has been given 2.25 million performance rights and 1 million appreciation rights.

The performance rights are to be issued in two tranches and vest upon the achievement of the following:

Tranche 1: 750,000 Performance Rights will vest subject to (1) the Company’s NPAT for the year ended 30 June 2024 being AU$40,000,000

Tranche 2: 1,500,000 Performance Rights will vest subject to (1) the Company’s NPAT for the year ended 30 June 2026 being AU$60,000,000.

Existing restriction limit the activation of these rights on: Nuich still being employed at the time, revenue and NPAT being generated through organic growth only and disposal of more than 50% of awarded shares cannot be made prior to the year of them being awarded.

Share appreciation rights vest on 30 June 2024 and expire on 30 June 2026. They will provide Nuilch an opportunity to convert them into shares, whereby each right gives him the number of shares calculated as a ratio of price at exercise – IPO price (AUD 1)/price at exercise.

Both incentives would result in the issuance of an additional 1.13% share in the case of the share returning to AUD 1, 1.51% using the current share price of AUD 4.33, or 1.56% in the case that the share price increases to AUD 8. Not the worst trade in terms of an incentive plan.

Be that as it may, the reward offered to Nuilch seems a fair price to pay if agreed-upon performance matrices are achieved in midterm. In a perfect world, no dilution would happen. However, if Mader is to use its legal form as a publicly listed company, turning its CEO into a major shareholder and providing generational wealth to Nuich Family Trust is the least harm it can do to existing shareholders.

Although only a minor shareholder, it is worth mentioning that James Walker resigned from the board of directors. Which is a peculiar development since he was reelected as a director just recently at the 2022 Annual General Meeting. One could speculate on his potential reasons for leaving, as he is apparently still active in his other positions. Similarly, given his business acumen, it is reasonable to assume that he did have a a strong contribution in connecting with potential clients or sourcing valuable employees. On the other hand, he might have just retired partially to reduce his work load. According to the company's remuneration policy, his compensation was limited to AUD 300,000, while in reality it was AUD 121,000. A small price to pay for a a well-deserved retirement, if that were the case.

Jim has over 45 years’ experience in the resources sector and was the former Managing Director of WesTrac and a Director of Seven Group Holdings and National Hire Group. Jim was formerly the Non-Executive Chairman of Macmahon Holdings Ltd (ASX: MAH) having been a member of the Macmahon board since 2013. Jim is also Chairman of Austin Engineering Ltd (ASX: ANG), MLG OZ Ltd (ASX: MLG), State Training Board, WA Motor Museum, RACWA Holdings Pty Ltd and RAC Insurance Pty Ltd. Jim has also been a past State and National President of the Australian Institute of Management.

Overview of the current insider sharehodlers:

Valuation

If you read any of my previous analyses, you probably noticed that I usually define one base scenario and then derive the possible distribution of enterprise and equity values around that distribution. In the background, a lot more happens. In the case of Mader, I considered three scenarios in total. Each scenario would have an impact on different business drivers and risk measures. Scenarios analysed were:

Base scenario: midterm expansion within the limitations of the generated cash flow to the firm and keeping a stable debt-to-equity ratio as the business grows. Bounded by the midterm target of $1 billion in revenue and net income margin expansion.

Optimistic scenario: unhampered growth. Mader growth is driven by every possible cent they can spare. No competitor is interested in entering their market on the scale that would affect them. A competitive advantage is built on sheer size and geographical presence.

Pessimistic scenario: investments are made to grow the business, same as in base scenario, but new business is not won as easily (lover sales to invested capital) and margins do not expand as a result of North America expansion. Aggressive growth funding is stopped, but shareholder value is destroyed before.

No growth scenario: Mader stops growing and keeps the level of its business perpetually stable. It becomes a dividend-generating machine.

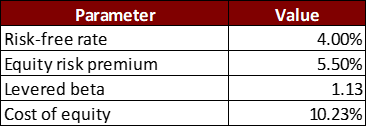

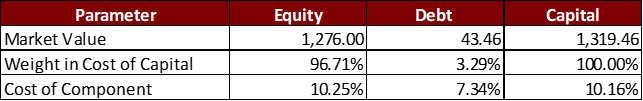

All scenarios hold some common assumptions related to the cost of equity, the cost of debt, the risk-free rate, and the cost of capital. But, in the words of one wise CEO, the cost of capital is around 10%.

For final terminal value, I would assume that the revenue will grow with my long-term expectation of the risk-free rate for Australia of 4% while discounted using the cost of capital of close to 10%. In a base and optimistic scenario, I would assume a small competitive advantage to be preserved, manifested in ROIC over the cost of capital spread. Pessimistic scenarios and no-growth assume ROIC at the level of the cost of capital. In an all but pessimistic scenario, I would assume that Mader maintains the current level, or something similar, of reinvestment efficiency measured through the sales-to-capital ratio. No-growht and pessimistic scenarios assume that operating margins remain stable at historical levels, either due to a lack of expansion in the North American market or due to miscalculated growth efforts that were driven more by price discounting that captured market demand.

Base scenario

Under the base scenario, Mader revenues will continue to grow at a maximum 25% CAGR over the next 5 years. In parallel, North American operations will grow to be close to 50% of Mader's revenue source for Mader, increasing its weighted average operating margin to 10.8% (derived from EBITDA margins of 18.5% for North America and 11.5% for Australia). A period of fast growth and a a stable capital structure should end within a decade while maintaining the ability to finance a growing dividend (FCFF is positive in all years). In perpetuity, revenue will grow at the level of the economy, with just a 3% spread between ROIC and the cost of capital. Ultimately, Mader becomes a company generating AUD 3.5 billion, implying that they hire close to 15,000 people now.

If you are a pricing person, this could be roughly explained as if you are to expect the P/E ratio should grow and contract over time, starting from its current value of 34 to final, hopefully reaching its fair value of close to 40 and then contracting to 10 (assuming payout ratio of 40%, 4% growth in earnings and 10% cost of equity) - follow this link for the explanation. At the same time earnings should increase 9 times.

Optimistic scenario

In this scenario, Mader continues to grow with the current momentum. Cash flow is negative for a few years as more and more debt is taken on. But faster growth and expansion in maintenance activities to different industries like transportation and energy, especially in North America, drives their margins even higher. They grew more than tenfold in revenue over this period. Strong assumptions here are that there is no competition in sight, some 25 thousand people are hired (equivalent to 10% of currently registered heavy diesel mechanics in the whole of the US), there is no corporate overhang from expanding operations, and culture is maintained. Greater size justifies a greater competitive advantage in the mature stage, and ROIC is 4% higher than the cost of capital. This is as perfect as it gets. highly unlikely outcome, though.

Pesimistic scenario

A pessimistic scenario is a story of overambitious growth in the short term that destroys shareholder value. Overpaid acquisitions, overstaffing, and a focus on top-line growth versus bottom-line profitability should work well in the direction of destroying shareholder value. Here I would assume growth as in the base scenario, but this time with decreasing margins, a decreasing sales-to-capital ratio, and thus a lower ROIC, approaching the current cost of capital much quicker.

Although I consider this scenario unlikely, it has influenced my position sizing.

No-growth scenario

This scenario simply assumes that past 2026, when mid-targets are met, the growth ambitions of Mader are ended and management is solely focused on returning money to the shareholders either through dividends, buybacks, or going private. All free cash flow is redirected from growth capital expenditures to maintenance capex or shareholders. Although Mader is now generating substantial free cash flow for equity holders, Mader will not form any type of competitive advantage in the long term (ROIC equals cost of capital).

One could make many more scenarios (and one did). But although excersise above seems comprehensive, we should not forget one strong assumption made in each of them. Every scenario assumes revenue growth. After all, Mader is a growth company. Assuming decrease in revenue and continued growth capex investments would unsuprisingly lead to extremlzy low value of the comapny. But, comfort can be taken in the fact that at least availabile history, shows that Mader is more than able to win new business and mantain client relationships (refer above to revenue per employee over time).

Summary

Mader is a unique growth company, at least among those I have found so far, before they became widely known. The business in which it operates is neither spectacular, popular, nor revolutionary; rather, it has existed in one form or another since the Stone Age. However, it was simply not done like this or on this scale before. As recent history of performance would indicate, its growth is also calculated, controlled, and executed without rush. Note that there is no need to rush it, as no one is directly competing against Mader. Either because of this or internal alignment with the current CEO, CFO, and Mader family, Mader's growth is not overleveraged and is independent of any stakeholders limitations (growth does not depend on loan or equity financing). Mader is a rare type of business that might grow much beyond what it currently is with enough patients from its current and future management.

I own part of Mader, and I would not be surprised if, in the future, I increase my holding size as the company matures and evolves. An interesting milestone will be in the middle of 2026, when the current incentive plan expires. However, as with any growth company, where value is highly dependent on future growth, the size of my holding is relatively small compared to my portfolio.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full time job.

Best of luck to all of us! 🍀

Thanks Nicoper for this great article.

Any thoughts about the current outlook of ´just´ 12-13% for revenue and earnings growth? Could be once again a conservative forecast.

awesome writeup. how do you feel about declining glassdoor scores. since this biz is essential labor arbitrage, retaining talent is key to future growth/roic.

(not from australia so glassdoor could be the wrong site to use)