17. Pinetree Holding: Special situations vehicle of Leonard family

Capital gains tax shielded special situations' investment facility of Leonard family (Constellation Software). Attempts at valuations included.

Pinetree is a former resource management company with its purpose redefined in March 2016 when a group of investors acquired it from its previous owners. Now, Pinetree is an investment vehicle that invests in public market listed software companies, predominantly owned by L6 Holdings, representing interest of the Leonard family (founders and owners of Constellations Software). There is no particular geographical focus as current holdings are located in North America, Europe and Australia. Some of them can be classified as growing companies, some as special situations. Faith would have it, there are a lot of those these days. Although not disclosed officially, their investment history also shows that they closely follow (but not blindly) some of the activities of Constellation Software and its business units. Pinetree carries more than CAD 400 million of prior period losses which serve as tax shield for future capital gains only, and manages a growing portfolio of more than to CAD 40 million in securities. Ten times less than their tax shield.

Why is it interesting

I have been coming back to Pinetree many times since I discovered Constellation, and up until recently I always considered it to be too complex for my limited understanding of accounting. My initial approach to estimating its value developed into a massive exercise of complex changes I applied to its financial statements requiring a lot of work, only to throw away all that work after a brief moment of clear thinking. Now it seems quite simple actually, just I failed to see it at first. Here, you get to learn this side of it.

In short, Pinetree is a corporate entity that carries losses from legacy investments (reported deficit in the balance sheet), which are then used used to offset capital gains from sales of non legacy investments. The only taxed income is non capital gains related, which in case of Pintree is insignificant. Effectively this means that for a good many years Pinetree will pay no capital gains tax if it ever realises capital gains. Since 2016 its primary activity is investing in publicly traded companies for the purpose of realising capital appreciation of its investments. Since any capital gains are effectively tax free, it is safe to assume that Pinetree will have a meaningful portfolio turnover, at least in the part of their portfolio that is focused on investments that are temporarily undervalued or require some form of active involvement focused on business improvements. Pinetree is not fully dependent on buying and selling its investments to generate cash flows to cover its operational costs, as it has made investments in debentures and high yielding ETF that cover majority of these costs.

Pinetree benchmarks itself against TSX Composite index, which depending on selected period or starting point yields a total return of 7.5% - 11% percent (not tax free).

Now, for a good part of 2023, and in so far in 2024, Pinetree was priced below its net asset value measured through mark to market. This is perfectly reasonable, as there is no certainty if that existing unrealized capital gains will ever be realized. But remember, Pinetree is not in a business of cumulating unrealized gains. In order to justify L6 Holdings initial investment, they need to realize gains, and a quite a lot of them. It is a vessel with an ultimate goal of using its losses carry forward of more than CAD 400 million through buying and selling the stock of publicly listed companies. It goal is ultimately to realize CAD 400 million of capital gains. Ultimately its portfolio should grow towards this value. Preferably not through capital raises, but they have happened before and it is more likely that they will happen again then not.

However it chooses to grow its portfolio, its limited history shows that it does grow, even when impact of additional capital raises are eliminated.

Lastly, Pinetree is an owner operated business. Peter Tolnai and Tolnai family, Damien Leonard and Leonard family and Shezad Okai are its principal owners with varying degrees of their own wealth invested in Pinetree.

How much Pintree’s active portfolio management outperform TSX performance? How will this relative performance evolve over time? By how much could it change? How much will you pay for it? These are the questions one should answer in order to understand the potential value prospect of this investment.

Measure of performance

In order to understand Pintree performance, numbers in Financial statements need to be reshuffled a little bit. In simplest, absolute result of interest of common shareholder should be the sum of proceeds from sales of investments + dividends + net interest - taxes - operating expenses). To measure the performance of Pintree, these values should be then compared to either cost of creating the beginning of the period portfolio (how much money was actually invested), or using the market value of the beginning of the period (how much money could have potentially be invested by someone copying the Pintree actions).

In addition, analysing Pinetree, means relying on a short period of historically stable operations. In their own words, and based on data they provided, Pinetree management can only be accountable for overall performance since December 2019.

To measure the effectiveness of Pinetree current investing results, one should compare investment results net of legacy investment realized losses in relation to the cost value of the current active portfolio. By current active portfolio I consider cost value of cash and cash equivalents, cost value of debentures and cost value of non legacy public and private investment. Ultimate goal is to perform an objective like for like comparison on an as objective measure of portfolio management results. Why cost and not fair value? This is a personal preference, but I see portfolio at cost as committed own money to a conscious investment decision. Paper gains or losses are not that relevant for the long term investing horizon (if never realized) and are much more volatile.

Ownership History

The latest stage of Pinetree history starts in April 2016, when the significant management change occurred. CEO at the time, Richard Patricio, was replaced with Peter Tolnai who came to Pintree as an activist investor through open market share purchases and redemption of subscription rights to acquire additional shares. As per my count, 2507492 Ontario Ltd, or TolaiCo, paid in total slightly less than CAD 5.7 million for what was then Pinetree, resulting in Peter Tolnai having effectively 31.2% ownership. With him, Ian Howat, Craig Miller, Howard Riback came to serve as members of a board of directors, replacing all previous board members and executive staff. Of them, Ian Howat is the only one no longer connected to Pinetree after not standing for reelection in May 2023.

Soon after this change, the previously announced 100 to 1 share consolidation was completed, bringing the Pinetree share count to then 4.5 million.

In May 2017 rights offering was announced, which resulted in doubling the outstanding share count, at CAD 2.1 per share for each right, for total proceeds of CAD 9.5 million. After this, TolanaiCo owned 3,511,114 of the 9,045,198 common shares, or 38.8% of Pinetree.

On September 12th, 2017, Peter Tolnai stepped down from the role of the CEO, whilst keeping his position in the Board of Directors, and Damien Leonard, Chief Operating Officer, at the time, was introduced as his replacement. Related to this, TolnaiCo sold 31.3%, stake in Pinetree (2,831,147 shares by my calculation), himself keeping 7.8% ownership, to 1338369 Ontario Inc., also known as L6 Holdings. For those that do not know, L6 Holding owns (at least according to the latest information) 1,000,000 shares of Constellation Software and is run by children of Mark Leonard (I would guess six Leonards are involved). This would imply that L6 paid a total consideration of CAD 5.9 million (based on the CAD 2.08 price at the moment of disclosure – subsequently shares were consolidated 2 to 1).

Total cost of ownership for L6 = 5.9 million

For perspective of size of investment for L6 Holdings, this equates to 4 years of dividend income collected from Constellation, or roughly 80,000 Constellation Software shares at the time (L6 owns substantially more Constellation shares, making L6 as almost insignificant investment for them). Subsequently, to this release, L6 increased its stake to 3,007,938 shares in Pinetree, or a total investment of CAD 6 million.

Total cost for ownership for L6 = 6 million

2020 market collapse was followed with introduction of the minor share repurchase (up to 222,636 shares) under the automatic repurchase plan with a target price of 75% of the book value per share.

March 2021 saw the arrival of Shezad Okhai, former Vice President at Volaris Group, as a new Chief Investment Officer. This job transition was also accompanied by issuance of 375,000 shares, which Shezad Okhai purchased at CAD 2 (while quoted share price was close to CAD 2.05 – before the later share 2:1 consolidation). This effectively gave Shezad a 4% stake at Pinetree. Shezad himself spent 10 years prior working in the Volaris Group, a business unit of Constellation Software, first as a director in M&A, and later as Vice President. As a Director, he oversaw (according to his LinkedIn page), more than 40 acquisitions within Volaris, which according to my count has 160 business within. To put it differently, he oversaw one quarter of all historical acquisitions in Volaris.

During the same month, another rights offering was announced. These rights were fully subscribed and provided additional CAD 17.4 million of capital. Share count was increased to 18,840,396 before consolidation, of which 6,630,153 belonged to L6 Holding, representing approximately 35.2% of the issued and outstanding common shares. Upon closing, Peter Tolnai and Shezad Okhai owned 7.9% and 4.6%, respectively, of the issued and outstanding common shares. In total, investment made by L6 Holdings in Pinetree is less than 1% of the portfolio they manage, even if that portfolio consists only of Constellation Software common stock.

Total cost for ownership for L6 = 12,9 million

Once equity markets were used as intended, to infuse additional capital into Pinetree, share consolidation of 100 to 1 and share split of 1 to 50 was announced. In effect this compensated with cash more than 7000 small shareholders holding less than 100 shares prior to the split with cash. After this, share count was reduced by half. One curiosity is that after this, a new CUSIP number was assigned to the common shares of Pinetree. Technically allowing then shareholders to avoid wash sale tax rule in some tax jurisdictions, by selling their stock with a loss before the split, and buying them immediately after (this was probably not the intention).

Current value of L6 ownership (35% of market capitalization) = 18.5million

Somewhere during this period, the corporate address of Pinetree and L6 Holdings became the same.

L6 Holdings and Pinetree’s head offices are located at 49 Leuty Avenue, Toronto, Ontario, M4E 2R2.

In 2022, Pinetree acquired 2.6% stake in Sygnity, outer rim satellite of Constellation Software, where it partnered in ownership with TSS (which currently holds a 72.7% stake). Since then, significant efforts were made in Sygnity of cutting down on non recurring business and restructuring unfavourable debt inherited from previous owners, brining it to a current stage where it is ready and able to replicate the M&A growth approach TSS had applied. As of December 2023, Sygnity completed its first acquisition and announced another one for March 2024.

In 2023, Pinetree and L6 acquired acquired a total 25.5% stake in Quorum Information Technologies (10.9% and 14.54% respectively). Each of these entities invest with its own goals, however, having activist investors as owners of major stakes, if they work in interest of common shareholder, helps introducing value creating changes, As of June 2023, Damien Leonard sits on Quorum Board of Directors.

Somewhat similar happened quite recently with Bravura Solutions Limited, where Pinetree took an activist role once again. Bravura also had other activist investors appearing as significant owners at the time. One of them being owners of Topicus.com, Strikwerda family. In addition, Shezad also invested a significant portion of his wealth and then left Pinetree to act as Bravura COO for a period of one year resulting in total activist ownership of close to 40%. Currently, restructuring plan is being implemented in Bravura, and should provide stable state operating model by FY 2024 (June 2024 in Australia).

The last three examples, show a quite interesting and inexpensive form of control leverage Pinetree is able to achieve due to its ties and wilingness to dialogue with Constellation Software, its partners and other active shareholders. Instead of raising additional capital on debt or equity markets, it can partner through open dialog with others to achieve meaningfull sharehodler majority to effectuate a positive change. As long as all parties work in common interest, this construction makes sense. Since they are more likely to do so than not, chances of positive outcomes in the special situations they invest increase.

Loss carry forwards

Loss carryforwards are a hidden contingent asset of Pinetree, and there are two types of them on their balance sheet. First is the Canadian non-capital loss carry forward in total of CAD 4.7 million. This translates to CAD 1 million in tax savings at corporate income tax rate of 21.5%. These carry forwards expire over time and grant Pinetree an option to utilize them over the next 20 years. Note that Pinetree currently has no operating profit, as it has no operations. It is most likely these savings will not be used. Something which even Pinetree openly states. Note that, according to its official definition they are a merchant bank, so in theory future can bring operating profits, it would be speculative to add any value to this.

What is not mentioned in the annual or quarterly reports is the use capital loss carry forward. Thanks to the extraordinary efforts of previous management, Pinetree currently has more than CAD 400 million in losses stemming from failed investments. Using the tax rate of 26.5% on capital gains (according to Pinetree statements), this translates to CAD 108.2 million in capital gains tax savings. Roughly more than 2.5 time of the current equity portfolio size.

To put this into perspective, Pinetree current portfolio at fair value excluding cash and legacy investments (carrying zero value) is CAD 39 million. If the portfolio was to increase by 10.4 times, proceeds from sale would be capital gains tax free. While for most, having a 10 bagger means effective 7 and a half bagger (after tax), Pinetree gets it all for themselves. If they could get it, that is.

Although the most relevant for Pinetree, little details is provided in it's financial statements and MD&A regarding capital loss carry forward. For initial reader of their reports there is also a confusion caused by existence of legacy investments with zero fair value still reported in MD&A. To my best understanding these are past investments which could still result in unexpected gains that would then be recorded in income statement, but are most likely to be realized at full loss. Hence they are carried in financial statements at their fair value of zero. In addition to them, there is an earlier CAD 405 million of losses related to past investments where there is not even the slightest probability of positive cash flows. These are disclosed only as a part of reported deficit and a negative item to their equity. My initial understanding was that reported deficit includes losses on past investments without possibility of realizations, while losses on legacy investments where some theoretical probability of any cash flow would still exist, were not a part of this deficit. However, checking multiple reporting dates and disclosure proved me wrong.

Treatment of legacy investments and measure of investment effectives

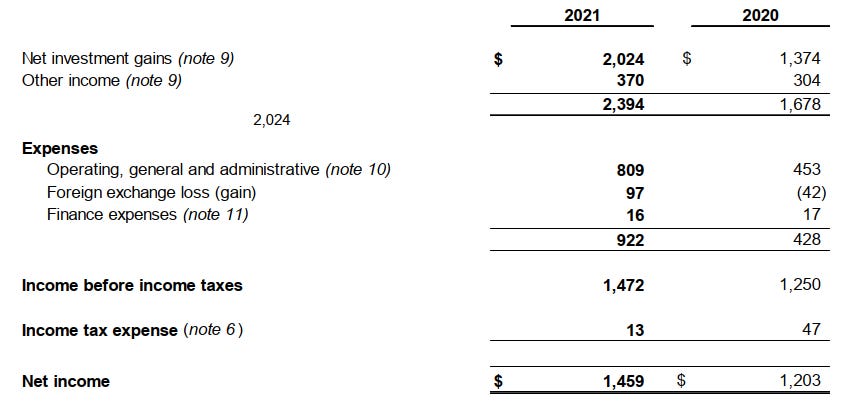

Part of my initial confusion in understanding Pinetree financial statements came from misunderstanding the effect of legacy investments disposal on profit and loss. Especially those legacy investments without fair value (or fair value of zero). Year 2021 is a good example since during this year Pinetree saw a decrease in outstanding legacy positions from 11,386 to 7,619 (difference of 3,081).

MD&A for Q4 2021 explains on page 10 that this resulted in net realized loss of 3,222 and total net realized result of -1,311.

Now, going to the notes of financial statements we see that when unrealized gains and losses (including those which are created as a reversion of the loss from legacy positions) are added to this number, we are left with the reported net investment gains.

Add operating expenses and interest and dividend income to this figure and we are left with reported net income of 1,459 which directly reduces reported deficit.

Prior to this realization I was adding back the impact of the realized losses from legacy investments either to reported net income, or alternately I was adjusting the reported deficit for the remaining amount. As it turns out, neither of the adjustments in needed as the net income eliminates the impact of the legacy investment derecognition, and at the same time, deficit is not affected.

Why did I consider this as relevant at the beginning? Net income directly affects reported deficit, which is the most important asset on Pinetree balance sheet as it serves as a capital gains tax shield.

This means that comparing reported net income with either cost or fair value based value of the portfolio in order to measure the effectiveness of Pinetree investment process is possible. Over the sufficiently long period of time, net income, which also includes unrealized tax free capital gains, could serve as a proxy for realized performance (more on this later). which with addition of excluding the cost of remaining legacy positions from the total portfolio value at cost.

Note that realised loss on legacy positions can be higher or lower than the cost, and that also cost might vary as positions are recognised or derecognised. Reasons for this are unknown to me, but this can be observed throughout time. Since its of low materiality, I will not investigate this further. For those of you with accounting background, if you know the explanation, I would be curious to know.

Valuation

In order to value Pinetree, it's necessary to estimate the real future cash flow it could generate and ranges around those estimates. As it will turn out this is a very difficult task. But first, forecast merits the answer to following questions.

Can Pinetree continue to buy and sell software companies while earning a positive rate of return?

Will Pinetree ever be able to utilize the full amount of its loss carry forwards?

How much time will it take them to use up the full amount if its cumulative loss carry forwards (affects the present value of the hidden tax asset)? How does this translate into value?

Can Pinetree continue to buy and sell software companies while earning a positive rate of return?

Answer to first question is the matter of trust, conviction and bias. By their choice, Pinetree invests in two types of companies. One are classical special situations, investments dependant on some catalyst which could result in increase in shareholder value. Others are what I would call Constellation linked assets. Be it in form of companies like AdoptIT, Sygnity, Bravura Solutions or Topicus, or in form of Constellation Series I debentures, Pinetree is closely tied with Constellation Software and its connected counterparties. There is nothing fundamentally wrong in this, but this also does not guarantee performance. However, based on short and limited history we have (luck would have it that this period includes biggest drawdown on software companies since early 2000s), it seems Pinetree can realize gains on investments in any segment of a market cycle, at least it can during market drawdowns. Furthermore, it is reasonable to assume that the effectiveness of their special situation approach will increase as they grow their capital base and are able to diversify more while still targeting special situations. Here I would still assume that on average they will achieve the same results in their special situation investments. However diversification, or more precisely higher number of investments would result in a more continuous cash flow and greater chance of having funds ready when opportunity arises.

Additionally Constellation itself seems to be involved in more and more carvouts and special situations than before (something they hinted in 2008-2009), and it’s fair to assume that the number of public listed companies they either acquire on a stand alone basis or through spin offs and mergers will grow from something we see every once in a while, to something that occurs in a more regular frequency. Constellation targets will grow in size. Larger companies are more likely to be listed. Pinetree could latch on more easily.

Last point should also be supported by the fact that now more then ever its possible to find small and mid sized software companies that are value investments (if you need inspiration, take a look at ROE reporter from Donville Kent - one of early investors in Constellation Software). Software companies are facing a new reality for them where capital is no longer abundant and more sound cash producing business will face some form of operational challenges, thus creating opportunities for activist investors. These are the companies that have bond like earning profiles, stable operating earnings, but far from optimal capital structure. Usually, they are burdened with the high level of debt that is eating up their cash flow, and that will in a two to three years force them into restructuring once debt refinancing is needed. Then I would expect Constellation to attempt to acquire them, and Pinetree to latch on.

Other than speculating about future, we can also look at the past. Below figure shows the history of Pinetree investments that it has exited completely. Apart from Crealogix (currently being acquired by Constellation Software), Pinetree did not exit that many of their investments with a loss. They do have holdings trading below their cost, but it seems that have patience to wait their thesis out.

Given that these types of companies have experienced the biggest drawdown since year 2000, it is reasonable to assume that at least similar if not better results can be achieved in the future.

Will Pinetree ever be able to utilize the full amount of its loss carry forwards?

Yes. No. Maybe. To repeat, Pinetree can generate 405 million in capital gains before it needs to pay any taxes. I was able to track individual closed investments only from December 2020, or 3 years, and in that period total of 4.2 million was realized. It may not seem much but, taking into account the length of the holding period and size of those investments, we are observing a CAGR on closed investments of close to 40%. Keep in mind that Pinetree sometimes trims its positions, like Sygnity in Q3 2023, and that focus here is only on positions it exits completely.

Same table, shown in a graph.

This does not mean that Pintree grows its portfolio by 40% each year. In order for this to hold, Pinetree would simply have to have a 100% portfolio turnover every year. Fortunately, turnover rate can be checked, even if on the limited history we have. Defining portfolio turnover as less of purchases and sales over a period (quarter) divided with average portfolio value (again over quarter), we can observe following figures:

Above values are calculated both on the portfolio at fair value (mark to market) and by cost (my preference since it is real money committed). Careful observation would lead to a conclusion that portfolio turnover is opportunistic and follows no prescribed pattern. Higher than 0%, lower than 100%, closer to 15%. Simple math would take the above mentioned CAGR of 40%, multiply it with 15% and use some 6% as a proxy for normalized earnings. However, this is only a part of the Pinetree source of income. Pinetree also trims and adds to existing positions.

One thing is certain, Pinetree earned real cash during the one of the greatest market downturns in software industry in last quarter century. It is not that far fetched to assume that they will continue to earn in future. However, can they earn more than 405 million from this point.

How much time will it take them to use up the full amount if its cumulative loss carry forwards (affects the present value of the hidden tax asset)? How does this translate into value?

To figure out how much time they will need, agree what Pintree is and what it isn’t, and then come back to the measure of their performance and agree what Pintree is and what it isn’t.

Pinetree is not Constellation Software. It will not become mini Constellation. If you look for miniaturized versions of Constellation Software, they already exist, and are partially owned by Constellation. Pinetree will most likely never acquire companies outright, since its main reason for existence is capital gains tax shield. This shield can only be used by buying and, at some point, selling investments in publicly listed companies. Once the shield is gone, it is fair to assume that Pinetree also might end its existence and be dissolved among surviving shareholders. This implies that at this point, all cumulative unrealized gains will be realized, making use of net income as a proxy for return actually reasonable. In other words, pinetree is more bond-of-a-kind investment with limited life than going concern. Why surviving shareholders? Because it might take time.

How much time? This depends on two driving factors. First, which we cannot forecast with any degree of certainty, is whether there will be additional capital raises, like those in previous history. For sake of simplicity, let’s assume no. But to clarify the risk for the existing shareholders, if Pinetree was to raise 400 million tomorrow, invest it in a holding that doubles within 3 years and is subsequently sold, tax shield is gone.

Second driving factor is the speed by which Pinetree is able to earn out its reported deficit. To identify this, we need some measure of normalised earnings. Simplest way to normalise the earnings is to take what is considered a representative period and calculate annualised value. Taking data from December 2019 to December 2023, we can see that the cumulative reported net income is close to 10.2 million.

Within this period, Pinetree had one large capital raise (when Shezad Okhai became shareholder), and portfolio at cost increased from 6,7 million to 33,9 million (17,4 million raised as additional capital). This is relevant for two reasons. Fist, absolute values of net income are not representative due to external change in its base (inorganic portfolio growth). Normalizing relative net income yield should solve this. Second, as the portfolio grows, share of operational costs goes down. Last point is relevant, as my theory is that Pinetree will always keep certain level of cash invested in bonds, ETFs and debentures to generate passive income financing its operational cost. This operational cost historically included salaries for 2 to 3 people, and this number should more or less remain constant even if they grow in size significantly. But because of this, I will always assume that they will park aside certain level of assets and invest the rest. Since I am taking part of the assets out of equation until the terminal year, I also need to take out income and costs related to those assets from net income(interest, dividends , coupons and sales and administrative expenses), before I normalize it.

Using quarterly data, we can generate the figures below.

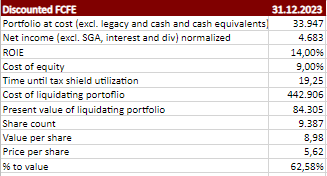

Over the selected period of 4,25 years, using period portfolio at cost values, cumulative realized adjusted net income implies annual rate of return of 14%, or monthly return of 3,33%. Remember, operating costs are excluded from these figures now, but so is passive income generated, and assets used to generate it (7 million at this point).

This can now serve as a basis for our simulations and attempt to determine when will the full amount of deficit be used up. Assuming 14% net income yield, we in effect assume 4,683 thousands in normalized adjusted net income as of today (compared to 5,768 thousands reported as of December 2023). Also, assume that almost all of generated income will be reinvested into future or existing holdings to generate same return on invested equity (ROIE). All but minor part needed to finance assets used for passive income generation, for which I will assume will grow at 2% per year.

From here we need to roll out our forecast into the future, up until the deficit is still negative. Value of portfolio then (without calculation you should understand that it is somewhere close to 445 million), should be discounted back for the determined period of time. As a discount rate, would use average cost of equity for software companies, or even maybe long term equity risk premium for Canada + 10 year bond rate. For cost of equity, data from professor Damodaran is a reasonable proxy.

For equity risk premium, Statista also provides information which seems to be aligned with the above, if we assume some 3,5% 10-year bond yield over a long period.

Rolling the previous net income yield assumptions, we get the following

Assuming 14% net income yield, with 98% reinvestment, it would take 19 years and 3 months for Pinetree to use up all its deficit. Surviving shareholders rejoice. Discounting the liquidation value of the portfolio back to present at 9%, this would yield a value if 84.3 million on enterprise level, or 8.98 per share using current share count.

For those wanting more details, here is the whole forecast 🧐. Those who are paid subscribers got the excel file with many goodies, including this, shortly after article publication.

Changing the assumptions for the normalized yield, following scenario values can be produced.

We know only need to know, each exact scenario will be realised and decision is simple.

This is of course not possible, but warnings should be made. To a degree, it is reasonable to assume that the implied rate of return on TSX will be close to 9% over quarter of a century period. Much more reasonable than 14% or 17%. As it seems so far, Pinetree earns a bit more than overall index, but they are concentrated and can have years of positive results nullified with one bad concentrated investment.

One should never forget that Pinetree is not an operating business but a basket of securities that for most part have quoted value. As of today April 17, 2024, their portfolio an values of the positions are the following:

—Update - post publication I was informed that Pinetree position in Trubridge is 500k shares. Above figures look somewhat different, although similar.

I personally invested in Pinetree when it was selling 20% below its cost value per share, implying that I should earn 14%/0.8 = 17.5% CAGR over time, if 14% yield holds. Buying it at today’s prices is risky, as you are only paying for the talent of limited track record (price is above the NAV) with great expectations.

On the other side, I still hold Pinetree as I believe that they have the connections and a unique position to practice special investments in a period of time when a great deal of good companies is in peculiar situations, keeping them one step away from becoming better business.

Annex

Other resources on Pinetree:

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my substack or Twitter account results in you earning a reasonable profit, keep the karma going. Subscribe, even for a month.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Excellent!

Excellent deep dive. Legend!