For whatever you read below, you find a flaw in my reasoning or simply see things differently, speak out, without mercy. After all, this is why these notes are public.

Below, one can find mentions of: Tier 1 SA, BFF Bank, Penneo AS, CompuGroup Medical, Topicus, Vysarn and Sygnity.

I purchased some of the Tier 1 SA which was taken private by Retex at 3 EUR per share. This individual transaction almost resulted in me ending up with the ownership in the private company due to an internal deadline for selecting a choice for corporate action with Interactive Brokers. Since I purchased shares on December 12, 2024, I was notified that the window for opting for sale of shares was closed, an hour after it was closed. The official deadline for selecting a choice action was December 16, 2024, but I overlooked that a broker might want to collect information beforehand, as they have the right too. Chasing these kinds of merger and acquisition spreads is risky, and this operational risk is something I neglected up until now. Lucky for me, customer support from Interactive Brokers is outstanding in my experience, and they did not fail now. My choice to tender the shares was submitted post internal deadline and the transaction has since closed.

In December, I sold part of my holding in BFF Group in order to harvest tax losses for the year. At the moment I assumed that there will be no relevant disclosures until the middle January 2025 when I planned to add back to my original holding size, and I was lucky enough to do it in January below the price I sold at initially. BFF is scheduled to present its FY 2024 results on February 10th, 2025. In case this backfired, I was still going to be fine. On a portfolio level, this was just a small holding, but a high IRR bet for me. I will publish my notes on BFF sometimes after this post. BFF is in a complicated situation, where they were required to increase their regulatory capital before they can continue to implement their shareholder capital distribution policy. They have two options in how to solve their problem. Accept permanently higher NPL and regulatory capital requirements and thus omit dividend distributions for past year and reinstate growing dividends at levels above historical, or work on optimizing how they manage and collect their purchased receivables from Italian NHS and how they calculate RWA (switch to AIRB approach) and free up capital from regulatory requirements, thus even enabling future special capital distributions to shareholders. Former applied, BFF is at just below fair value, later applied, it gives more than a sufficient margin of safety and potentially above average returns as a value investment alone. However, second option is targeted by the management. They have even implied that the additional RWA of 1.8 billion should be cleared by the middle of 2028 (duration of the bond they issued in 2024 was tied to expected rundown of this portfolio). There is also a strong motivation for BFF to clear their NPL portfolio from books until June 2026, when this vintage of the NPL should be fully provisioned under prudential provisioning rules. This provides some level of asymmetric expectations compared to current state, as at least so far BFF has been reducing its contagion portfolio (cause of RWA increase), and has taken legal steps to increase the speed of collections (court injunctions against overdue counterparties). Given that BFF is a bank, whatever financial model I build for it, it is inherently instable and volatile, and I prefer to share it only upon request, and if you have your own opinion about it. Feel free to request, and challenge thereafter.

Continuing with merger and acquisition spread chasing, I purchased shares in Penneo AS after the announcement was made by Visma that has launched a cash offer to acquire it at 16.50 per share. Since then, offer documents were published by Penneo of December 19, 2024 on their website with the following timeline of the transaction:

I managed to acquire a relatively small number of shares at 15.70 for a spread of 5% before tax. I intended to keep this a relatively small position due to risks of the deal failing. At a moment of an offer, close to 53% of shareholders have committed to accepting the offer, with approval of 90% of shareholders being needed to accept the offer. My assumption was that Penneo shareholders would accept the offer, which was more fair, even under the assumption of aggressive future growth. I wrote down my thoughts at the time in a note.

Shortly before the offer acceptance period, I closed my position at DKK 16.3, providing me a 3.8% pre-tax return over a less than a month long holding period. Those who decided to wait for the shareholder vote, got pleasant news on January 22, 2025, that the vote was in favor by 91%. Remaining minority shareholders will be forced to sell at 16.50 in weeks following February 3rd, 2025, leaving some spread on the table still. I managed to cumulate even larger positions than originally at DKK 16.3.

For those who remember, I speculated that CompuGroup Medical has once again become a holding of Pinetree in somewhere before June 2024, and that Pinetree increased their position prior to Q3 2024 results publication. Given the comment Pinetree provided in their MD&A, I was guessing that it also sold down on their stake since they mentioned questionable CEO successions (son of the old CEO, became a CEO although having limited business experience, but strong academic background). Shortly after that CompuGroup received a take private offer from CVC capital, requiring 67% shareholder approval (which was guaranteed based on announcements) which would leave the current management and owners as operators. Spread after the announcement was narrow, and I formed my position at EUR 21.7 per share (offer price was EUR 22). As a precaution in these acquisition transactions, I always leave an order to sell above the offer price. In this case, on no news of change of the offer, except reinstated recommendation of the CompuGroup board to the shareholders to accept the offer, price jumped to 22.2 on January 6th and 22.5 on January 7th 2025. My order was filled at EUR 22.1, but on a subsequent day I shorted the stock at EUR 22.2. Reason why I did this was because:

the necessary vote in favor of the transaction was secured, and

there was no indication that CompuGroup would seek to ask for a higher price given that they refer to EUR 22 price as a fair offer, and current owner operators will not sell their stake, but convert it to private ownership. Sometimes, markets seem inefficient for brief moments.

A few days later, I closed a short position. Same day I was long again and tendering the shares. Price again went above offer price close to the offer period end, and I sold them again. Not something I hope to do for the most of my time, but opportunity presented itself, and it was interesting to do almost risk-free trading from both sides at the time. In hindsight, I was lucky here, since I did not consider a possibility that someone might be acquiring shares in CompuGroup with an idea to remain as a partner in the private entity (buying shares above offer prices and choosing not to tender them). I am not quite certain, but I believe I was exposed to the risk of short squeeze at the transaction settlement date, in case that I would not have closed my short position before the offer close date.

These kinds of situations might seem like a waste of time for most, but they do offer some monetary benefit which measured on an annualized IRR basis, over the holding period, seem far above market returns (until one falls into a trap). What is also an element of added value for me personally, is that I get to know companies I would have never looked at normally, since these are usually not the best businesses put there. I hope I subconsciously pick up some of their properties and patterns, which in future prevent me from investing in them on a standalone basis. Lastly, they satisfy the urge to do something in what I think is an expensive market environment in a relatively safe way.

Apart from this there were no other additions in the past two months, though it was tempting to trade in and out of the certain names I know and own, and there was ever present subconscious pressure to find attractive opportunities supported by loose narratives.

Like many, I was tempted to add to Topicus after the announcement of Cipal Schaubroeck NV acquisition, which will increase their total revenues by roughly 9% in FY 2025. However, I chose to wait a better opportunity. I don't think investing in Topicus now would give bad returns. I would just like better. I want implied return from figure below to be above 10%.

Keep in mind that I have historically bad timing in my Topicus purchases, and to date it is one of the lowest CAGR investments in my portfolio.

My to-do list currently consists of the following companies I am researching in more depth and might post some notes on them in the upcoming period:

Quorum Information Technologies (trying to understand the chaos of ERP software used in North American car dealerships)

BFF Bank

Valuing Vysarn Asset Management (VAM)

Doing regular biannual review of the Constellation

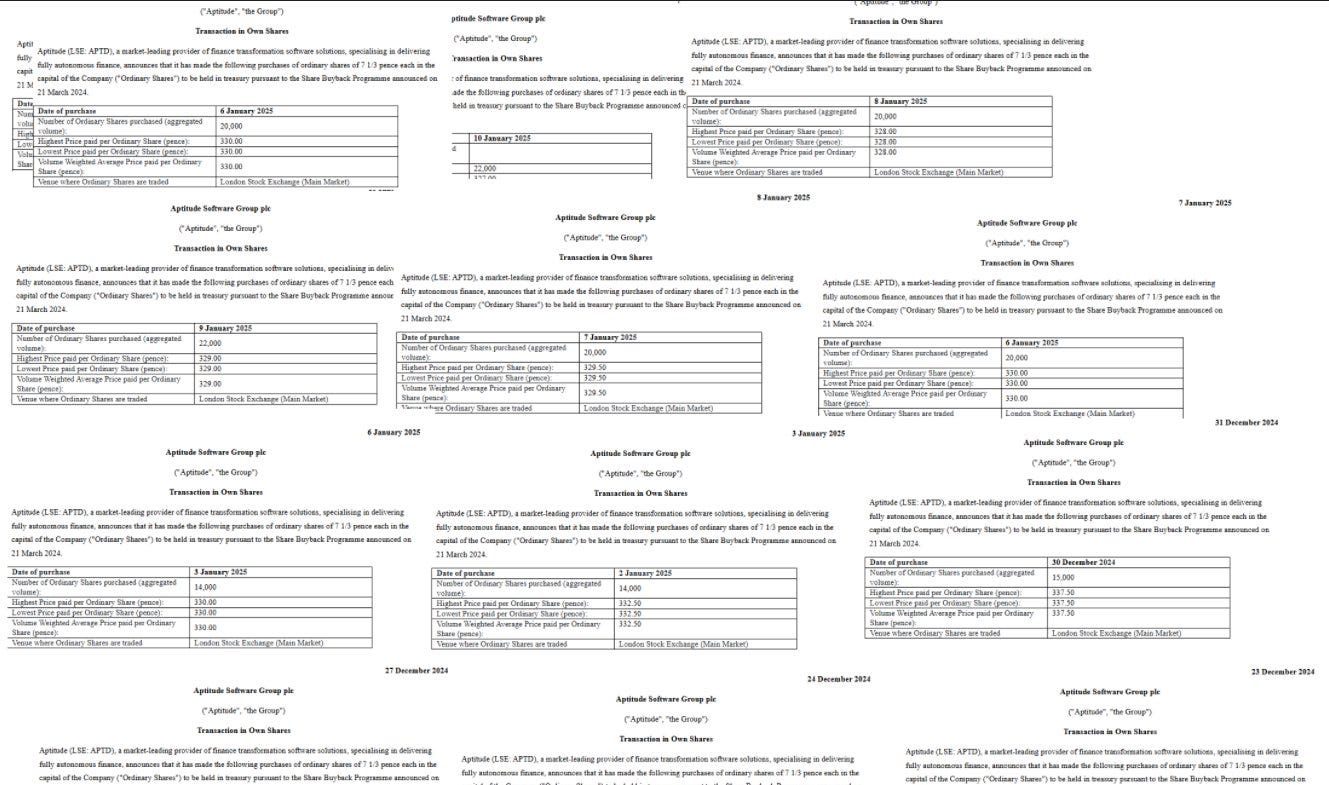

Aptitude Software (another Pinetree holding). I know very little about it at this point, except that they keep buying their shares at around GBPp 320.

Brown and Brown and Arthur J Gallagher (just researching capital allocators and trying to figure out why intangible assets exist in insurance brokerage industry).

I have very little insight into Aptitude Software, but they have a daily habit of repurchasing their shares. In past few months, they occur daily.

Regarding VAM and Vysarn, they remain my constant object of interest and hopefully source of returns in future. From time to time I do random searches and recently VAM became a little more real. Existing webpage was updated with content, albeit not much of it. I cannot help myself from not thinking: “Why advertise if you will not sell anything soon?”

Interestingly enough, image above is that of Harding Dam - major source of fresh water in Pilbara, close to many aboriginal territories whose corporations might consider a JRA similar to that made with Kariyarra. There are some minor details appearing in the public around VAM. But the Harding Dam, itself might be an interesting source of projects for Vysarn according to the following:

One interesting outcome that could be linked with the above, would be a potential JRA, or at least a project with Banjima nation. Why Banjima? They are geographicaly close to Harding Dam, but moreover, in their latest annual report, Banjima Corporation mentioned some involvement with Pentium Water

While this is speculative for VAM, there was some real progress made with the Kariyarra JRA. I managed to find the news that Pentium Water hired MGA for providing cost estimates on pipeline construction in Pilbara, titled Wodgina Transfer Pipeline. Wodgina mine, in Kariyarra region, is 100 km away from the Port Hedland.

I would guess, that the first pipeline operated by VAM, will be roughly 100km long. I would also guess, that there would be more JRAs in not so distant future.

Close to the end of January, I increased my holding in Sygnity, at the expense of some shares of Philips (Sygnity is still a relatively small position in my portfolio, but I view it as a part of the larger Constellation and affiliates position which is almost 25% of my portfolio at this point). This was not based on any news, rather than a simple math I did while waiting for g.on experiance acquisition, or any other acquisition for that matter.

Above assumes that the total additional debt capacity, plus 20 million in cash, is reinvested in acquisitions today, which is not realistic, but it shows that compared to the rest of the CSI, Sygnity is yet to start with acquisitions as their ongoing operating model. Currently, they sit on excess capital (real and potential), and have sizable team of M&A people with significant prior experience. It is rational to assume that they are working, and in a way its reassuring that they are not deploying this capital irresponsibly. One can interpret a lack of acquisitions as a result of adherence to Constellation acquisition playbook.

At some point, Sygnity will start completing acquisitions and their revenue, income and free cash flow generation will grow and compound.

Finally, my own portfolio is still doing well, probably unsustainably well. It is ahead of the targets I set up a long time ago, and currently it's more than a year and a half ahead of its through the cycle expected size. As always, it lags the returns of most fintwit and financial substack, but is higher than 0% over the log run, and above my 15% post tax target CAGR rate. For the time being, I will be just going through the limited number of companies I have on my to-do list, and reevaluating some of the holdings I have. Hoping for a downturn, and getting mentally prepared for inevitable portfolio price (not value) correction. I run a small portfolio, but I would run it the same if it was 10 times bigger. Hopefully I am there in 15 years time and this is true.

Unrelated to investing, I like the format and process of creating this note more than expected. Draft of it was being created throughout past two months as a personal investment log, and was modified as the time went by. I am curios how I will be looking at these decades from now, so I might keep this format going forward.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe as a paid subscriber, even for a month. Even years after you have read something from me, based on realized experience.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Great detective work on VAM! Really curious to know when we'll get some solid official updates from management on this, and how many JRAs are in various states of play...

I would be curious to hear your thoughts on QIS once you get through it. I looked in 2022/23 and had a hard time seeing what their multiple would be with their organic growth profile.