22. Own portfolio updates - November 2024

Overview of my portfolio activities for past 2 months

In the future, I will provide a description of my portfolio activities covering the previous two months. I hope this helps me identify some of my biases as time goes by, but also I hope it stimulates some interesting comments in the comment section below. If I see that they take too much of my time, and add little value to me or others, I will stop producing them. Until then, tell me what I did wrong, without mercy.

November saw two of my acquisition spread investments close successfully (they are not merger arbitrages, since they carried risk). One was OneSoft solutions, the other was Trinity exploration. OneSoft contributed only slightly to the overall portfolio return, but IRR over the investment period was high. Trinity, about which I wrote, was a particularly nice find since the shareholder vote was never going to be against the proposed acquisition.

I financed both investments with debt at reasonable rates from Interactive Brokers. There are many acquisitions waiting to be closed, but I need some sort of certainty before investing into them, as I don’t run a diversified portfolio of these. I am yet to regret this approach. For those interested, one source to track these deals could be Alpharank.

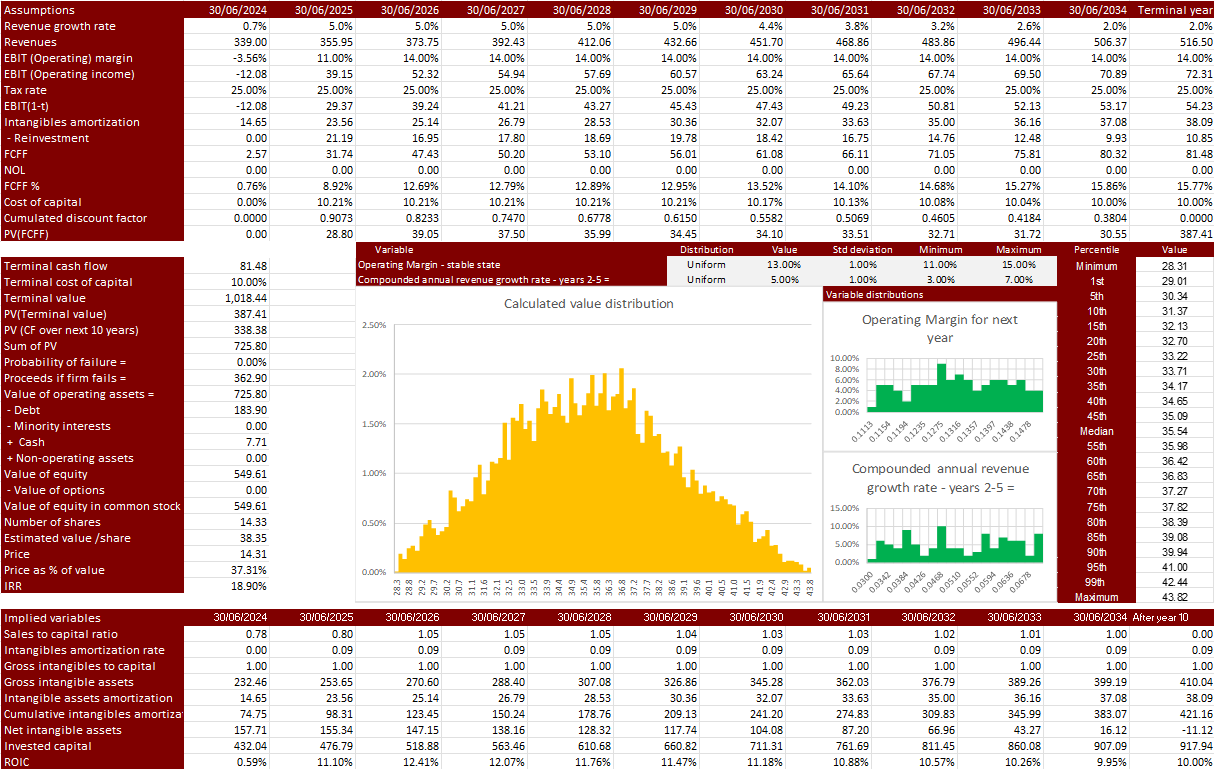

I made significant additional investment in Vysarn when the price reached 0.44 AUD, and then again after the AGM when price briefly went down to 0.275 AUD (I managed to add to my holding at 0.39 AUD). I estimate that Vysarn’s fair value at this point is around 0.5 AUD, but excluding any future income or cost associated with VAM. If you followed Vysarn story, you will recognize that most of their activities are gearing towards VAM becoming a center of their operating model. I have many scenarios for VAM transferred to numbers. Most of them lead to profit. Some to significant profit. Below is my base scenario valuation for Vysarn and a possible timeline of net income flows from VAM (not included in the valuation).

I made a small library card investment in Tasmea Limited. Tasmea is an acquirer in of the mining fixed plant maintenance companies in Australia, that has shifted its model from construction to maintenance over the past decade. It seems like an ambitions and fairly easy business model, and I will definitely continue to follow it. One downside is that it reached a certain level of retail fame among Spanish investors (cannot explain why) that could lead to unhealthy shareholder base. This can also be a nice opportunity to add to the holding later on, as low conviction shareholder base usually leads to higher price volatility that is not strictly related to fundamental business developments.

I sold my small position in GEE Group and Converge Technology as I have no faith that existing management will ever really act in the interest of shareholders (this is generally a rare property to find globally). I consider both investments to be mistakes on my side. Companies are still undervalued by any measure. But, for Converge, I simply cannot guess what the future holds, and for GEE Group scenario where management simply drains the available cash for personal gain is realistic. Proceeds were used to fund the part of the next speculative investment in Trubridge and Quorum Information Technologies.

I invested in Trubridge after realizing the role of the new CFO in business optimization. More details of that investment can be found here 21. Trubrige Inc: Second time around. Most of my position was formed before the release of the article, with subsequent purchases after.

On multiple occasions, I was purchasing small quantities of BFF Bank. Logic here is simple. BFF is generating capital as always, however that capital serves a large RWA base. Once the portfolio that caused RWA increase is gone from the banking book (part of receivables having high RWA%, but low real loss), capital will remain. This will result in higher distributions to shareholders thereafter. That is at least the idea.

I sold my shares in Synchrony Financial after the price reached my estimate of its fair value. Few weeks after that, as a result of the USA presidential election, price of the shares rose almost by 20%. Whatever the outcome of the next presidency is, it wont be immediate, it is not certain at this point and it should not push the price above the fair value this much. As a result, I shorted one third of my previously held position measured through the number of shares. I closed the short position few days ago.

Going though Pinetree latest MDA, I decided to go through the rest of the holdings they have with a goal of learning and finding potential investment. This resulted in adding a small position in Quorum Information Technologies, which I view only as a value investment. As Quorum stabilizes its cash flow, market price should approach its value, which is roughly two time higher according to my estimates. Figures below show what Quorum achieved since 2022 when they started optimizing their current business at the expense of business growth.

Lastly, like many Pinetree shareholders, I was also happy and confused with share price run up.

My Q3 updated tracker does not support this value, and current NAV is some 35% below market price. For more details on how I value Pinetree go following notes:

Updated NAV tracker looks like the following:

However, if I add my fair value estimates for Trubridge, Quorum and Topicus in, and analysts targets to others (ignoring the one for Sygnity), price seems a little more explainable.

Someone out there must have a complete faith in Pinetree and its holdings reaching their targets. John Bouffard, CFO of Pinetree, is one of them (at small scale though).

At this price, I find it risky to invest in Pinetree.

I am still searching which Australian utilities software company was added to Pinetree portfolio, and feel free to suggest in comments.

Finally, my own portfolio is doing well, probably unsustainable well. It lags the returns of most fintwitt and financial substack, but is higher than 0% over the log run, and above my 15% post tax target return rate. For the time being, I will be just going through the limited number of companies I have on my to-do list, and reevaluating some of the holdings I have. Hoping for a downturn, and getting mentally prepared for inevitable portfolio price (not value) correction. I run a small portfolio, but I would run it the same if it was 10 times bigger. Hopefully I am there in 15 years time.

Disclaimer and kind request

Before you take any actions based on this article, remember, you are trusting an experimental analysis of an anonymous person. However, if you like it, and you think it makes sense, feel free to support my writing which I do in my spare time, while working a full-time job.

If anything you pick up from my Substack or Twitter account results in you earning a reasonable profit, or avoiding unreasonable loss, keep the karma going. Subscribe, even for a month. Even years after you have read something from me, based on realized experience.

In any case, it does not hurt to subscribe, share this article or comment. It hurts me if you don’t 😇

Or just share your best idea you can quantify with me.

Best of luck to all of us! 🍀

Thanks for the detailed update, very transparent! 💚 🥃

Thanks for sharing your portfolio.